USD gives back recent gains alongside US regional bank equity sell-off

USD: Market focus switches back to US encouraging weaker USD

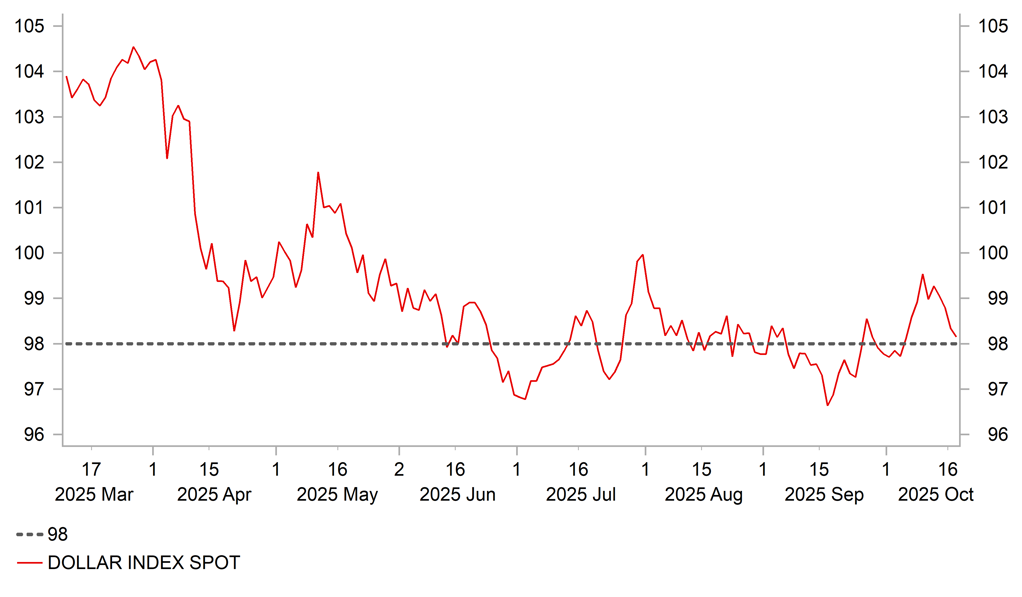

The US dollar has continued to weaken overnight resulting in the dollar index falling back towards the 98.000-level. It has now almost fully reversed the gains it made during the prior week on the back of heightened political uncertainty in France and Japan which lifted the dollar index up to a high of 99.563 on 9th October. The reversal of those dollar gains over the past week has been encouraged an easing of political uncertainty in France and Japan. French Prime Minister Lecornu survived two no-confidence votes yesterday after announcing plans to suspend pension reforms until after the next Presidential election in 2027. The first no confidence motion proposed by the far left France Unbowed party was defeated when 271 lawmakers backed it which fell short of the 289 majority required to force the prime minister to resign. The second no confidence motion proposed by the far right National Rally party received even less support when only 144 lawmakers voting in favour. It provides more breathing room for Prime Minister Lecornu to put together a budget for next year although it remains far from clear that his budget will pass smoothly through parliament. Political uncertainty could flare up again later this year if the proposed budget for next year fails to pass through parliament. Please see our latest FX Focus report (click here) released yesterday for further insights into political, trade and debasement risks currently impacting the FX market.

The easing of political risks outside of the US in the near-term have seen the market’s attention shift back to the latest developments in the US reinforcing the US dollar sell-off overnight. One of the main developments yesterday was the sharp sell-off for US regional bank equities. The S&P Regional Banks Select Industry Index declined by -6.3% which was the largest daily decline since the sell-off in April triggered by President Trump’s “Liberation Day” tariffs announcement. According to Bloomberg, Zions Bancorp fell by 13% after a USD50 million charge-off tied to a California Bank & Trust loan, while Western Alliance Bancorp dropped by 11% after revealing exposure to the same borrowers. It follows last month’s collapse of auto lender Tricolor and auto-parts supplier First Brands Group which has triggered some unease amongst market participants in the near-term. On the other hand, there has been some positive news for US automakers. It has been reported that the Commerce Department is expected to announce a five-year extension for an arrangement that allows automakers to reduce what they pay in tariffs on imported cars. The provision was previously scheduled to sunset after two years.

At the same time Fed Governor Waller, who remains one of the leading candidates to be appointed the next Fed Chair when Jerome Powell’s term expires in May of next year, stated yesterday that he continues to support lowering rates by a further 25bps at the end of this month despite limited further insight into the health of the US economy while the US government shutdown continues. He stated “you don’t want to make a mistake, so the way to avoid that is to go cautiously or carefully and do a 25, wait and see what happens, and then you can get a better idea of what to do”. It fits with our and the market’s view that in the absence of major economic data releases the Fed is likely to stick to plans from the September FOMC meeting to lower rates again later this month. However, Fed Governor Waller did express more caution over delivering another rate cut in December. He wants to see if US economic growth softens to match the soft labour market, or the labour market rebounds in the coming months.

USD CONTINUES TO CONSOLIDATE AT WEAKER LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Lower US yields & comments from BoJ Governor weigh on USD/JPY

The broad-based correction lower for the US dollar has helped to drag USD/JPY back below the 150.00-level overnight as it moves further below the high from 10th October at 153.27. Downward pressure on USD/JPY was reinforced by the sharp move lower in US yields yesterday. The 2-year US Treasury bond yield hit a fresh year to date low of 3.39% and the 10-year US Treasury yield fell back below 4.00%.

The rebound for the yen has been supported as well by domestic developments in Japan this week. Comments from BoJ Governor Ueda overnight have encouraged expectations that the BoJ still plans to resume rate hikes before the end of this year. The Japanese rate market is currently pricing in around 15bps of hikes by the December BoJ policy meeting but only 5bps for later this month. Governor Ueda told reporters that “there’s no change in our stance that we will adjust the degree of monetary easing if our confidence in hitting the outlook increases”. He added that the BoJ will collect more information before making the October policy meeting. It suggests that it is not necessarily a done deal that the BoJ will refrain from resuming rate hikes later this month but it is still unlikely given lingering uncertainty over political developments in Japan and the health of the US economy from the ongoing government shutdown. It was a message repeated by Deputy Governor Uchida who reiterated that they will keep raising rates if the economic outlook is met. He noted that he has no preconception if the outlook will be realized but remains optimistic the economy will pick up after moderating on tariffs and that the price trend will be in line with their goal in the 2H outlook.

Political uncertainty in Japan (click here) is set to extend into next week ahead of the Diet vote on who will become the next prime minster on 21st October. Recent developments have suggested that new LDP leader Takaichi chances of becoming prime minster have increased in recent days after talks continue with the Japan Innovation Party to secure support although it is not yet a done deal. The co-leader of the Japan Innovation Party Hirofumi Yoshimura stated overnight that “we are standing at a cross-roads of where we will go”. A failure to reach an agreement with the Japan Innovation Party would leave Takaichi’s bid to become the next prime minster at risk although it would require the three main opposition parties to unite around a shared candidate. A potentially higher hurdle to get over than for the LDP to reach an agreement with Japan Innovation Party. Overall we continue to expect the yen to rebound as initial optimism over much bigger stimulus from looser fiscal and monetary policies triggered by Takaichi’s LDP election victory continue to fade.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SW |

07:00 |

Unemployment Rate SA |

Sep |

8.7% |

8.8% |

!! |

|

EC |

10:00 |

CPI YoY |

Sep F |

2.2% |

2.2% |

!! |

|

CA |

13:30 |

Int'l Securities Transactions |

Aug |

-- |

26.69b |

!! |

|

US |

13:30 |

Housing Starts |

Sep |

1320k |

1307k |

!! |

|

US |

13:30 |

Import Price Index MoM |

Sep |

0.1% |

0.3% |

!! |

Source: Bloomberg & Investing.com