Will stronger China growth breathe fresh life into reopening trades?

AUD: China activity data provides encouragement for reopening trades

The Australian dollar has been the best performing G10 currency overnight resulting in the AUD/USD rate moving back above the 0.6700-level. It follows a rebound for the US dollar at the start of this week that has been supported by the paring back of dovish Fed policy expectations. The US rate market is now only expecting the Fed to deliver one 25bps cut by the end of this year and has moved to fully price in one more 25 hike into the tightening cycle. The repricing has helped the US dollar to stage a relief rally since late last week when the dollar index hit a year to date low on Friday at 100.79. The US dollar rebound has dragged the AUD/USD rate back below its 200-day moving average that comes in at just below 0.6750 where the April has been trading since late February. Developments overnight have proven favourable for the Australian dollar. Firstly, the Australian dollar has been supported by the release of the latest GDP report from China which revealed that activity bounced back even more strongly than expected in Q1 following the removal of COVID restrictions at the end of last year.

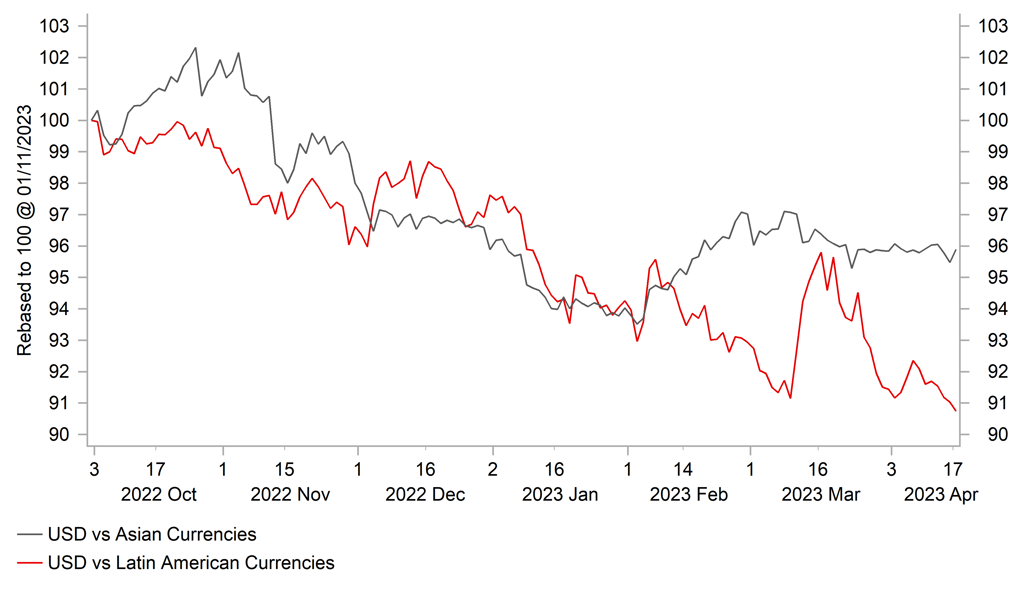

The report revealed that GDP growth picked up to an annual rate of 4.5% in Q1 up from 2.9% in Q4 of last year and exceeded consensus expectations for an increase of 4.0% in Q1. One of the main positive surprises was the strength of retail sales in March perhaps driven by the release of pent up demand. Retail sales growth jumped to an annual rate of 10.6% in March up from 3.5% in the first two months of the year. Industrial production picked up as well to an annual rate of 3.9% in March up from 2.4% in the first two months of the year. It was only partially offset by the surprising slowdown in fixed asset investment to an annual rate of 5.1% in March down from 5.5% in the first two months of the year. The was also continued weakness in property investment that fell by an annual rate of -7.2% in March down from a -5.7% drop in the first two months of the year. Overall, the developments provide encouragement that stronger cyclical momentum in China will continue in Q2. Despite the stronger data releases from China it remains notable that Asian currencies including the renminbi have struggled to regain upward momentum at the start of this year even as the US dollar has weakened further. Th Australian dollar has underperformed as well year to date. In contrast, the other commodity-related Latam currencies that benefit from stronger China demand have been the best performing currencies this year. We continue to hold the view that stronger China growth will provide broader support from re-opening trades this year.

Secondly, the Australian dollar has derived support as well overnight from the release of the minutes from the RBA’s last policy meeting on 4th April. At the meeting the RBA decided to leave their policy rate unchanged a 3.6% bringing an end to a series of 10 consecutive rate hikes. The minutes signalled a higher risk that the RBA delivers at least one final 25bps hike at upcoming policy meetings. The RBA discussed delivering a 25bps hike at the 4th April policy meeting before deciding to leave rate on hold, and the board suggested that rates may need to be increased at subsequent meetings if inflation remains too high and the labour market tight.

ASIAN CURRENCIES HAVE STRUGGLED TO REGAIN UPWARD MOMENTUM

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Reversal of pessimism has helped pound to outperform this year

The pound has been one of the top performing G10 currencies so far this year beaten by only the Swiss franc. It has resulted in cable briefly rising back above the 1.2500-level last week as it moved back towards the highs from May and June of last year. The move higher in cable has been driven both by the broad-based weakening of the US dollar but also reflects some easing of investor pessimism towards the UK. While the UK economy is still expected to be one of the worst performing major economies this year, the risk of recession/deeper slowdown has diminished. Economic data releases have continued to surprise to the upside over the past month providing encouragement that two consecutive quarters of negative growth can be avoided in the first half of this year. Growth though is still weak with the economy having roughly flat lined since the second half of last year, but importantly for market participants the negative hit from the terms of trade shock has not been as bad as feared so far.

The more resilient UK economy has strengthened the case for the BoE to deliver further policy tightening to help address ongoing concerns over domestic inflation pressures. Th UK rate market is currently pricing almost wo further 25bps hikes that would lift the policy rate up to a peak of 4.75%. The release today of the latest labour market report and tomorrow’s CPI report for March will be important in shaping BoE rate hike expectations ahead of the next MPC meeting on 11th May. The labour market report released this morning has strengthened the case for another 25bp hike in May by revealing stronger than expected wage growth. The report revealed that average weekly earnings growth remained stronger than expected at 5.9% 3M/YoY. The regular pay measure remained firmer still at 6.6%. The recent slowdown in wage growth is less pronounced now after the jump in February. Speculation over another 25bps hike from the BoE in May will help to support the pound in the near-term

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

German ZEW Current Conditions |

Apr |

-40.0 |

-46.5 |

!! |

|

EC |

10:00 |

Trade Balance |

Feb |

-- |

-30.6B |

!! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Apr |

13.0 |

10.0 |

!! |

|

US |

13:30 |

Building Permits |

Mar |

1.450M |

1.550M |

!!! |

|

US |

13:30 |

Housing Starts |

Mar |

1.400M |

1.450M |

!! |

|

CA |

13:30 |

CPI (YoY) |

Mar |

4.3% |

5.2% |

! |

|

EC |

14:00 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

|

CA |

16:00 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

|

UK |

17:00 |

Labour Productivity |

Q4 |

0.3% |

0.9% |

!! |

|

US |

18:00 |

FOMC Member Bowman Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg