USD is testing the top of its recent narrow range

GBP: Softer wage data triggers pound sell-off

The US dollar has rebounded overnight rising up towards the top of the recent narrow range between 102.00 and 103.00. Asian currencies have continued to weaken following the election results in Taiwan over the weekend. USD/TWD has increased by a further +0.6% rising up to 31.500 which has been exceeded by the adjustment higher in USD/KRW which has risen by around +0.9%. There does not appear to be any fresh catalyst overnight for the US dollar rebound following yesterday’s US holiday. Market attention in Asia will shift tomorrow to the release of the latest economic data releases from China. The release of the latest Q4 GDP report and monthly activity data for December are expected to reveal that China’s economy lost upward momentum at the end of last year although growth for 2023 as whole is expected to meet the government’s target of around 5.0%. Despite the loss of growth momentum the PBoC surprisingly held its one-year medium-term lending facility rate at 2.50% at the start of this week when it disappointed market expectations for a 10bps cut. Instead the PBoC injected a net CNY216 billion of cash into the banking system with its one-year MLF following on from injections of CNY800 billion in December and CNY600 billion in November. We still expect the PBoC to deliver further rate cuts this year to support growth which will be required if they set their growth target again at around 5% for 2024. In these circumstances, we expect ongoing concerns over the health of China’s economy to remain a headwind for Asian currency performance at the start of this year.

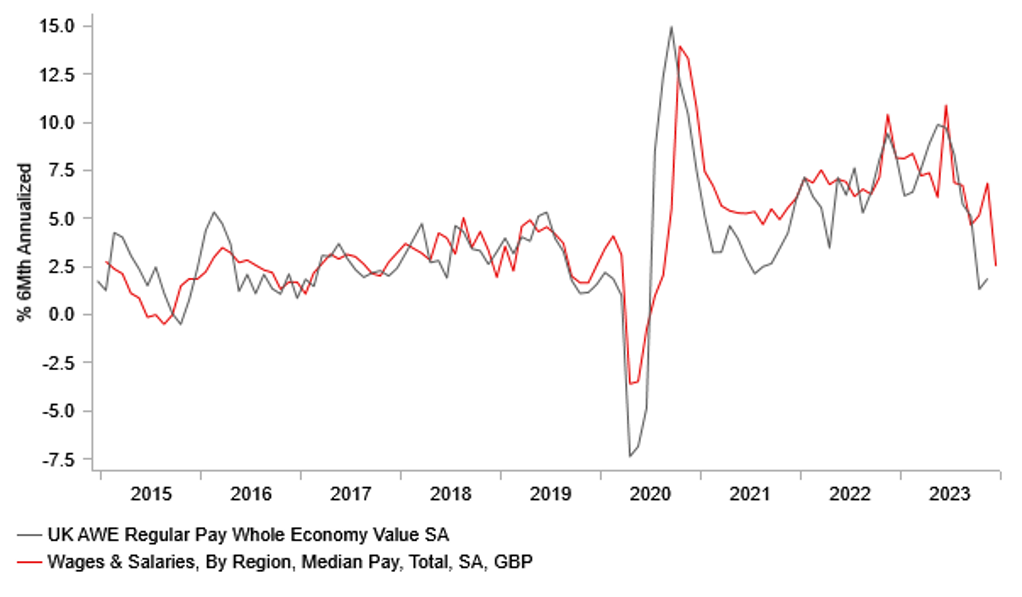

Amongst G10 currencies, the commodity currencies of the Australian and New Zealand dollars have underperformed amidst more risk averse trading conditions. The pound has also sold-off at the start of the European trading session following the release of the latest UK labour market report that has contributed to cable falling back towards 1.2650. The report revealed further evidence that wage growth in the UK is continuing to slow from elevated levels. Average weekly earnings on a 3M/YoY basis slowed to 6.5% in November down from 7.2% in the prior month and moving further below the peak from August of 7.9%. There has been a marked slowdown in wage growth over the last six months. AWE regular pay has slowed sharply to an annualized rate of 3.8% in the six months to the end of November down from a peak of 8.7% in the six months to the end of June. A similar picture is also evident in the PAYE median pay measure that has slowed to an annualized rate of 2.5% in the six months to the end of December compared to the peak of 10.9% in the six months to the end of June. The developments should provide further reassurance to the BoE that the risk of more persistent inflation in the UK are easing. It will encourage the UK rate market to price in earlier and deeper BoE rate cuts in the year ahead weighing on the pound.

WAGE GROWTH CONTINUES TO SLOW IN UK

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB officials reinforce their relatively hawkish policy guidance

The recent paring back of ECB rate cut speculation continued yesterday encouraged by further hawkish comments from ECB officials. Governing Council member Robert Holzmann delivered the most hawkish comments by stating that” we should not bank on the rate cut at all for 2024”. The comments were in response to the risk that tensions in the Middle East could escalate further and pose upside risks to inflation in the year ahead. Freight rates have already jumped higher at the start of this year as shipping through the Red Sea has been disrupted. On the plus side, it was reported yesterday that the benchmark Dutch front-month natural gas contract dropped below EUR30/mega-hour for the first time since the summer highlighting that fears over another energy-supply side shock for the euro-zone economy have not yet materialized. The benchmark Dutch front-month natural gas price has been on average over the past month around 60% lower than in the same period a year ago. The easing of the energy price shock in the euro-zone has been an important driver of the euro’s recovery from the lows prior to last winter.

The euro is also benefitting in the near-term from building speculation that the ECB will lag behind the Fed when cutting rates this year. Comments yesterday from Bundesbank President Nagel and Chief Economist Lane over the weekend that have indicated that the ECB is unlikely to begin cutting rates until late in Q2 at the earliest. Bundesbank President Nagel stated “maybe we can wait for the summer break or whatever but I don’t want to speculate…I think it is too early to talk about cuts”. Chief Economist Lane cautioned that “a false dawn, too rapid a recalibration, can be self-defeating”. He is worried that the ECB could repeat past mistakes by cutting rates too soon before higher inflation is conquered. As a result, he wants to confirm that inflation will slow enough to allow them to begin cutting rates. He indicated that the ECB will not have “important data” to make that decision until the “June” policy meeting including on wage growth and national accounts for Q1. He remains concerns by the strength of wage growth that is increasing the risk of more persistent inflation int eh service sector. With the US rate market still confident that the Fed could begin to cut rates by the end of this quarter, the ECB’s relatively hawkish policy stance is encouraging short-term yield spreads to move in favour of a higher EUR/USD rate. Our short-term valuation model estimate has just moved above the 1.1000-level.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

10:00 |

ECOFIN Meetings |

-- |

-- |

-- |

! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Jan |

21.9 |

23.0 |

!! |

|

CA |

13:15 |

Housing Starts |

Dec |

243.0K |

212.6K |

!! |

|

CA |

13:30 |

CPI (YoY) |

Dec |

3.3% |

3.1% |

! |

|

UK |

15:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

US |

16:00 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg