All eyes on BoJ policy update after Fed pushes back against March rate cut

USD: Fed pushes back against rate cut expectations as early as March

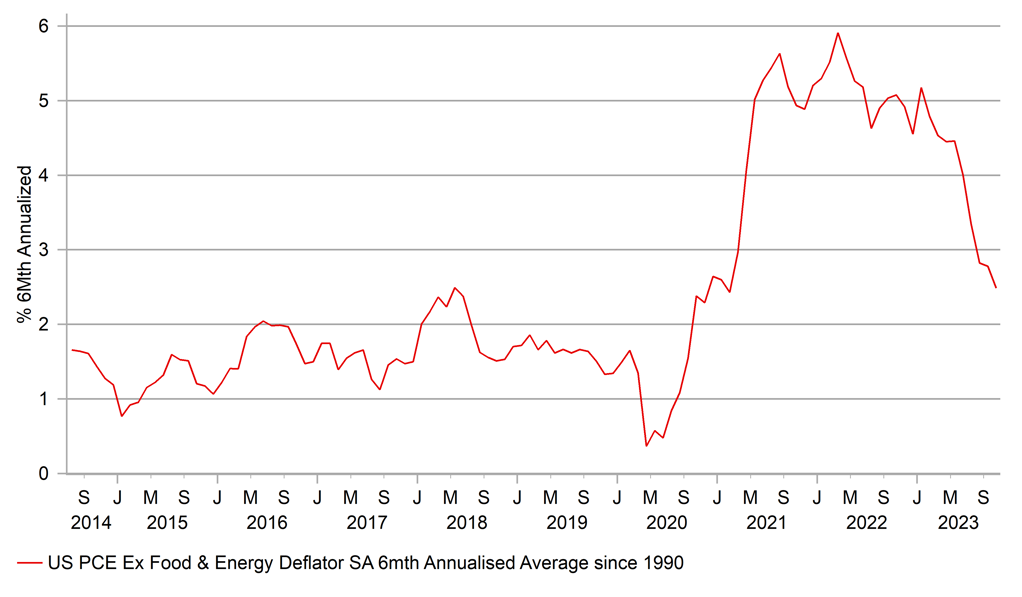

The US dollar is continuing to trade at modestly stronger levels after a staging a relief rally on Friday following comments from New York Fed President Williams who attempted to push back against market speculation for the Fed to begin cutting rates as soon as in Q1 of next year. He told CNBC on Friday that “we aren’t really talking about rate cuts right now”, and that “it’s just premature to be even thinking” about a March rate cut. While the comments suggest that the Fed leadership is currently not on board with the idea of cutting rates as soon as at the March FOMC meeting, market participants remain reluctant at this stage to significantly scale back their expectations for earlier and deeper rate cuts next year. The US rate market is still pricing in around 21bps of cuts by 20th March FOMC meeting and around 145bps of cuts in total by the end of next year. After last week’s FOMC meeting, market participants are more confident that the Fed will begin to cut rates next year in response to slowing inflation. The release of the latest PCE deflator report in the week ahead for November is expected to provide further evidence that underlying inflation pressures have slowed and give the Fed more confidence that inflation is returning back towards their 2.0% target. Over the last six months to October the core PCE deflator had already slowed to an annualized rate of 2.5% down from 5.1% over a year ago. If inflation continues to surprise to the downside at the start of next year, it will keep alive expectations that the Fed could begin to cut rates as soon as March even if it does not currently appear to be the base case scenario for the Fed.

The bearish repricing of expectations for Fed policy next year have increased downside risks for the US dollar heading into early next year. Yet we remain wary over chasing further US dollar weakness in the near-term, and conditions could fall into place early next year for a rebound against the euro and pound. Firstly, the US rate market is already pricing in expectations for earlier and deeper Fed rate cuts which provides a higher hurdle for further dovish policy surprises. Secondly, the weakening economic data flow from Europe could quickly trigger a bigger dovish policy shift from European central banks early next year. Further evidence that core inflation is falling more quickly alongside ongoing economic stagnation/recession risks in the euro-zone could force the ECB to abandon their commitment to keep rates at restrictive levels, and start moving back towards more neutral levels closer to around 1.50-2.00%. Even in the UK where the BoE is more concerned over persistent inflation risks, there have been encouraging disinflationary developments this week. Wage growth is slowing and GDP contracted in October. In these circumstances, the window for further US dollar weakness against the euro and pound could prove short-lived. The yen remains best placed to outperform amongst the majors currencies as the Fed, ECB and BoE all begin to lower rates next year.

SLOWING US INFLATION ENCOURAGING FED RATE CUT SPECULATION

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Will the BoJ prepare the ground for rate hike as soon as in January?

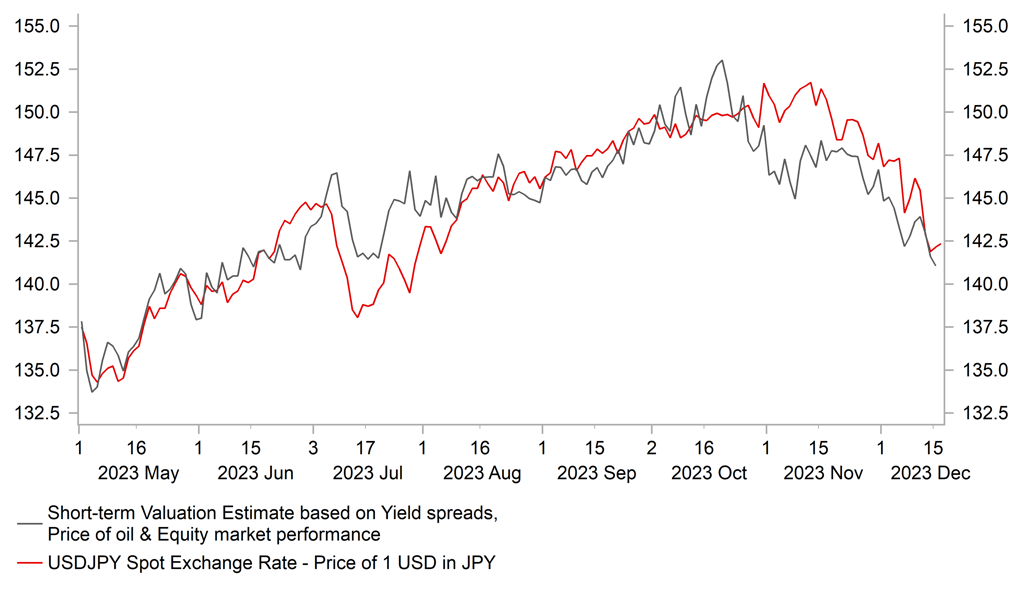

The BoJ will be the last major central bank to provide a policy update this year when they announce their policy decision tomorrow. Market speculation over another change to the BoJ’s policy settings as soon as at tomorrow’s policy meeting has died down since the start of last week after Bloomberg released a BoJ sources report that was clearly intended to downplay expectations for an imminent shift away from negative rate policy. The report initially triggered a yen sell-off early last week but those losses have since been fully reversed. The main driver of the yen’s rebound over the past month that has resulted in USD/JPY falling from an intra-day high of 151.91 on 13th November to a low last week of 140.97 has been building expectations for earlier and deeper rate cuts next year from other major central banks that would narrow the current wide policy divergence with the BoJ.

We expect the BoJ to reinforce the yen’s upward momentum at the start of next year by removing negative rates in January for the first time since early 2016. In this light, market attention at tomorrow’s policy meeting will focus on the updated policy statement and comment from Governor Ueda to see if prepares the ground for a rate hike as soon as in January. The most obvious potential alteration to the statement would be to the final sentence – “The Bank will continue to maintain the stability of financing, mainly of firms, and financial markets, and will not hesitate to take additional easing measures if necessary”. If the BoJ were to remove the bias to ease, that would be a strong signal to the markets and would prompt a clear rates and FX reaction. Making changes to the assessment of the economy or inflation seems less likely given it was the last meeting when we had an updated release of forecasts. That said, there have been some developments that could prompt some tweak in wording related to inflation and wages to indicate progress is being made. Governor Ueda’s press conference and his views on evolving progress toward price stability and wage growth may be where we get an indication that gradual progress has continued, thus leaving open the possibility of a change in policy in January but also leaving the BoJ with some flexibility.

The correction stronger of the yen is now the most significant since the period from October last year to January. Any hawkish surprise tomorrow like the removal of the bias to ease or a more explicit signal of the price stability goal being close to achieved will certainly see the yen advance further. IMM positioning data still indicates substantial short yen positions held amongst Leveraged Funds. Fundamentals as a driver of FX over the coming weeks can certainly play less of a role and liquidity and positioning can be key. USD/JPY though has now dropped 10 big figures from the high in November and hence further big moves to the downside are much less likely. Indeed, a status-quo message from Ueda tomorrow could prompt some renewed selling although yields abroad will also remain important. Please see our latest FX Weekly for more details (click here).

NARROWING YIELD SPREADS ARE ENCOURAGING A STRONGER JPY

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

IFO Business Climate |

Dec |

87.7 |

87.3 |

!! |

|

EC |

13:30 |

ECB's Schnabel Chairs Panel |

!! |

|||

|

US |

15:00 |

NAHB Housing Market Index |

Dec |

37.0 |

34.0 |

!! |

|

EC |

15:00 |

ECB's Lane Chairs Panel |

!!! |

Source: Bloomberg