JPY can recover further as political landscape becomes clearer

JPY: BoJ rate hike still plausible by year-end

The yen continues to slowly recover from the initial sell-off sparked by the political uncertainty created by the surprise victory in the LDP leadership election for Sanae Takaichi. From an intra-day high of 153.27 last Friday, USD/JPY has declined by 1.5% with the prospect of a Takaichi victory no longer fuelling further yen selling. The collapse of the New Komeito coalition altered the landscape somewhat and ultimately weakened Takaichi’s position which could well undermine her ability to pursue her policy agenda that was viewed as being yen negative. The LDP is continuing to push for a PM vote in the Diet next Tuesday and the LDP has now entered discussions with Japan Innovation Party (Ishin) on entering a coalition agreement. This will be crucial as a successful agreement would put to bed the idea of an opposition block by CDPJ, DPP and Ishin putting forward its own candidate for PM. A coalition with Ishin is certainly more plausible from a policy perspective and indeed one reason we believed Koizumi would win the leadership election was due to him being well positioned to form a coalition with Ishin. There are policy differences however and the LDP will likely have to compromise in order to reach a deal. One key Ishin policy is the suspension of the sales tax on food until March 2027. While not an LDP policy, it is a more manageable sales tax cut in that it is food only and has a clear end-date. The other main parties have more aggressive sales tax cut plans. Ishin while supporting increased spending does also promote fiscal sustainability and aims for consolidation over the medium term. Ishin is also an Osaka-based political party and believes in policies to decentralise certain government decision-making roles to Osaka and to restructure Osaka into special wards as in Tokyo. Takaichi has expressed scepticism on these policies so this is likely another area where compromise will be required.

On BoJ policy it’s likely that Ishin would support leaving policy decisions to the BoJ and is viewed as being supportive of the gradual removing of monetary easing. A coalition agreement with ad-hoc support from New Komeito would likely be viewed as a reasonable outcome based on the options prior. We still suspect it will be US economic developments and Fed policy that will prove most important for USD/JPY. BoJ policy board member Naoki Tamura spoke today and being one of the members who voted to hike in September it was no surprise that his comments today were consistent with supporting a rate hike going forward. Finance Minister Kato stated overnight in Washington that he was seeing “rapid FX moves in a weak yen direction” and would watch for “excessive, disorderly moves”. Renewed yen weakness is not in Japan’s interest and will only undermine Japanese household support for the new government and threaten relations with the US – so yen downside risks from here look to be receding. Still, that will only become clearer once the political uncertainty over the PM vote clears next week.

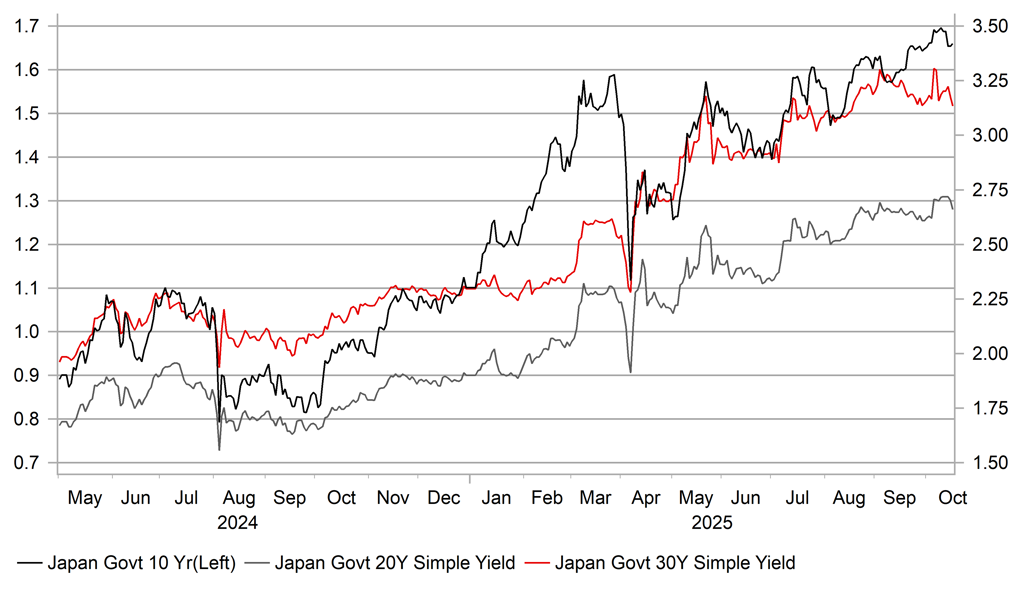

LONG-TERM JGB YIELDS HAVE STABILISED

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Lower front-end yields curtailing EUR upside

The lack of top-tier economic data from the US has not stopped front-end yields from declining with expectations remaining firm that the FOMC will deliver two additional rate cuts this month and in December. From an intra-day high on 25th September to the low yesterday, the 2-year UST note yield has dropped 20bps with a big move on Monday in response to the increased trade tariff risks. Over the same period the Germany 2-year yield is down around 15bps. The German 2-year yield is just 8bps below the ECB’s policy rate while the 2-year UST note yield is 60bps below.

The messaging from the ECB has been indicative of no policy change going forward although we do see risks building that the ECB’s rhetoric could start to change and we still expect the ECB to lower the policy rate further. There are a number of factors that will likely support additional action, likely in the first half of 2026. ECB council members are certainly keeping their options open and President Lagarde on Tuesday stated that she would “never say rate cuts are over” while ECB council member Villeroy de Galhau sees more downside than upside inflation risks. There are others who believe the opposite like Makhlouf and Nagel who yesterday cited upside inflation risks.

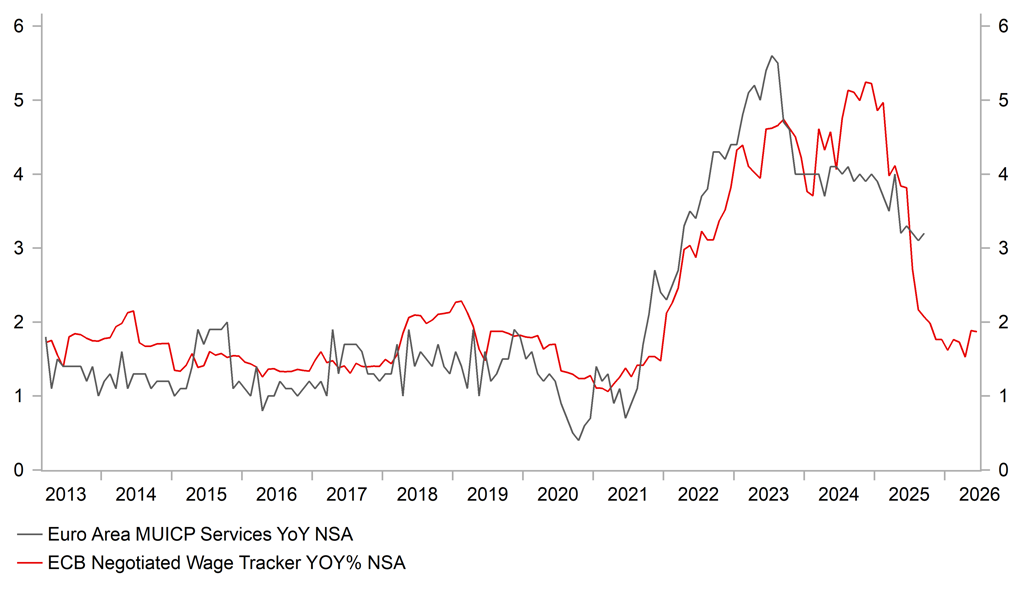

But we would at this stage side with Villeroy de Galhau. As can be seen in the chart, the ECB negotiated wage growth tracker has fallen back sharply and looks set to put downward pressure on services inflation going forward. Secondly, the annual change in crude oil prices in EUR terms are likely to decline over the coming 6mths that will result in the energy component in the CPI basket falling further, putting further downward pressure on the headline CPI rate. Given the anticipated global supply surplus as OPEC+ bring production back on line, a crude oil price rebound looks much less likely. Thirdly, export diversion from China could add to goods disinflation. China export data, released on Monday, revealed a 27% YoY plunge in exports to the US but a 14.2% YoY growth in exports to the EU, the fastest gain in three years. German industrial production fell 4.3% in August with auto production down 18.5% YoY. While possibly distorted due to summer shutdowns, the drop was much larger than expected. Despite the data, the German government this week raised its growth forecast for 2026 from 1.0% to 1.3% underlining the importance of domestic-generated growth to offset external demand weakness. The fiscal spending for Germany will be a key support for the economy.

But given the downside risks to inflation could become more apparent due to the factors above, the ECB should at least have the capacity for some further easing, albeit limited given the ECB’s own forecast is for a pick-up in GDP growth in 2026. But the ECB has a sole inflation target mandate and hence should still be in a position to cut. One cut by mid-2026 is unlikely to derail prospects of a rebound in EUR/USD given the Fed is set to be much more active and with a risk of pricing of cuts over that period increasing further as well.

A SHARP RETRACEMENT IN NEGATOIATED WAGE GROWTH SUGGESTS SCOPE FOR SERVICES INFLATION SLOWDOWN

Source: Bloomberg & Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

EU Harmonised CPI MoM |

Sep F |

1.30% |

1.30% |

! |

|

IT |

09:00 |

EU Harmonised CPI YoY |

Sep F |

1.80% |

1.80% |

! |

|

EC |

10:00 |

Trade Balance; EUR |

Aug |

7.0bn |

5.3bn |

! |

|

US |

13:30 |

Philly Fed Business Outlook |

Oct |

10.0 |

23.2 |

!! |

|

US |

13:30 |

New York Fed Services Activity |

Oct |

-- |

-19.4 |

! |

|

UK |

14:00 |

BoE's Mann speaks |

!!! |

|||

|

US |

14:00 |

Fed's Waller speaks |

!! |

|||

|

US |

14:00 |

Fed's Miran speaks |

!! |

|||

|

US |

15:00 |

NAHB Housing Market Index |

Oct |

33 |

32 |

! |

|

EC |

16:45 |

ECB's Lane speaks |

!! |

|||

|

EC |

17:00 |

ECB's Lagarde speaks |

!!! |

|||

|

UK |

19:30 |

BoE's Greene speaks |

!!! |

Source: Bloomberg & Investing.com