Limited spill-overs from Middle East conflict into FX market

USD: Muted FX market response to Middle East conflict and China activity data

There has been a muted response in the foreign exchange market to the ongoing conflict between Israel and Iran with most major currency pairs largely unchaged at the start of this week. The US dollar strengthened modestly at the end of last week (click here) after Israel launched military strikes on Iran but there has been little follow through strength following continued fighting over the weekend. The dollar index continues to trade close to year to date lows set last week at 97.602. Similarly the price of Brent crude oil has dropped back towards USD73/barrel overnight after hitting a high on Friday of USD78.50/barrel. The price action highlights that market participants are relatively relaxed at the current juncture that the conflict is unlikely to significantly disrupt global supply chains and the supply of oil. President Trump has called on both Israel and Iran to “make a deal” but admitted that “sometimes they have to fight it out”. According to media reports, Israel appears not to have targeted Iran’s oil fields or crude-shipment facilities. Sardar Esmaeli Kowsari who is senior IRGC commander and member of Iran’s parliament told the domestic media over the weekend that closing the Strait of Hormuz was “under consideration”. The Strait handles around 26% of the world’s oil trade. However, market participants are sceptical that Iran would ever take such action given it would prevent it from exporting its own oil.

The other main economic news overnight was the release of the latest activity data from China which revealed that the economy is continuing to grow more strongly than expected at the start of this year. The latest monthly activity data for May revealed that retail sales growth unexpectedly picked up to an annual rate of 6.4%. It was the fastest monthly increase since April 2023. In contrast, industrial production and fixed asset investment growth slowed modestly to 5.8% and 3.7% YTD YoY. The pick-up in retail sales growth was driven by fiscal support from the government. A government-sponsored trade-in program for home appliances and electronics boosted sales in May. Sales of home appliances surged by 53%YoY after an increase of 39% in April. Export growth is expected to pick-up as well in June providing more support for growth in Q2 after President Trump announced a 90-day pause for higher reciprocal tariffs. However, we would expect to see more payback weakness in 2H of this year. Better than expected growth in the first half of this year has provided more support for Asian currencies as they have rebounded amidst broad-based US dollar weakness.

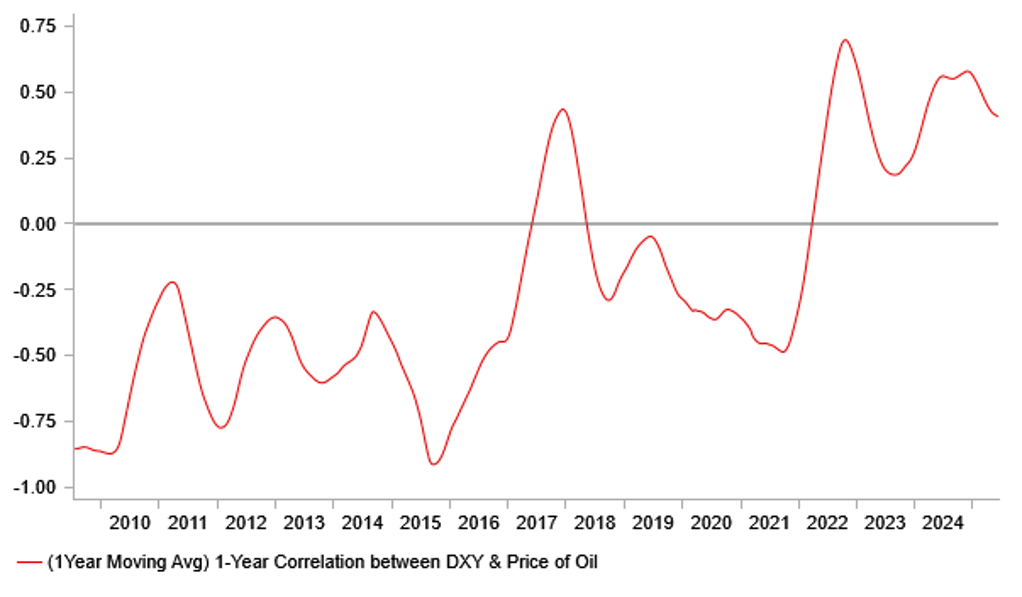

POSITIVE CORRELATION BETWEEN PRICE OF OIL & USD

Source: Bloomberg, Macrobond & MUFG GMR

USD/JPY: Heightened uncertainty to encourage caution from BoJ and Fed

There is a heavy schedule of central bank meetings in the week ahead including the BoJ tomorrow, the Fed on Wednesday, the BoE, SNB and Norges Bank all on Thursday. Higher geopolitical risks add to the already elevated level of uncertainty triggered by President Trump’s disruptive trade policy. It will reinforce caution amongst central banks when they meet this week. All except the SNB are expected to leave their policy rates unchanged in the week ahead. Market participants’ will be expecting the Fed to acknowledge further encouraging evidence of softer US inflation at the start of this year in May. At the same time, the latest weekly initial and continuing claims data from last week did point to some loosening of US labour market although the data is unlikely to be sufficient to make the Fed signal it is more seriously considering cutting rates as soon as at the following policy meeting in July. We expect the Fed to prefer remaining on hold until the level of uncertainty eases and they have more clarity over the economic impact from current shocks which hopefully will become more evident in the coming months. The updated DOT plot is likely to be similar to in March still signalling 2 cuts by the end of this year and 2 further cuts by the end of next year as the policy rate moves back closer to neutral at around 3.00%. The passage of time increases the risk that one of the planned cuts for this year could be pushed back into next year. The Fed would have to deliver a much more dovish policy signal this week signalling a stronger likelihood of another cut as soon as July to reinforce US dollar weakness.

While the BoJ is expected to leave their policy rate unchanged tomorrow, there is a strong expectation amongst market participants heading into the meeting that they will adjust their plans for QT. Media reports in the run up have stated that the BoJ is considering announcing plans to slow tapering from start of the next fiscal year in April 2026 in order to provide more support for long-term JGBs. After hitting a high of 3.20% on 21st May, the 30-year JGB yield has dropped back and stabilized at just above 2.90% supported in part by the expectations that the BoJ will slow tapering plans and the MoF will reduce plans for long-term JGB issuance. According to a recent poll by Bloomberg, about two-thirds of Japanese economists who responded expected the BoJ to slowdown tapering from next April. Since last August, the BoJ has reduced its bond purchases by JPY400 billion every quarter so that by Q1 2026 monthly purchases would be almost halved compared to roughly JPY6 trillion before QT began. BoJ officials are reportedly considering slowing the pace of QT by about half to a JPY200 billion reduction in monthly purchases each quarter. The recent softening of the yen could already partly reflect expectations for a cautious policy update from the BoJ tomorrow alongside negative spill-overs for Japan from the Middle East conflict.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CA |

08:15 |

Housing Starts |

May |

248.0K |

278.6K |

!! |

|

US |

08:30 |

NY Empire State Manufacturing Index |

Jun |

-5.90 |

-9.20 |

!! |

|

GE |

12:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com