JPY is little changed after BoJ policy update

JPY: Limited market impact from BoJ’s plan to slow tapering

The main event overnight has been the BoJ’s latest policy meeting. The BoJ decided to leave their policy rate unchanged at 0.50% and announced plans to slow down the pace of tapering. From the next fiscal year starting in April 2026 monthly bond purchases will be cut back by JPY200 billion per quarter down from JPY400 billion for the rest of the current fiscal year. The plans would lower the volume of monthly purchases to around JPY2 trillion by Q1 2027 which was roughly the same amount the BoJ was buying back in 2013. The adjustment to the BoJ’s tapering plans had already been well flagged in advance which helps to explain the limited market reaction at least in the FX market where USD/JPY is largely unchanged overnight as it continues to trade just below the 145.00-level. In contrast, there has been a modest sell-off for long-term JGBs. The 10-year and 30-year JGB yields have both risen by around 3bps and 2bps respectively perhaps reflecting some initial disappointment that they BoJ did not go further and slow tapering for the current fiscal year as well although based on recent communication from BoJ officials including Governor Ueda that never appeared likely. Market participants are also eagerly waiting to see if the MoF will adjust debt issuance plans going forward to help alleviate upward pressure on yields at the long end of the curve if required.

In the policy statement, the BoJ reiterated that “it is extremely uncertain how trade and other policies in each jurisdiction will evolve and how overseas economic activity and prices will react to them”. The extreme level of uncertainty is holding back the BoJ from raising rates further in the near-term. In the accompanying press conference Governor Ueda stated that it was appropriate to continue to reduce bond purchases in a predictable manner, and they plan to conduct a mid-term assessment of their bond taper plan in June next year. He reiterated that long-term yields are to be formed in financial markets although they are willing to respond nimbly if there is a sharp rise in yields. On the outlook for the policy rate, he continued to signal that the BoJ would raise rates further if the economic outlook is met although warned that uncertainty is “extremely high”. He noted that the hard economic data released in Japan was still looking “fairly solid so far” but that many expected worse data in the 2H of the year. In light of extremely high uncertainty he noted that it is becoming more vital to assess a wide range of data and info. Overall, there were no significant changes in the BoJ’s guidance for the policy rate. The BoJ is clearly not in a rush to raise rates further right now and will wait for the extreme level of uncertainty to ease. We still believe that the BoJ could hike rates further later this year providing support for the yen. A trade deal between the US and Japan in the coming months could give the BoJ more confidence to hike rates further if global trade disruption eases as well.

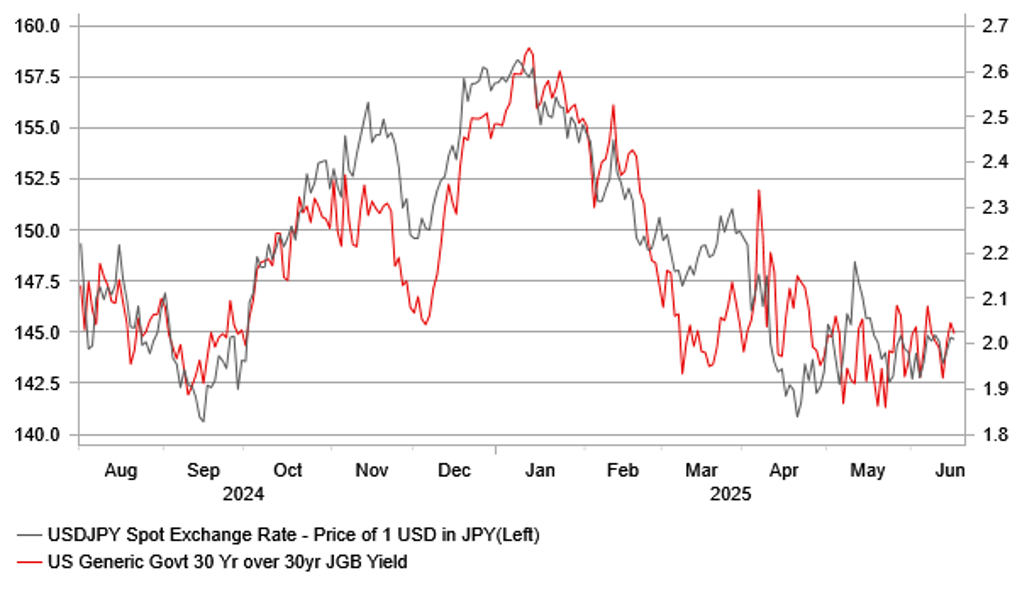

USD/JPY HAS BEEN TIGHTLY LINKED TO LONG-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

USD: Investor fears over Middle East tensions ease triggering renewed sell-off

The US dollar has continued to trade at weaker levels overnight after giving back gains recorded on Friday at the start of this week. Renewed US dollar weakness was driven by an easing of initial fears over potential global disruption from the ongoing conflict between Israel and Iran. The high beta G10 commodity currencies of Australian and New Zealand dollars outperformed yesterday boosted by the improvement in global investor risk sentiment. Market participants have been encouraged that Israel has avoided targeting oil production facilities in Iran over the weekend, and then it was later reported that Iran was seeking to bring a quick end to the conflict. The lack of disruption to oil supply resulted in the price of oil dropping back sharply yesterday towards USD70/barrel although it has since picked back up towards USD75/barrel overnight. It had been reported yesterday that Iran was urgently signalling that it seeks to end hostilities and resume talks over its nuclear programs, sending messages to Israel and the US via Arab intermediaries according to Middle Eastern and European officials. Iran would reportedly be willing to return to the negotiating table as long as the US does not join the attack.

However, there has been no sign so far from Israel that they are prepared to halt their military operations before doing more to destroy Iran’s nuclear program and ballistic missiles as it also seeks to further weaken the Iranian government’s grip on power. The same report noted that Irsraeli officials have said that the military has prepared for at least two weeks of strikes. Hopes for an immediate end to the military operation have diminished overnight after President Trump urged “everyone to immediately evacuate Tehran” and left the G7 Summit early to “attend many important matters”. He posted on Truth Social that “Iran should have signed the “deal” I told them to sign. What a shame, and waste of human life. Simply, IRAN CAN NOT HAVE A NUCLEAR WEAPON. I said it over and over again”. He reportedly wants a “real end” to Iran’s nuclear program. As we have seen so far market participants are willing to look through uncertainty triggered by the heightened geopolitical tensions in the Middle East so long as the conflict does not directly restrict global supply chains and oil supply.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

09:00 |

IEA Monthly Report |

-- |

-- |

-- |

!! |

|

GE |

10:00 |

German ZEW Current Conditions |

Jun |

-74.0 |

-82.0 |

!! |

|

US |

13:30 |

Import Price Index (MoM) |

May |

-0.2% |

0.1% |

!! |

|

US |

13:30 |

Retail Control (MoM) |

May |

0.3% |

-0.2% |

!! |

|

US |

13:30 |

Retail Sales (MoM) |

May |

-0.5% |

0.1% |

!!! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

4.7% |

! |

|

US |

14:15 |

Industrial Production (MoM) |

May |

0.0% |

0.0% |

!! |

|

US |

15:00 |

NAHB Housing Market Index |

Jun |

36 |

34 |

! |

Source: Bloomberg & Investing.com