USD rebound unfolding given the richness of US rates curve

USD: Rebound has more room to go until data worsens

Regular readers will know we have a moderate bias for US dollar strength based simply on the view that the FX move in December over-extended and potentially reinforcing that the prospect of the markets doubting the possibility of the FOMC being in a position to cut rates as soon as March. While inflation is falling quite quickly now for the FOMC to cut we will need to see some clearer evidence of a deteriorating labour market that would prompt increased fears of recession. That of course may well come in either the February or March payrolls reports but if not in February we may well see a full retracement of the EUR/USD rally in November/December, taking spot back down to around the 1.0600-1.0700 area.

The hawkish ECB comments when the US markets were out for MLK Day on Monday resulted in catch-up yesterday with short-end rates in Europe close to unchanged. The US rates move higher was then reinforced by the comments from Fed Governor Waller who spoke in some detail at the Brookings Institution about the outlook to monetary policy this year coving both interest rate and balance sheet policy.

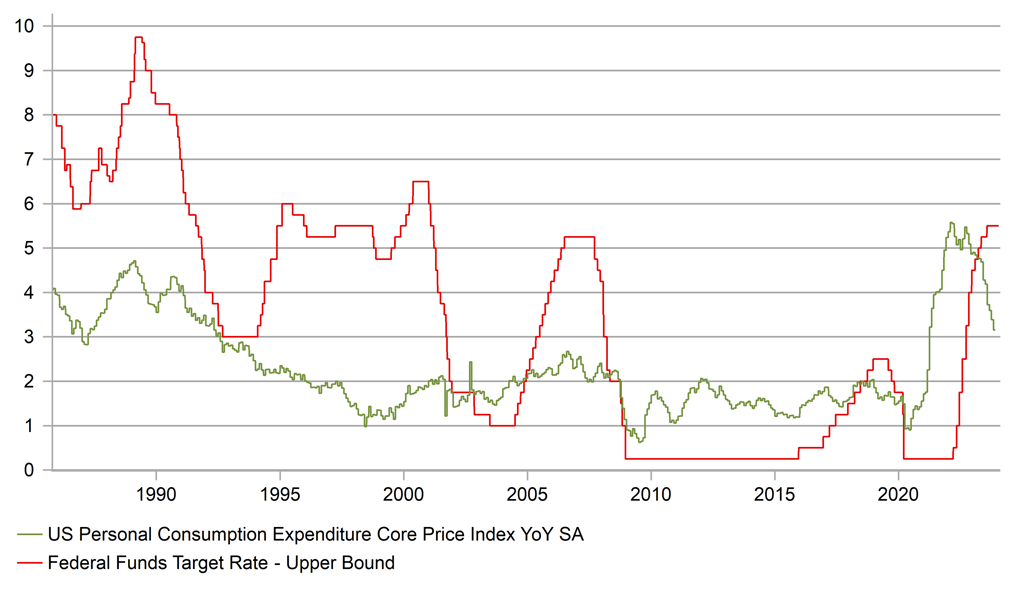

The 2-year UST bond yield jumped in response to his comments at 4pm London time and it was clear from that response that there wasn’t enough in his comments to endorse the pricing of a rate cut in March. The probability of a cut in March fell by about 20% in the 90min period following his comments. Waller was certainly very clear on there being scope for rate cuts “this year” adding that more information was needed in order to commence easing. He also added that cuts shouldn’t be as rapid as in the past and cuts should be “methodical and careful”.

That’s all logical and sensible stuff from Waller and there was nothing in his comments that implied any kind of bias in relation to possibly cutting in March. More information needed could easily be two more PCE and CPI inflation reports which is what the FOMC will have by March. Not cutting as fast as in previous cycles is basically always the objective of any central banker. To cut rapidly implies a policy error. So Waller basically has left all options on the table and hence we’d be surprised to see this rates move extend further until we have more data to provide direction. The PCE inflation data for December on 25th January and the NFP on 2nd February are the two key upcoming data point and sandwiched between the FOMC meeting.

But in the meantime, we stated above, the dollar sell-off into year-end looked overdone and hence there remains scope for further dollar strength, especially on days like yesterday when we see bigger jumps in yields. The FOMC meeting on 31st January is teeing up to being a pretty tricky one for the Fed in offering guidance on the following meeting (20th March), which could prove a source of disappointment for the markets (unless the FOMC has some sense of the NFP data two days later!).

THE REAL FED FUNDS RATE NOW RISING RAPIDLY HIGHLIGHTING THE SCOPE FOR RATE CUTS “THIS YEAR” ACCORDING TO WALLER

Source: Macrobond & Bloomberg

GBP/CNY: Firmer UK inflation & softer China activity data in focus

The US dollar’s broad-based rebound has resulted in USD/CNY rising back up to the 7.2000-level overnight. Asian currencies have extended their sell-off this week following the election result from Taiwan over the weekend. Weakness in the renminbi and other Asian currencies has also been reinforced overnight by the releases of softer than expected economic data from China. GDP growth in Q4 came in slightly below expectations at an annual rate of 5.2% compared to consensus expectations for an increase of 5.3%. For the year as a whole it marked a step up in growth as the economy removed COVID restrictions but the strength of the recovery has disappointed expectations. The monthly activity data revealed that retail sales growth slowed to an annual rate of 7.4% in December down from 10.1% in November while industrial production and fixed asset investment picked up to 6.8% Y/Y and 3.0% YTD Y/Y. For Q4 as a whole the economy lost upward momentum with the property sector remaining weak where investment contracted by -9.6% YTD Y/Y. Investors continue to remain concerned by the health of China’s economy. The Shanghai composite equity index fell to fresh lows overnight and is now trading at its lowest level since the mid-2020. Negative investor sentiment remains a headwind for Asian currency performance.

The other main economic data release this morning has been from the UK where the latest CPI report for December revealed firmer than expected inflation. The report revealed that headline inflation unexpectedly picked up to 4.0% in December up from 3.9% in November. It partially reverses the downside surprise provided by the prior CPI report for November. For Q4 as a whole headline inflation has averaged an annual rate of 4.2% which is still well below the BoE’s forecast from the November Quarterly Inflation report of 4.6%. Nevertheless, the stronger than expected reading for both core and services inflation in December at 5.1% and 6.4% are disappointing and will discourage the BoE from beginning to cut rates sooner. The UK rate market is not fully pricing in the first 25bps rate cut from the BoE until June. The hawkish repricing of the UK rate curve has contributed to the pound strengthening modestly this morning.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:15 |

ECB's Simkus Speaks |

!! |

|||

|

EC |

09:30 |

ECB's Villeroy Speaks |

!! |

|||

|

EC |

10:00 |

CPI YoY |

Dec F |

2.9% |

2.9% |

!! |

|

US |

13:30 |

New York Fed Services Business Activity |

Jan |

-- |

-14.6 |

!! |

|

US |

13:30 |

Retail Sales Advance MoM |

Dec |

0.4% |

0.0% |

!!! |

|

US |

13:30 |

Import Price Index YoY |

Dec |

-2.0% |

-1.4% |

!! |

|

US |

14:15 |

Industrial Production MoM |

Dec |

-0.1% |

0.2% |

!! |

|

US |

15:00 |

NAHB Housing Market Index |

Jan |

39.0 |

37.0 |

!! |

|

EC |

15:15 |

ECB's Lagarde in Davos |

!!! |

|||

|

EC |

18:30 |

Bundesbank Chief Nagel Speaks in Davos |

!!! |

|||

|

US |

19:00 |

Federal Reserve Releases Beige Book |

!! |

Source: Bloomberg