BoJ caution will have limited FX impact

JPY: Weak GDP will add to BoJ caution

USD/JPY has now fully reversed the move higher this week and is trading at the same level as the end of last week. This mainly reflects a broader dollar correction weaker with the initial enthusiasm after Monday’s de-escalation of trade tensions fading. We have seen a similar move in front-end yields in the US with the 2-year UST note yield jumping 15bps in response to Monday’s announcement – that move has now nearly fully reversed. Some weakness in underlying retail sales data yesterday from the US (Control Group Sales -0.2% m/m vs expected +0.3%) and weaker PPI data helped drive the move lower in yields.

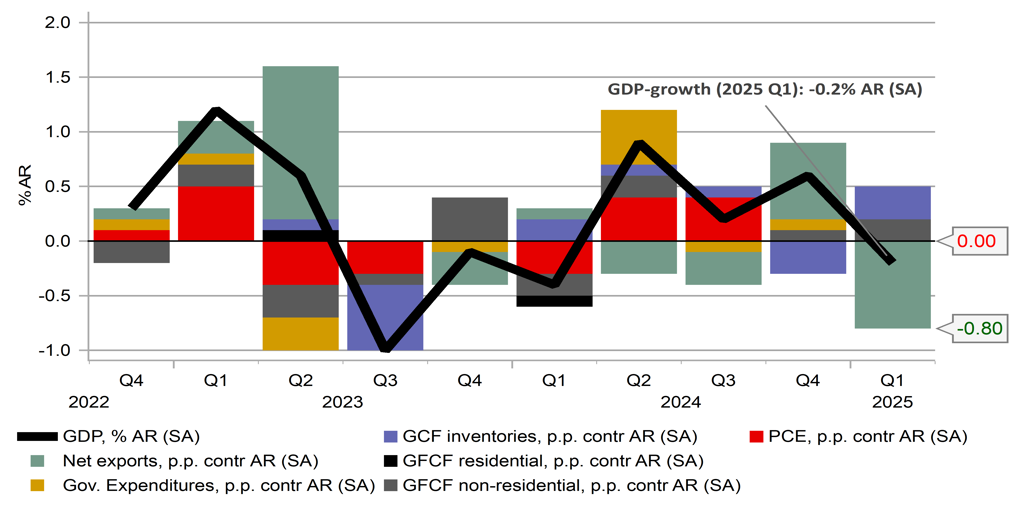

It will be these developments that will be more important for the direction of USD/JPY and given our view of weakening economic growth in the US we continue to expect USD/JPY to decline. The gain we had from the low last week to Monday’s high has now retraced by over 50% and today’s weaker than expected GDP data for Q1 from Japan is unlikely to have much impact. Real GDP contracted by 0.7% Q/Q on a SAAR basis following a 2.4% gain in Q4 last year. There was no rush to export ahead of tariffs with exports declining 0.6% Q/Q while imports jumped 2.9%. The household sector also remains weak with private consumption flat in the quarter. The cost of living crisis remains an issue for Japanese households.

In that regard to the BoJ is unlikely to shift its monetary stance notably which will help support yields in Japan. BoJ policy board member Toyoaki Nakamura spoke today in Fukuoka and again warned against further rate hikes. This is no surprise given he’s viewed as one of the most dovish members of the board. Nakamura will also reach the end of his 5-year term next month. But no doubt, the lack of growth in Japan and the ongoing uncertainty globally will have an impact on the BoJ and certainly if we see the US economy begin to slow more notably in the coming months, the scope for the BoJ to raise rates again will be a lot less. Investors already see this. The OIS market has seen pricing for hikes by year-end diminish from nearly 40bps toward the end of March to 16bps today.

The yen correlation with risk and volatility is reviving and along with US yields will be the key drivers of yen direction. In any case, the BoJ will still stand out within the G10 space given the BoJ is very unlikely to be cutting rates in contrast to the Fed and most other central banks that will continue to ease policy.

JAPAN GDP Q/Q GROWTH & CONTRIBUTIONS TO OVERALL GROWTH – NET EXPORTS THE BIG DRAG ON GROWTH

Source: Bloomberg, Macrobond & MUFG GMR

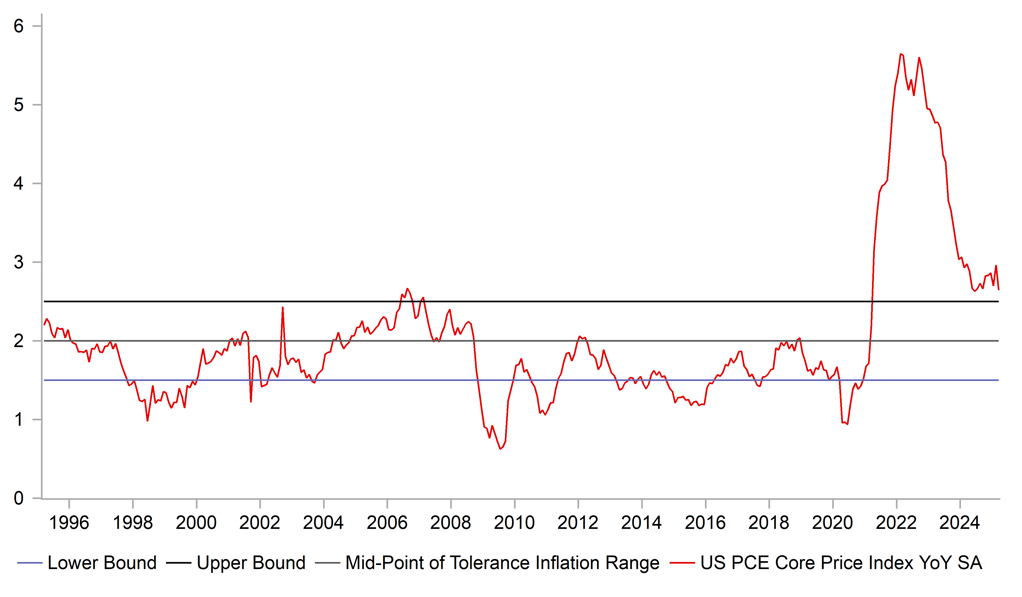

USD: Fed will alter its policy framework to reflect a different world

How fast circumstances change. You have to argue that the first framework review of monetary policy by the Federal Reserve that concluded in 2020 was somewhat ill-timed. Back then, the issue for the financial markets since the GFC had basically been the FOMC failing to achieve its inflation goal with inflation slightly undershooting relative to the 2% goal. There was much debate in 2019-20 about the Fed creating a framework akin to inflation average targeting that would allow the Fed to accept an inflation overshoot when there has been a sustain period of undershoot. It seemed a reasonable approach at the time. The final document released in 2020 did refer to seeking “to achieve inflation that averages 2.0% over time” and laid out explicitly then the strategy of when inflation is below target to run an appropriate monetary policy that aims to “achieve inflation moderately above 2.0% for some time”.

Fed Chair Powell attended the start of a two-day conference on updating that framework yesterday and it is clear that the new framework will incorporate more on the extraordinary events of the last five years including being a bit more balanced in how the framework was described and the words used. The 2020 framework looks dated now given the wording focuses on the issue of too low inflation. The framework also needs to highlight scenarios of much larger shocks that could be more frequently supply rather than demand related. Chair Powell hinted that the framework could scrap the reference to inflation averaging. That makes sense – otherwise the framework would imply the need for the Fed to run a policy consistent with a period of considerable undershoot of inflation relative to the 2% target.

Of course flipping back and forth on the design of the monetary policy framework that is updated every five years is not particularly helpful and could be seen as undermining credibility. But then you could also argue that what has taken place in the last five years was unprecedented and in hindsight releasing the framework in the middle of a global pandemic was probably not wise.

From a financial markets perspective there is limited impact from this likely revised policy framework. Still Powell’s emphasis on supply-side risks to the economy does underline the caution expressed by Powell at the policy meeting press conference last week. A rate cut is now not fully priced until the September meeting while July is now only a 40% probability. We still see July as quite plausible for a cut but labour market conditions will be key. We maintain that damage has been done from trade policy uncertainty already and while yesterday’s comments highlighted further the Fed’s caution in a new world of potentially frequent supply-side shocks, labour market weakness is still set to unfold which will see the Fed’s caution ease. That remains one of a number of factors that we believe will weaken the dollar further this year.

ACTUAL INFLATION IN THE US PRIOR TO INFLATION SHOCK HAD BEEN SKEWED TO THE DOWNSIDE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian CPI (YoY) |

Apr |

2.0% |

1.9% |

! |

|

IT |

09:00 |

Italian CPI (MoM) |

Apr |

0.2% |

0.3% |

! |

|

IT |

09:00 |

Italian HICP (MoM) |

Apr |

0.5% |

1.6% |

! |

|

IT |

09:00 |

Italian HICP (YoY) |

Apr |

2.1% |

2.1% |

! |

|

IT |

10:00 |

Italian Trade Balance |

Mar |

5.150B |

4.466B |

! |

|

EC |

10:00 |

Trade Balance |

Mar |

17.5B |

24.0B |

!! |

|

SZ |

12:00 |

SNB Vice Chairman Schlegel Speaks |

-- |

-- |

-- |

!! |

|

US |

13:30 |

Building Permits |

Apr |

1.450M |

1.467M |

!! |

|

US |

13:30 |

Export Price Index (MoM) |

Apr |

-0.5% |

0.0% |

! |

|

US |

13:30 |

Housing Starts |

Apr |

1.360M |

1.324M |

!! |

|

US |

13:30 |

Import Price Index (MoM) |

Apr |

-0.4% |

-0.1% |

!! |

|

US |

15:00 |

Michigan 1-Year Inflation Expectations |

May |

-- |

6.5% |

!!! |

|

US |

15:00 |

Michigan 5-Year Inflation Expectations |

May |

-- |

4.4% |

!!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

May |

53.1 |

52.2 |

!! |

|

CA |

15:30 |

BoC Senior Loan Officer Survey |

Q1 |

-- |

-1.9 |

! |

|

EC |

16:00 |

ECB's Lane Speaks |

-- |

-- |

-- |

!!! |

|

US |

21:00 |

US Foreign Buying, T-bonds |

Mar |

-- |

106.20B |

! |

|

US |

21:00 |

TIC Net Long-Term Transactions |

Mar |

44.2B |

112.0B |

!! |

Source: Bloomberg & Investing.com