USD still stuck in tight range as Fed rate cut expectations increase

USD: Weak PPI report reinforces expectations for earlier Fed rate cuts

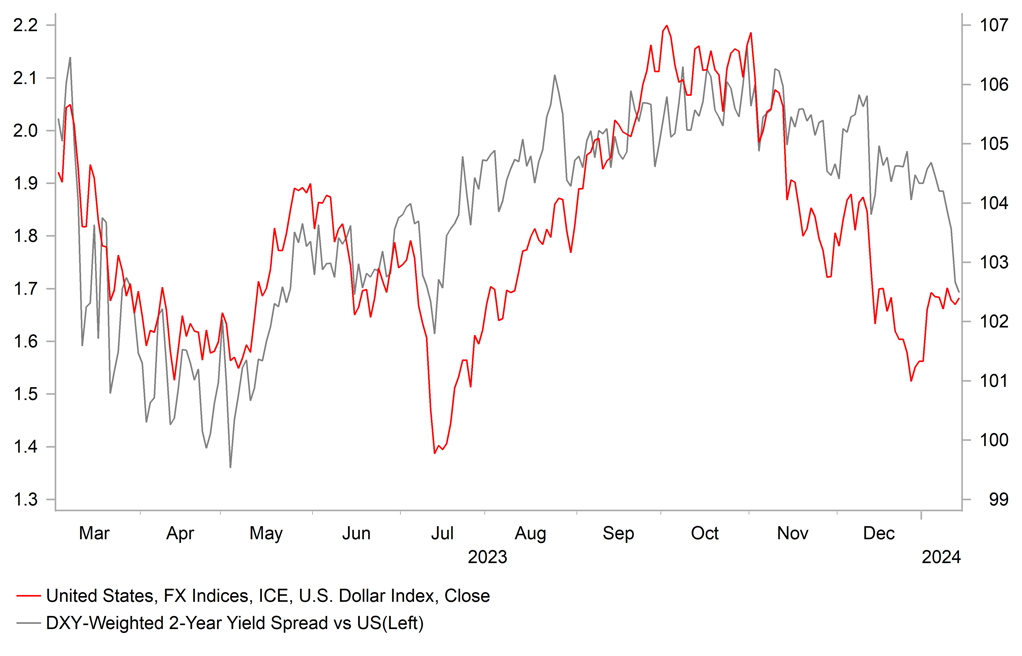

The US dollar has remained relatively stable against the other major currencies. The dollar index has traded within a narrow range between 102.00 and 103.00 in recent weeks. The main development for the US dollar at the end of last week was the release of the weaker than expected producer price inflation report from the US. The report has reinforced market expectations for the Fed to deliver earlier rate cuts. The US rate market has moved to more fully price in the first rate cut from the Fed by the March FOMC meeting. there is currently around -21bps of cuts price din by March and a cumulative total of around -166bps of cuts by the end of this year. The PPI report revealed that producer prices fell by -0.1%M/M in December. Weakness in the headline figure was weighed down by a -0.9%M/M drop in food prices. There was also a sharp -3.0%M/M drop in used car prices that contributed to unchanged core goods prices. There were also favourable inflation developments in the service sector where trade services fell by -0.8%M/M. It was the fourth consecutive decline and shows that gross margins for wholesalers and retailers are compressing. The report has reinforced expectations that the release of the latest PCE deflator report on 26th January will continue to show slowing inflation. Over the last six months to November the core PCE deflator has already slowed to an annualized rate of just 1.9% which is encouraging expectations that the Fed will soon move to begin lowering rates to make policy less restrictive as they become more confident inflation will return to target. The release of the weaker PPI report initially led to a US dollar sell off but there has since been little follow through as the recent range trading environment remains in place.

The other main development over the weekend that has impacted US dollar performance at the start of this week has been the Taiwan election results. The results revealed that the ruling Democratic Progressive Party won the presidency but lost their legislative majority. It will now have to work with the opposition parties to pass legislation. Lai Ching-te will become the new president of Taiwan after securing 40.05% of the vote compared to 33.49% for Hou Yu-ih from KMT and 26.46% for Ko Wen-je from the TPP. It the first time a party has won three consecutive terms but Taiwan but it was a marked step down in support after current President Tsai Ing-wen won 57% of the vote share in 2020. In the legislative election, the KMT won the most seats 52 (a gain of 14 seats compared to 2020) followed closely by the DPP who won 51 seats (a loss of 10 seats compared to 2020) and the TPP won 8 seats (a gain of 3 seats compared to 2020). It means the DPP no longer have a majority in the 113-seat parliament. The initial foreign exchange market reaction has been negative for the TWD and more mixed for other Asian currencies. The TWD has declined modestly by around -0.4% against the US dollar since the end of last week. The biggest underperformer over has been the KRW that has declined by -0.5% while the THB has strengthened by +0.5%. Market participants will now be watching closely to see how relations between the new administration and the Communist party evolve in the coming months and years. While the victory for Lai Ching-te has increased the risk that relations will deteriorate further, the loss of the DPP’s majority will likely be welcomed by the Communist party in China. At the current juncture we are not expecting a significant easing of geopolitical risk in the region that will remain a headwind for Asian currencies.

SHORT-TERM YIELD SPREADS MOVING AGAINST USD AT START OF 2024

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Will the BoE lag the ECB and Fed when cutting rates?

The GBP has outperformed at the start of 2024 when it has been the best performing G10 currency. It has resulted in cable rising back up towards the high from the end of last year at 1.2827 while EUR/GBP had dropped back below the 0.8600-level. The biggest mover has been GBP/JPY which has jumped from just below the 180.00-level back up to the 185.00-level. It marks a reversal in fortunes for the GBP after it underperformed in December. At the start of this year, market participants have been scaling back expectations over how early and deeply the BoE is likely to cut rates this year. The implied yield on the June and December 2024 three-month SONIA futures contracts have increased by around 13bps and 21bps respectively since late last year.

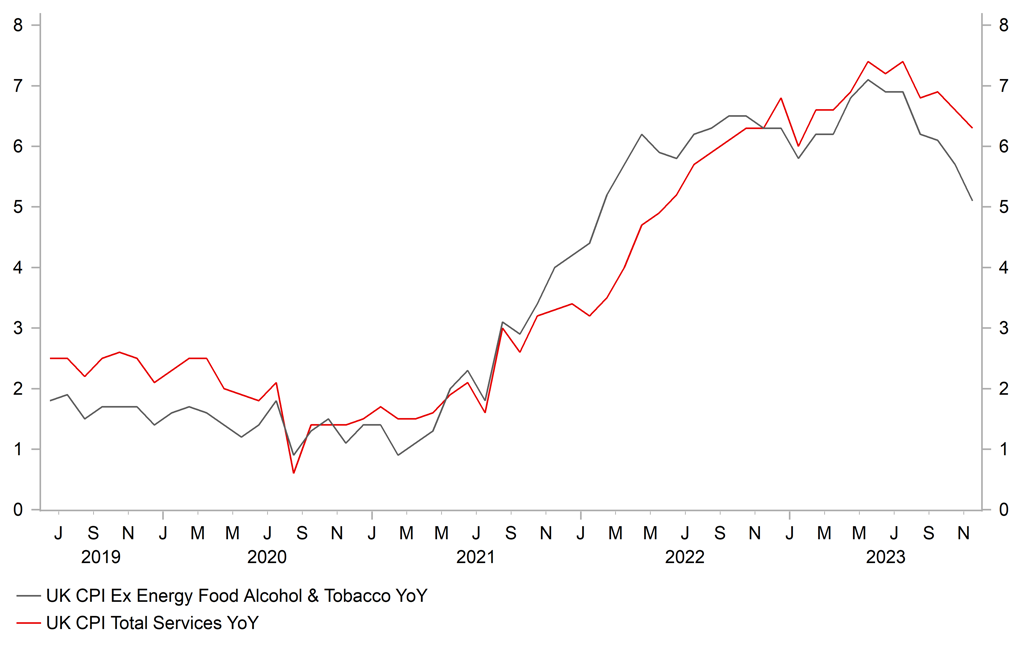

The BoE is still expected to lag behind both the Fed and ECB when cutting rates in the year ahead. The first 25bps cut from the BoE is not fully priced until 20th June MPC meeting. In comparison the first 25bps rate cuts from the Fed and ECB and fully priced in by their 1st May and 11th April policy meetings respectively. For this year as a whole, the UK rate market is roughly pricing in around 25bps less of cuts than in the euro-zone and US. The divergence continues to reflect investor concerns that there is a higher risk of inflation proving more persistent in the UK. Those concerns were eased somewhat by reassuring evidence of slowing inflation and wage growth at the end of last year which contributed to GBP underperformance in December. In the week ahead, the release of the latest UK CPI (Wed) and labour market (Tues) reports will be scrutinized even more closely to better assess whether the disinflationary developments evident in December will be sustained. Inflation is running well below the BoE’s own forecast from the November QIR in which they forecast headline and core inflation ending last year at around 4.6% and 5.6% respectively. We expect significant downward revisions to the BoE’s inflation forecasts in February.

The relative caution over the timing and scale of BoE rate cuts also partly reflects expectations that their room to make policy less restrictive will be curtailed by fiscal policy in an election year in the UK (click here). In recent weeks, UK Chancellor Hunt has announced that the Budget will take place on 6th March and PM Sunak has suggested that he favours holding an election in the 2H of this year. The announcements have already fuelled speculation that government will take advantage of lower borrowing costs to provide more fiscal giveaways in the pre-election budget as they continue to lag well behind in the polls. While looser policy would provide more support for the UK economy that has been stagnating over the past year, it could discourage the BoE from cutting rates in the year ahead. The releases of the latest UK CPI and labour markets reports in the week ahead will provide an important tests for the GBP. Further evidence of disinflationary pressures poses the main downside risk to GBP outperformance at the start of this year. Please see our latest FX Weekly for more details (click here)

WILL UK INFLATION SLOW FURTHER IN THE WEEK AHEAD?

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

09:00 |

German GDP Annual |

-- |

-0.30% |

1.90% |

! |

|

UK |

09:30 |

Labour Productivity |

Q3 |

-0.3% |

0.7% |

!! |

|

EC |

10:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Industrial Production (MoM) |

Nov |

-0.3% |

-0.7% |

!! |

|

EC |

10:00 |

Trade Balance |

Nov |

11.2B |

11.1B |

!! |

|

CA |

15:30 |

BoC Business Outlook Survey |

-- |

-- |

-- |

!! |

Source: Bloomberg