Are the cracks beginning to emerge as US yields march higher?

USD: ARS devaluation; RUB plunge – the weakest links always fall first

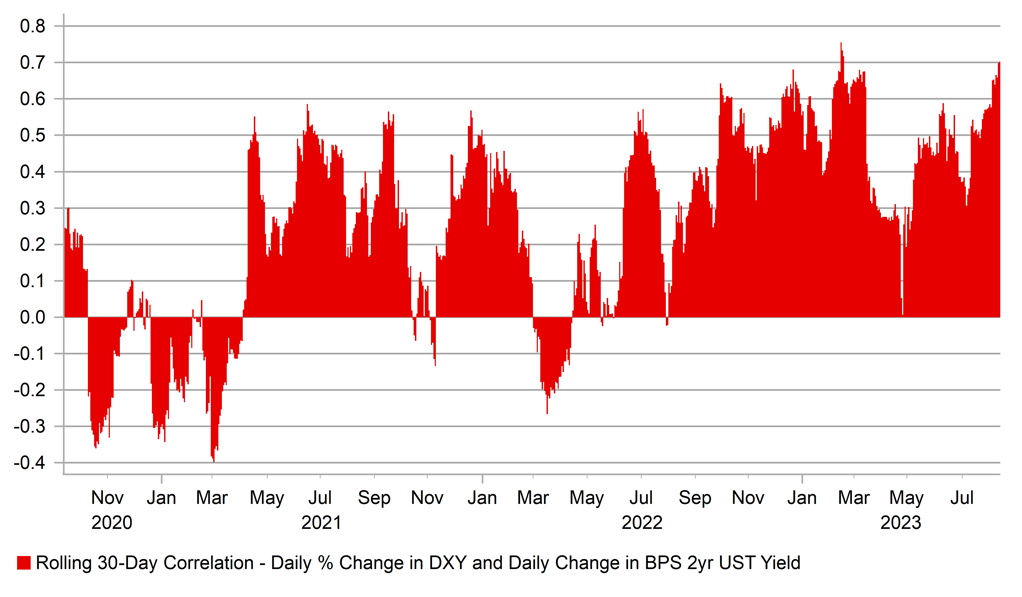

It’s August, yes that quiet time of the year when either absolutely nothing happens or we have market tumult. We have been highlighting the attractiveness of the US dollar from a yield perspective with the 30-day correlation of daily percentage changes in the dollar and short-term US yields back at levels not seen since before the regional banking sector turmoil in March. That correlation now stands at 0.70 and underlines the draw to carry when market volatility is low. If that volatility is threatened it could well still mean dollar strength but just under different market dynamics. In that context, the 18% devaluation of ARS and the emergency central bank meeting in Russia called for today are notable.

It’s not that either ARS or RUB depreciation will have direct reverberations for the broader markets, they won’t but the developments do highlight the draw of the US dollar as yields continue to move higher. Weak links are nearly always the first to reveal ‘cracks’ and certainly ARS and RUB are weak links but if US yields continue to drift higher from here, we are likely to see further ‘cracks’ appear that could have greater implications for broader markets. The 10-year UST bond has now traded above the 4.00% level for ten consecutive days now and looks increasingly like these levels above 4.00% can be sustained for a longer period of time. In Oct/Nov 2022, the 10-year yield was above 4.00% for 18 out of 19 days but of course back then, the real yield was a little lower given inflation concerns were a little higher back then. The real 10yr yield at 1.80% is the highest since July 2009. This increase will continue to raise the bar on EM countries to draw in capital inflows and hence spells increased risks for deficit-financing countries in particular.

There are specifics of course for ARS and RUB. An initial open primary election result in Argentina saw Javier Milei win the majority (over 30%) highlighting his potential. Milei wants to scrap the peso and burn down the central bank! A first round election will take place on 22nd October and the result means a second round run-off vote is probable, potentially between two hard-line candidates. In Russia, the depreciation of RUB through the 100-level has sparked a lot of focus in Russia and this breach has clearly prompted the emergency meeting today. A 100bps hike seems plausible today. But declining export revenues and the ongoing cost of the invasion of Ukraine will likely mean downward pressure could continue to build.

US dollar support in Asia has been helped by the decision of the PBoC to cut rates. The Medium-Term Lending Facility one-year rate was cut by 15bps to 2.50%. While not linked to the march higher in US yields, the decision reinforces the growing divergence in yields between the US and China and will add to USD/CNY upward momentum. Every data release today from China, including retail sales and industrial production were weaker than expected.

USD / 2YR YIELD CORRELATION BACK TO HIGHS FROM FEBRUARY

Source: Bloomberg, Macrobond & MUFG GMR

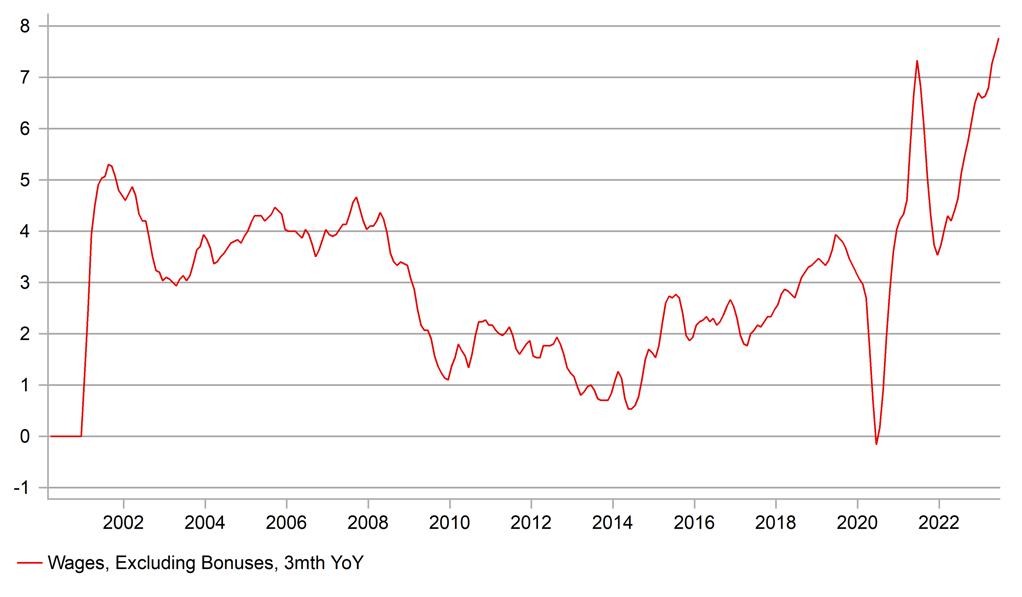

GBP: Another surge in wage growth nails on more BoE action

Another month and another stronger than expected wage growth reading in the UK jobs data. The 3mth YoY annual wage growth rate accelerated from an upwardly revised 7.2% (6.9%) to 8.2% (expected 7.4%) while the ex-bonus reading accelerated from 7.5% (7.3%) to 7.8% (expected 7.4%) and will make for uncomfortable reading for the BoE. However, there will be another jobs report before the Sept meeting. As we have seen before, the strong wage growth readings were accompanied by signs of weakening labour demand. The 3mth/3mth employment change revealed a 66k drop in jobs while the unemployment rate jumped from 4.0% to 4.2%. We have now had a 0.7ppt increase in the unemployment rate from the low of 3.5% which is meaningful.

The ONS data does reveal that between the period of Jan to Mar 2023 and Apr to Jun, there was a large net movement from economic inactive into unemployed. However, the numbers inactive due to long-term sickness increased to a new record. The number of vacancies fell by 66k on the quarter to 1.02mn underlining the weakening momentum for demand for labour.

The conclusions from a BoE policy and markets perspective is of course very clear. The BoE will hike at the meeting in September. The jump in overall wage growth today does incorporate one-off bonus payments related to pay deals in the NHS with the one-month public sector YoY in June at 16.5%. While the BoE could look beyond that, the ex-bonus reading for both private and public sector pay accelerated in June from May (8.3% from 8.1% and 6.5% from 6.0% respectively) and hence the wage growth risks to inflation will continue to offer justification for further BoE tightening.

We think the BoE will stick to a 25bp hike in September. Flipping back and forth between 25bps and 50bps is unlikely but yields will push further higher today, helping GBP but could be contained to a degree given the CPI data release tomorrow.

UK UNDERLYING WAGE GROWTH HITS A NEW RECORD HIGH

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

German ZEW Current Conditions |

Aug |

-62.6 |

-59.5 |

!! |

|

GE |

10:00 |

German ZEW Economic Sentiment |

Aug |

-16.0 |

-14.7 |

!! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Aug |

-- |

-12.2 |

! |

|

EC |

11:00 |

European Union Economic Forecasts |

-- |

-- |

-- |

! |

|

US |

13:30 |

Core Retail Sales (MoM) |

Jul |

-0.3% |

0.2% |

!!! |

|

US |

13:30 |

Retail Control (MoM) |

Jul |

0.2% |

0.6% |

!!! |

|

US |

13:30 |

Retail Sales (YoY) |

Jul |

1.50% |

1.49% |

! |

|

US |

13:30 |

Retail Sales (MoM) |

Jul |

0.4% |

0.2% |

!!! |

|

US |

13:30 |

Retail Sales Ex Gas/Autos (MoM) |

Jul |

-- |

0.3% |

!! |

|

US |

13:30 |

NY Empire State Manufacturing Index |

Aug |

-0.75 |

1.10 |

!! |

|

CA |

13:30 |

Common CPI (YoY) |

Jul |

4.7% |

5.1% |

!! |

|

CA |

13:30 |

Core CPI (YoY) |

Jul |

2.8% |

3.2% |

!!! |

|

CA |

13:30 |

Core CPI (MoM) |

Jul |

0.4% |

-0.1% |

!!! |

|

CA |

13:30 |

CPI (MoM) |

Jul |

0.3% |

0.1% |

!!! |

|

CA |

13:30 |

CPI (YoY) |

Jul |

2.7% |

2.8% |

!!! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Jun |

0.0% |

1.2% |

! |

|

CA |

13:30 |

Median CPI (YoY) |

Jul |

3.7% |

3.9% |

!! |

|

CA |

13:30 |

Trimmed CPI (YoY) |

Jul |

3.4% |

3.7% |

!! |

|

US |

15:00 |

Business Inventories (MoM) |

Jun |

0.1% |

0.2% |

! |

|

US |

15:00 |

NAHB Housing Market Index |

Aug |

56 |

56 |

! |

|

CA |

15:30 |

BoC Senior Loan Officer Survey |

Q2 |

-- |

11.3 |

! |

|

US |

16:00 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

|

US |

21:00 |

US Foreign Buying, T-bonds |

Jun |

49.90B |

37.50B |

! |

|

US |

21:00 |

Overall Net Capital Flow |

Jun |

42.80B |

-167.60B |

! |

|

US |

21:00 |

TIC Net Long-Term Transactions |

Jun |

107.2B |

25.8B |

! |

|

US |

21:00 |

TIC Net Long-Term Transactions including Swaps |

Jun |

114.50B |

17.50B |

! |

Source: Bloomberg