JPY continues to underperform ahead of Upper House election

USD/CNY: Details of China GDP not as reassuring as headline growth

The major foreign exchange rates have remained relatively stable overnight with the dollar index trading around the 98.000-level. The main economic data releases were from China overnight although the market impact has been limited. Asian currencies have similarly traded within tight trading ranges despite the release of further evidence revealing that China’s economy has held up better than expected during the 1H of this year in the face of US trade disruption. The latest activity data from China revealed that the economy expanded by an annual rate of 5.2% in Q2 following growth of 5.4% in Q1. For the first half as whole the economy expanded by an annual rate of 5.3% which was comfortably above the government’s official target of 5.0% for this year. Economic growth has been supported by the positive contribution from net trade. Weakness in exports to the US was more than offset by stronger exports to other trading partners including the EU and Asia. In contrast, softer private domestic demand remains a concern. It was revealed that annual rate of retail sales growth slowed more than expected to 4.8% in June down from 6.4% in May. Bloomberg highlighted that the the slowdown could reflect payback for “618” promotions in May that brought forward demand while sales continued to benefit from the cash-for-clunkers program. Similarly, fixed-asset investment also contracted on a monthly basis in June revealing weakness in private domestic demand. Fixed asset excluding rural investment slowed to a YTD annual rate of 2.8% in June down from 3.7% in May. According to Bloomberg, private investment declined 0.6% below the year-earlier level in 1H 2025 with weakness broad-based across major sectors in 1H.

Overall, the breakdown of the data reveals that the resilience of the headline growth figures while reassuring does not tell the full picture. Going forward support for growth from net trade could be disrupted more by ongoing trade tensions with the US, while Chinese policymakers will remain under pressure to deliver further stimulus to support weak private domestic demand. It is one reason why our colleagues in Asia are still maintaining a cautious outlook (click here) for the renminbi and other Asian currencies through the rest of this year. Chinese policymakers continue to prioritize renminbi stability against the US dollar. USD/CNY has been trading within a tight trading range between 7.1500 and 7.2000 since May even as the US dollar has continued to weaken more broadly. By maintaining stability against the US dollar this year while the US dollar has weakened sharply, it has meant that the renminbi has also weakened sharply against the currencies of other trading partners making their exports more competitive outside of the US where higher tariffs have been put in place. The CFETS index has fallen by around 6.4% from the peak at the start of this year. Falling prices for China’s goods are also helping as well. The GDP deflator fell by an annual rate of -1.2% in Q2 which was the biggest decline since the Global Financial Crisis.

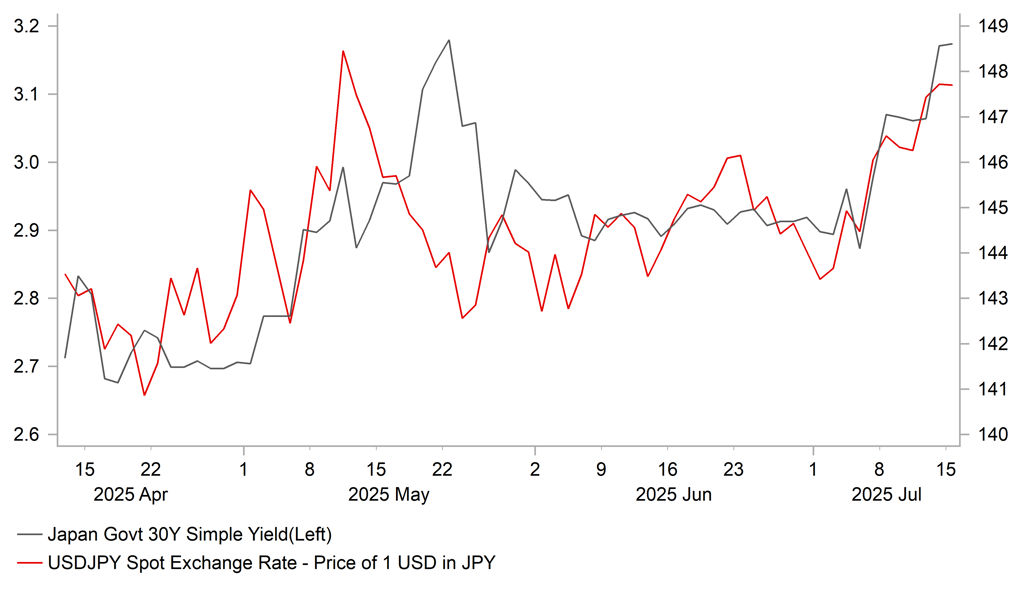

JPY & JGBS SELLING OFF AHEAD OF UPPER HOUSE ELECTION

Source: Bloomberg, Macrobond & MUFG GMR

USD/JPY: US CPI report & Japan elections in focus

The US dollar is continuing to rebound ahead of the release today of the latest US CPI report for June. The dollar index recorded its tenth consecutive day of gains yesterday which has been supported by the recent scaling back of Fed rate cut expectations. The 2-year and 10-year US Treasury yields have both risen by around 20bps over the same period. The stronger nonfarm payrolls report for June and recent tariff announcements from President Trump have dampened expectations that the Fed will resume rate cuts as soon as this month. The US rate market has also moved to price in a lower probability of the Fed cutting rates at the following meeting in September. It is currently pricing in around 16bps of cuts compared to 28bps at the end of June. The release today of the latest US CPI report for June is not expected to significantly alter market expectations for the Fed to leave rates on hold this month. Fed Chair Powell has indicated that he wants to see how inflation picks up in the coming months to better assess the impact of tariffs on the economic outlook. So far this year it has been reassuring that the disinflation trend has continued. By the September FOMC meeting the Fed should be in better position to assess the impact of tariffs when the new 1st August deadline for “reciprocal” tariffs will have passed.

The recent pick-up in US yields and the US dollar has helped to lift USD/JPY back up closer to the 148.00-level. The move higher in USD/JPY also reflects yen weakness ahead of this weekend’s Upper House election. The risk of the government losing its majority was highlighted by a poll in the Asahi Shimbun published today (click here). The mid-point forecast showed the LDP and their coalition partner Komeito on course to win just 43 seats which when combined with the 75 uncontested seats would mean that they are on track to fall seven seats short of the 125 needed for a majority. The upper bound forecast projected the ruling coalition winning 51 seats implying they still have a chance of maintaining their majority but it is not looking good for the government. The Asahi Shimbun were correct in calling the ruling coalition losing their majority in the Lower House. Losing their majority in the Upper House as well would fuel expectations for looser fiscal and monetary policies and encourage yen selling (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

ZEW Survey Expectations |

Jul |

50.4 |

47.5 |

!! |

|

EC |

10:00 |

Industrial Production SA MoM |

May |

1.0% |

-2.4% |

!! |

|

US |

13:30 |

Empire Manufacturing |

Jul |

- 9.2 |

-16.0 |

!! |

|

CA |

13:30 |

CPI YoY |

Jun |

1.9% |

1.7% |

!!! |

|

US |

13:30 |

CPI YoY |

Jun |

2.6% |

2.4% |

!!! |

|

UK |

21:00 |

BoE Governor Bailey speaks |

!!! |

Source: Bloomberg & Investing.com