Powell signal helps fuel renewed dollar selling – but a lot priced

USD: Powell confirms what’s largely priced

The US dollar has weakened a little further during the Asian trading session following the selling yesterday helped by growing optimism in France that PM Lecornu has done enough to avoid defeat in a government no-confidence motion and more importantly in response to comments from Fed Chair Powell who gave a speech on balance sheet policy. In the speech to the National Association for Business Economics Powell was clear that labour market risks were to the downside given the economy was “at a place where further declines in job openings might very well show up in unemployment”. The comment puts to rest the idea that the government shutdown, in creating an information vacuum, could result in the FOMC deciding to hold off on cutting rates. But the OIS market has indicated a 25bp cut on 29th October has been close to fully priced since the start of October and hence the UST bond yield impact was marginal. Markets were less clear on balance sheet policy though and Powell gave a strong hint that QT would end in the coming months given the indications of some tightening in liquidity conditions – Powell did not want to see a repeat of tighter liquidity conditions that took place in 2019. That hint did help lower longer-term yields but the 10-year remains at just above 4.00% and you get the sense that something significant will be required in order to give market participants the conviction to buy 10-year bonds at yields below 4.00%. We shouldn’t dismiss the potential for a catalyst and the collapse of First Brands Group and Tricolor Holdings has had some reverberations in the credit space and an example like this, but on a bigger scale, would likely be that catalyst for a bigger yield drop and from an FX perspective would be a trigger for notable gains for both the yen and Swiss franc. The lead story in the FT today is on concerns being expressed over excessive leverage in the private capital industry that can be difficult to quantify.

The yen is the top performing G10 currency today but that’s from a position of being the worst performing since the start of October. That month-to-date performance of course reflects the ongoing political uncertainty. The uncertainty did not undermine today’s 20-year JGB auction however with a bid-to-cover of 3.56, above the 12mth average of 3.25. The LDP has proposed holding an election for PM in the Diet on 21st October but the three-party opposition talks on proposing their own candidate continue and hence did not agree to the date. The LDP suggesting the date points to confidence that they can win and we still see Sanae Takaichi as most likely to become PM. Closing the policy gaps amongst the opposition will remain difficult. While politics will remain a drag on yen performance, Fed rate cuts, the end of QT, and the potential for increased volatility will likely prove more important. So USD/JPY should still grind lower but the yen is likely to underperform within G10 until we get political clarity.

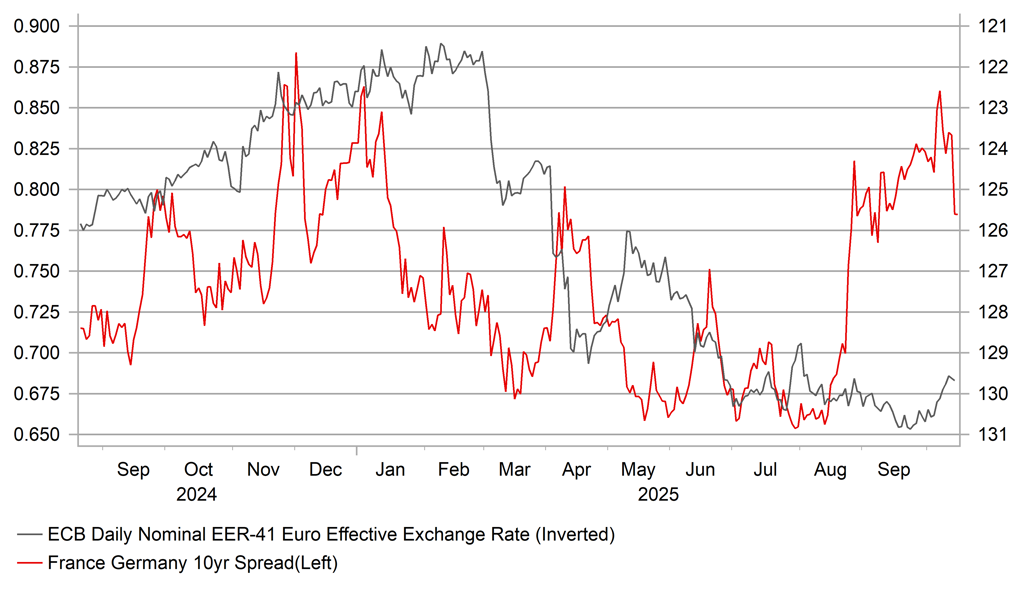

OAT/BUND SPREAD NARROWS BUT STILL AT ELEVATED LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

GBP: UK data provide mixed signals with BoE outlook finely balanced

The pound underperformance yesterday was contained mostly to against the core G10 currencies with the risk-off sentiment resulting in the high-beta G10 currencies like NOK and AUD performing worse. But EUR/GBP did have its largest one-day gain since 16th September as investors started to position for the potential for the BoE to ease sooner than expected. The 2-year Gilt yield dropped 5bps yesterday with the prospects of a rate cut before the end of the year increasing from a 20% probability to a 40% probability over the last three trading days. Did yesterday’s employment data justify the drop in yields?

Certainly, we would argue the lack of pricing for a cut by year-end (in December basically) is one reason for this move. Pricing appears too low when you consider there is quite a period between the November and December MPC meetings. Between these two meetings two jobs reports and two CPI reports will be released so given that fact alone there is plenty of scope for market expectations to shift based on those data releases. Between those two meetings we will also have the UK Budget on 26th November which in all likelihood will confirm a net fiscal drag for the economy going forward as the government attempts to fill an estimated GBP 30bn fiscal hole.

The jobs data yesterday did contain factors that were consistent with lower yields but overall the data was mixed and in some ways the scale of reaction to the data was a surprise. The key focus for bond market bulls was the slowdown in private sector wage growth excluding bonuses, which fell to 4.4% on a 3mth annual basis, with the data suggesting a notable undershoot of the BoE’s Q3 estimate for this measure of 4.6%. Our estimate of the 3mth/3mth annualised increased slowed to 3.6%, which is certainly closer to what the BoE would deem as a wage growth rate consistent with price stability (around 3.0%). The one-month YoY rate slowed to 4.2%, the weakest rate since December 2021. The note of caution though is that public sector wage growth jumped sharply – the one-month YoY rate from 5.4% to 6.7%, the highest since March 2024.

The PAYE employment data also suggested that the impact from the NICs increase could be fading, resulting in the labour market stabilising. Employment fell by 10k in September but the August data was revised 18k higher to +10k. Based on previous data revision patterns, the September data will be revised higher too. The unemployment rate did tick 0.1ppt higher to 4.8%, but how much the MPC will take that data at face-value is questionable.

So while we believe there was some cherry-picking of the jobs data yesterday, we concur with the overall direction of the rates move given we see scope for the BoE to be in a position to cut in December. We also had comments from MPC member Alan Taylor yesterday – a known dove, who voted with Swati Dhingra to cut rates in September, his comments nonetheless came across as more confident in believing that the economy needs further monetary easing. Taylor’s speech was on trade diversion and one conclusion was that trade diversion on a “material scale” would likely have “substantial bearing on prices” in the UK. China exports to the UK in September data released this week revealed a 12.2% YoY increase. Exports to the US fell 27%. Taylor and Swati remain the lone doves on the MPC for now but assuming inflation slows in October/November data and wages do not rebound, the justification for a rate cut will likely grow. We maintain our view of a gradual increase in EUR/GBP into year-end as market positioning for a BoE rate cut increases. Long EUR/GBP remains a trade view published in our FX Weekly publication.

3MTH & 6MTH ANNUALISED WHOLE ECONOMY REGULAR PAY CONTINUES TO DECELERATE CLOSE TO PRE-COVID LEVELS

Source: Bureau of Labor Statistics & Macrobond

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:00 |

BoE's Ramsden speaks |

!!! |

|||

|

EC |

10:00 |

Industrial Production MoM |

Aug |

-1.60% |

0.30% |

! |

|

EC |

10:00 |

Industrial Production YoY |

Aug |

0.00% |

1.80% |

! |

|

CA |

13:30 |

Manufacturing Sales MoM |

Aug |

-1.50% |

2.50% |

! |

|

US |

13:30 |

Empire Manufacturing Index |

Oct |

-1.8 |

-8.7 |

! |

|

US |

14:30 |

Fed's Miran speaks |

!!! |

|||

|

EC |

14:45 |

ECB's Rehn speaks |

!! |

|||

|

US |

18:00 |

Fed's Waller speaks |

!!! |

|||

|

US |

19:00 |

Fed's Beige Book released |

!! |

|||

|

UK |

19:00 |

BoE's Breeden speaks |

!! |

Source: Bloomberg & Investing.com