USD continues to strengthen supported US retail sales & higher USD/CNY fix

USD: Strong US retail sales reinforce US dollar’s upward momentum

The US dollar has continued to extend its advance overnight resulting in the dollar index rising hitting a fresh year to date high of 106.39. The stronger US dollar has been encouraged by a further paring back of Fed rate cut expectations following the release yesterday of the stronger than expected US retail sales report for March. The report revealed that control retail sales increased strongly by 1.1%M/M in March. It was the strongest monthly increase since January 2023. Furthermore, there were upward revisions to retail sales growth in January and February as well. As a result, it appears that the slowdown in consumer spending in Q1 is likely to be more modest than expected after annualized growth of just over 3.0% in 2H of last year. The Atlanta Fed’s GDPNow index is currently tracking growth of 2.8% in Q1. The continuation of strong US growth at the start of this year has placed additional upward pressure on US rates and the US dollar. The 10-year US Treasury yield hit a fresh year to date high of 4.66% yesterday, and has now risen by 88bps since the low at the end of last year.

Market participants will be listening closely to comments from Fed officials this week including Fed Chair Powell later today to see how their plans for monetary policy are adjusting in response to the recent run of stronger US activity and inflation data. New York Fed President Williams indicated yesterday that he didn’t see the recent inflation data as a “turning point” but added the figures will affect his opinion and forecasts. He still believes that the Fed will begin lowering rates this year if inflation contuse to gradually come down. He also added that Fed officials are watching the unfolding situation in the Middle East “very carefully” though he didn’t see it as a major driver of the Us outlook at the current juncture. The initial market reaction to escalating tensions between Israel and Iran has been muted. The price of Brent has remined relatively stable at just over USD90/barrel. Market participants are still waiting to see how Israel will respond to the attack over the weekend from Iran. Bloomberg has reported that top Israeli military officials have reasserted that their country has no choice but to respond to Iran’s weekend drone and missile attack, even as European and US officials have called on Israel to avoid a tit-for-tat escalation that could provoke a wider war in the region. Heightened geopolitical tensions and the risk of another global energy price shock are further boosting the relative appeal of the US dollar in the near-term.

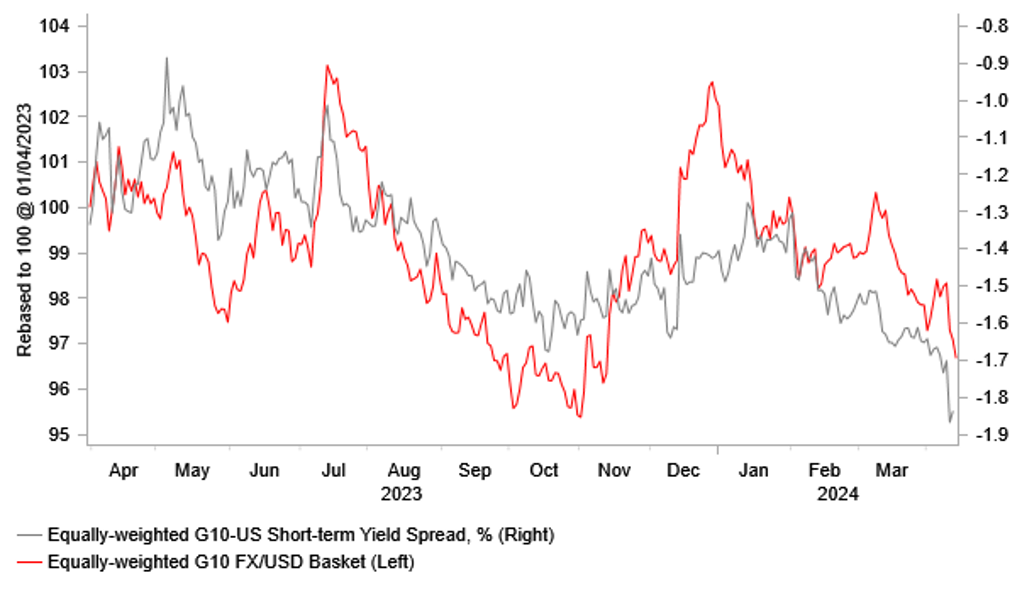

YIELD SPREADS MOVING IN FAVOUR OF STRONGER USD

Source: Bloomberg, Macrobond & MUFG GMR

CNY: Higher USD/CNY fix & China activity data in focus

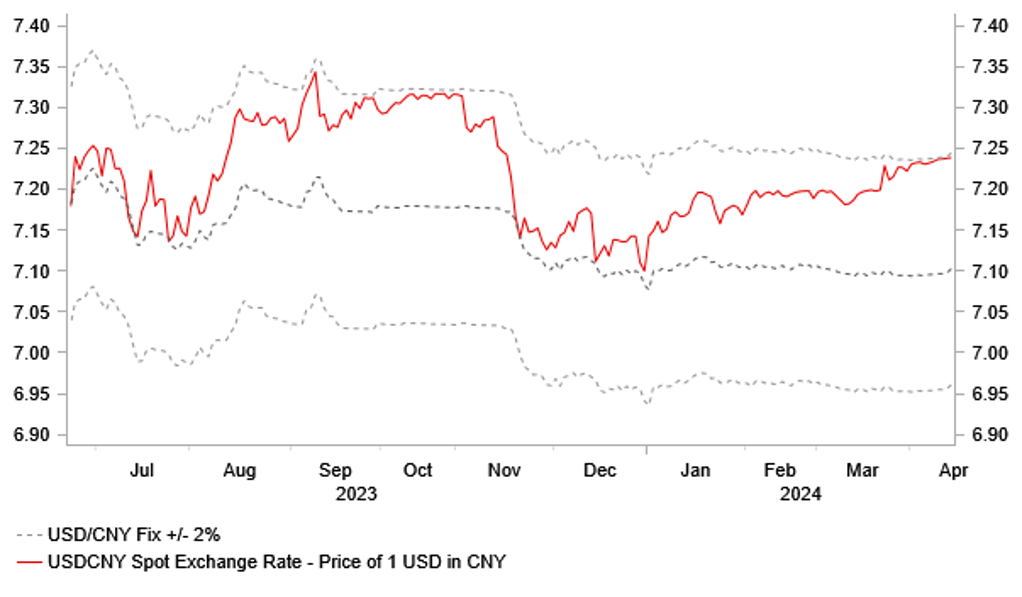

The renminbi has weakened overnight alongside the broad-based strengthening of the US dollar. It has resulted in USD/CNH hitting a fresh year to date high overnight of 7.2831. The renminbi sell-off has been encouraged as well by the PBOC setting a higher daily fix for USD/CNY at 7.1028. It is the highest daily fix for USD/CNY since 1st March and will encourage market expectations that Chinese policymakers will allow USD/CNY to move gradually higher if the US dollar continues to strengthen in the near-term. USD/CNY has not yet moved up to the top of the daily trading band which has been raised to 7.2450.

The other main development overnight from China was the release of the latest economic activity data for March. It was confirmed that economic growth in China strengthened in Q1 as a whole when it expanded by 5.3%Y/Y and 1.6%Q/Q. Growth in Q4 of last year was also revised higher by 0.2ppt to 1.2%Q/Q. Fixed asset investment expanded strongly by 4.5%Y/Y in Q1 following growth of 3.0% in 2023 highlighting the supportive impact from government stimulus. Stronger growth at the start of this year has though helped to ease some pressure on policymakers in China to provide further stimulus to support growth. However, the monthly activity data for March has cast some doubt on whether the pick-up in growth will be sustained. Industrial production and retail sales growth both were much weaker than expected in March when activity slowed to 4.5%Y/Y and 3.1%Y/Y respectively. Overall, the pick-up in growth at the start of this year in China supports our relatively more upbeat growth forecast (click here). However, it has not been sufficient to prevent the renminbi from weakening further against the US dollar. If US yields and US dollar continue to rise in the near-term, it is more likely that USD/CNY will be allowed to gradually drift back up to last year’s highs at closer to the 7.3000-level.

PBOC SETS HIGHER DAILY FIX FOR USD/CNY

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian CPI (YoY) |

Mar |

1.3% |

0.8% |

! |

|

US |

10:00 |

IMF Meetings |

-- |

-- |

-- |

! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Apr |

37.2 |

33.5 |

!! |

|

US |

13:30 |

Building Permits |

Mar |

1.514M |

1.524M |

!! |

|

US |

13:30 |

Housing Starts |

Mar |

1.480M |

1.521M |

!! |

|

CA |

13:30 |

CPI (YoY) |

Mar |

-- |

2.8% |

! |

|

US |

14:00 |

Fed Governor Jefferson Speaks |

-- |

-- |

-- |

! |

|

US |

14:15 |

Industrial Production (MoM) |

Mar |

0.4% |

0.1% |

!! |

|

US |

17:30 |

FOMC Member Williams Speaks |

-- |

-- |

-- |

!! |

|

UK |

18:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

US |

18:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

18:15 |

Fed Chair Powell Speaks |

-- |

-- |

-- |

!!! |

|

CA |

18:15 |

BoC Gov Macklem Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg