Global growth concerns appear to be on the rise

USD: Softer US data & lower oil price fuelling growth concerns

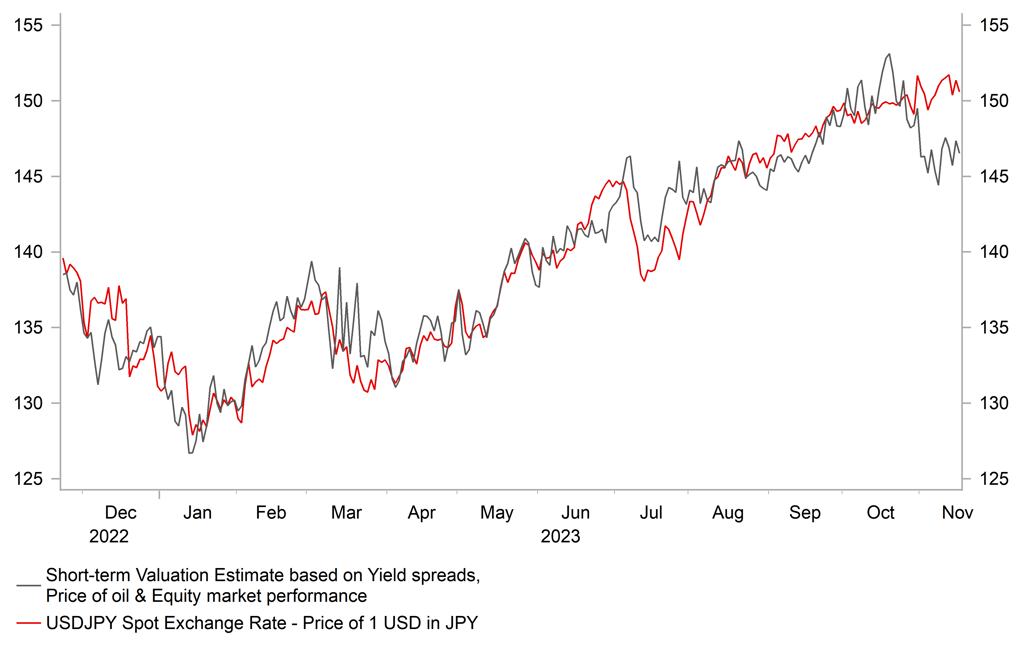

The US dollar weakened further yesterday in response to the release of weaker US economic data although the sell-off was narrowly focused against the other major currencies of the euro and yen. In contrast, the US dollar has recovered some lost ground against the G10 commodity currencies of the Australian dollar, Canadian dollar, New Zealand dollar and Norwegian krone. The more narrow focused US dollar sell-off appears to reflect building concerns over the global growth outlook. The price of oil fell sharply yesterday resulting in Brent hitting a fresh low of USD76.60/barrel as it moved further below the peak from late September at 97.69/barrel. It is keeping downward pressure on market-based measures on inflation expectations and nominal government bond yields. It is creating a more favourable external environment for the yen which has tended to benefit from: i) lower energy prices, ii) falling yields outside of Japan and iii) building concerns over the global growth outlook. If these developments continue, it will encourage the yen to strengthen. So far that has not been the case as the yen has continued to underperform even as the US dollar has corrected lower. USD/JPY has remained relatively stable at just over the 150.00-level when the dollar index has fallen by around 3% from last month’s peak. It has resulted in the yen falling to fresh year to date lows against the Australian dollar, euro, Swiss franc, pound, Swedish krona, and New Zealand dollar.

The drop in US yields and pick-up in global growth concerns was triggered by more evidence of softer US economic data at the start of Q4 following unsustainable growth of close to 5% in Q3. Over the past month initial and continuing claims have started to drift higher again after falling in Q3 although remain at historically low levels. The release of the much weaker nonfarm payrolls report for October has left market participants more sensitive to further evidence of labour market weakness in the near-term. Furthermore, the recent sharp drop in the NAHB housing market index which is a measure of homebuilder confidence sends a clear signal that the sharp adjustment higher in mortgage rates since the summer is providing a significant headwind to growth in the more interest sensitive sectors of the US economy such as the housing market. The NAHB index has fallen for four consecutive months as it moves back closer to the low from the end of last year. It is providing encouragement for the US rate market to fully price in a 25bp Fed rate cut by Q2 of next year.

USD/JPY HAS HELD UP BETTER THAN EXPECTED SO FAR THIS MONTH

Source: Macrobond & MUFG GMR

GBP: Pricing in earlier & more BoE rate cuts into next year

The UK rate market has been adjusting over the past week to price in earlier and larger rate cuts from the BoE for next year. The implied yield on the June 2024 SOFR futures contract has fallen by around 0.14 point since 13th November, and is now almost fully pricing in the first 25bps rate cut from the BoE. For the year as a whole, the UK rate market has moved to price in almost 75bps of BoE cuts by the end of next year. The ongoing dovish repricing of the BoE’s policy outlook has been mainly encouraged by evidence of softening inflation pressures this week. The latest labour market report revealed wage growth has been slowing recently although annual rates remain elevated. While the sharp drop in the annual rate of headline inflation was expected driven by lower energy prices in October, it was reassuring that core and services measures of inflation fell more than expected.

The combination of slowing inflation and weak UK growth after the economy has stagnated in recent quarters is casting doubt on the BoE’s forward guidance to leave rates on hold for an “extended period”. BoE Chief Economist Huw Pill has indicated that the BoE could begin to consider cutting rates by the middle of next year, but market participants have been moving to price in earlier cuts into the 1H of next year. The release today of the latest retail sales report for October provided further evidence of weak cyclical momentum. Retail sales contracted for the second consecutive month, and third out of the last four months. The report will further encourage earlier BoE rate cut expectations even though BoE trying to discourage them. MPC member Megan Greene was emphasizing yesterday that rates will need to remain higher for longer. She remains worried over the risk of more persistent high inflation with wage growth still “incredibly high”. She is in the hawkish minority at the BoE having voted for a hike at the last three MPC meetings.

The dovish repricing of BoE policy expectations has contributed to the pound underperforming modestly over the past week. It has resulted in EUR/GBP climbing to a fresh high yesterday of 0.8766 as it moves further above support from the 200-day moving average at around 0.8685. Cable has also failed to break above resistance from the 200-day moving average at around 1.2445 after briefly rising above just after the release of the weaker US CPI report for October that triggered a sharp broad-based US dollar sell-off earlier this week.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

Current Account |

Sep |

20.3B |

27.7B |

! |

|

EC |

10:00 |

CPI (YoY) |

Oct |

2.9% |

4.3% |

!!! |

|

GE |

13:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

UK |

13:10 |

MPC Member Ramsden Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Housing Starts |

Oct |

1.345M |

1.358M |

!! |

|

US |

15:00 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg