G10 FX rates are consolidating ahead of Jackson Hole

G10 FX: Geopolitical risks in focus as FX vol trades close to lowest in a year

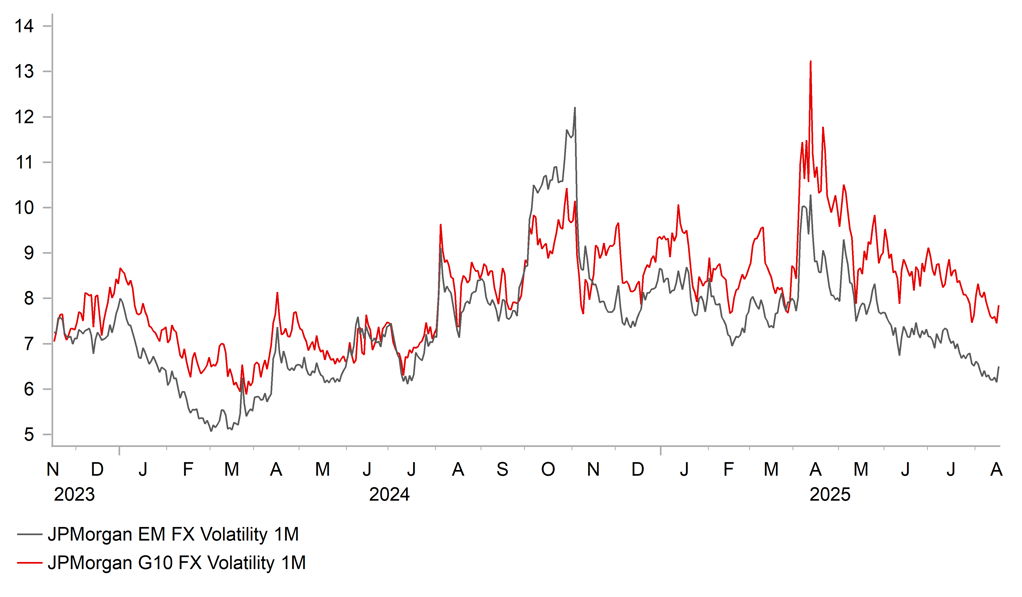

The major foreign exchange rates have remained stable overnight with the dollar index continuing to trade just below the 98.00-level after weakening for the second consecutive week. Geopolitics is the main focus at the start of this week following the meeting between Presidents Putin and Trump at the end of last week. In a Truth Social Post from overnight, President Trump stated that Ukrainian President Zelenskiy “can end the war with Russia almost immediately, if he wants to, or he can continue to fight”. President Zelenskiy is scheduled to meet President Trump in Washington today as he faces growing pressure to agree a quick peace deal with Russia that involves ceding territory. According to Sky news, he will be joined by European Commission President Ursula von der Leyen, NATO Secretary General Mark Rutte, Finnish President Alexander Stubb, German Chancellor Friedrich Merz, UK Prime Minister Keir Starmer, French President Emmanuel Macron and Italian Prime Minister Giorgia Meloni. European leaders are reportedly seeking robust security guarantees. President Trump reportedly told European leaders in a call on Sunday that he was prepared to contribute to security guarantees with Europe so long as it didn’t involve NATO which he suggested President Putin would be ok with such an arrangement. President Trump is also reportedly looking to set up a meeting between Presidents Putin and Zelenskiy as early as within a week. President Putin is reportedly wants Ukraine to cede control of the entire Donbas region while President Zelenskiy has repeatedly ruled out giving up all of Donetsk and Luhansk provinces. The impact on financial markets at the start of this week from the latest geopolitical developments has been limited. In our latest FX Weekly (click here), we highlighted that measures of FX market volatility have fallen back to their lowest levels in a year. A further reduction in geopolitical risk should a ceasefire be agreed would favour lower volatility alongside recent decisions from major central banks to leave rates on hold. A lower vol regime supports high beta G10 currencies at the expense of the safe haven currencies of the Swiss franc and yen.

LOWER VOLATILITY FOR BOTH G10 AND EM FX

Source: Bloomberg, Macrobond & MUFG GMR

USD: Will the Jackson Hole symposium be important for Fed policy outlook?

The US dollar has continued to trade at weaker levels over the past week. Renewed US dollar weakness was initially triggered earlier this month by the release of the weaker NFP report for July including the significant downward revisions to employment in May and June that have made market participants more confident that the Fed will resume rate cuts as soon as next month. The release of mixed US inflation data over the past week has not significantly altered expectations for a Fed rate cut next month. The US rate market is still pricing in around 21bps rate cuts in September. Market participants were reassured that the pass-through from higher tariffs to consumer goods prices slowed in the July CPI report. However, stronger producer price inflation for July has since sent a cautionary warning that the upward impact on consumer prices is likely to build heading into year end. It has dampened expectations that the Fed could cut rates more aggressively after US Treasury Secretary Bessent made the case last week for the Fed to start off with a larger 50bps cut like last September.

The next key event for Fed policy communication will be the upcoming annual Jackson Hole Economic Symposium scheduled to be held between 21st and 23rd August. The theme for this year’s symposium is entitled “Labor Markets in Transition: Demographics, Productivity and Macroeconomic Policy”. The Jackson Hole Economic Symposium has historically been a key venue for the Fed to signal major shifts in monetary policy. At last year’s Jackson Hole Economic Symposium, Fed Chair Powell sent a clear signal that the time had arrived to start lowering rates which was followed by a larger 50bps rate cut at the September FOMC meeting. He stated that “the time has come for policy to adjust. The direction of travel is clear” with inflation on a “sustainable path” toward their target. At this month’s Jackson Hole Economic Symposium market participants will be listening closely to see if Chair Powell validates pricing for rate cuts to resume next month. The risk is that Chair Powell refrains from providing a clear signal over the timing of the next rate cut giving the Fed more time to continue assessing incoming data before the September FOMC meeting. It could help to dampen downward pressure on the US dollar in the near-term.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

Trade Balance SA |

Jun |

-- |

16.2b |

!! |

|

CA |

13:15 |

Housing Starts |

Jul |

265.0k |

283.7k |

!! |

|

CA |

13:30 |

Int'l Securities Transactions |

Jun |

-- |

-2.79b |

!! |

|

US |

13:30 |

New York Fed Services Business Activity |

Aug |

-- |

- 9.3 |

!! |

|

US |

15:00 |

NAHB Housing Market Index |

Aug |

34.0 |

34.0 |

!! |

Source: Bloomberg & Investing.com