Yen rebounds after stronger economic growth in Japan

USD: Stronger US PPI reports creates unease over US inflation outlook

The US dollar has weakened modestly overnight resulting in the dollar index falling back towards support at around the 98.000-level. It follows the sharp rebound for the US dollar yesterday after the outsized upside surprise from the latest US PPI report which has increased unease over the potential for inflation pressures to pick-up in response to higher tariffs through the rest of this year. It prompted the US rate market to scale back expectations for Fed rate cuts encouraging a stronger US dollar. The 2-year US Treasury yield initially jumped by around 8bps. However, it has not significantly altered expectations that the Fed is likely to resume rate cuts as soon as the next FOMC meeting in September. A 25bps rate cut is still almost fully priced in although it has put a dampener on tentative expectations that the Fed could deliver an even larger 50bps rate cut like last September. Market participants are still confident that the Fed will resume rate cuts in response to weakness in the labour market and the lack of pass through so far to consumer prices from higher tariffs as evident in this week’s CPI report.

Even after the release yesterday of the much stronger US PPI reports, forecasts for the Fed’s preferred measure of core inflation, the core PCE deflator were only revised marginally higher and it is still expected to increase by 0.3%M/M in July. Nevertheless, the US PPI report did highlight the risk that there could be more pass-through from higher tariffs to consumer prices going forward which could encourage the Fed to remain cautious over cutting rates. The US PPI report revealed that manufacturers are continuing to increase their prices steadily. Durable consumer goods prices increased by 0.3% in July and by an annualized rate of around 4.0% over the last three months which is the most since October 2022. Overall, the report has provided support for the US dollar by dampening expectations for more aggressive Fed easing but is unlikely on its own to reverse the current weakening trend for the US dollar in the near-term.

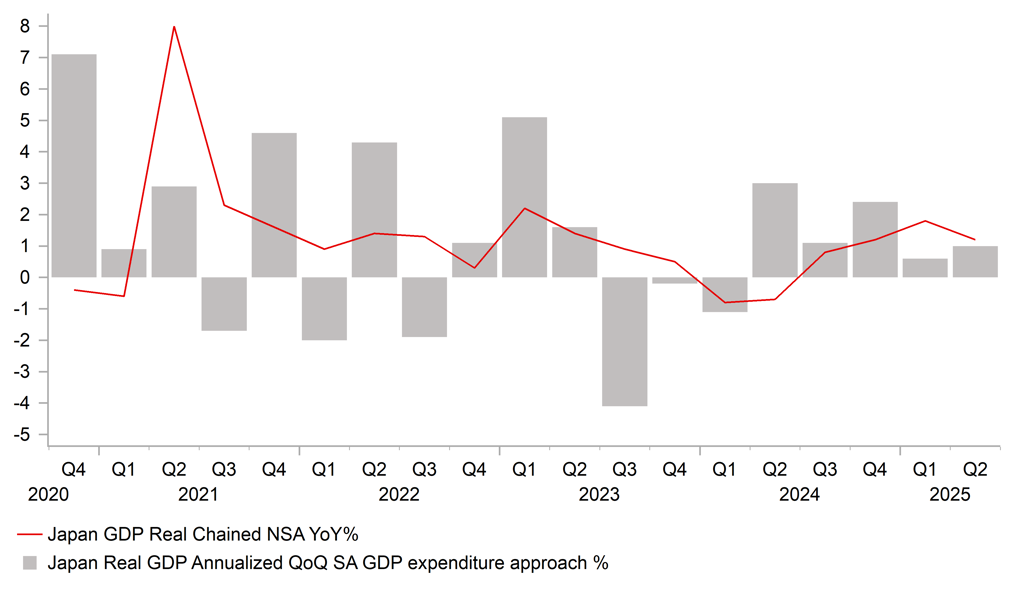

JAPAN’S ECONOMY EXPANDS FOR 5TH CONSECUTIVE QUARTER

Source: Bloomberg, Macrobond & MUFG GMR

JPY: BoJ rate hike expectations supported by resilience of Japan’s economy

The jump in US yields triggered by the stronger US PPI report helped to lift USD/JPY to high yesterday of 147.96 up from an intra-day low of 146.21. The pair has since fallen back towards the 147.00-level overnight as the yen has strengthened across the board following the release of the latest GDP report from Japan. The report revealed that Japan’s economy picked up more than expected in Q2 expanding by an annualized rate of 1.0%. In addition, the economic contraction in Q1 of -0.2% was revised away as growth was revised up to 0.6%. As a result, Japan’s economy has now recorded positive growth for five consecutive quarters. The expenditure breakdown revealed that private final consumption increased for the second consecutive quarter by 0.2% in Q2. Capital investment picked up to 1.3% in Q2 from 1.0% in Q1. Despite tariff disruption, exports (2.0%) increased more strongly than imports (0.6%) resulting in net trade contributing positively (+0.3ppts) to growth in Q2. Export growth may partly reflect some front-loading of demand prior to the US-Japan trade deal but will provide reassurance that the negative impact from trade disruption is less than feared.

Overall, the report should give the BoJ more confidence that Japan’s economy is holding up better than expected so far this year to negative external shocks. The BoJ has already acknowledged that the uncertainty over the economic outlook has eased in response to the US-Japan trade deal which should further help ease downside risks to growth. While the BoJ will continue to monitor closely how Japan’s economy performs in the coming months, we believe there is a higher likelihood that the BoJ will resume rate hikes this year perhaps as early as in October. The Japanese rate market has moved to price in closer to a 50:50 probability of the BoJ hiking rates by October and is currently pricing in around 17bps of hikes by the end of this year. A wider policy divergence between BoJ and Fed policies heading into the autumn should the Fed cut rates and BoJ hike rates could weigh more heavily on USD/JPY.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

13:30 |

Import Price Index (MoM) |

Jul |

0.1% |

0.1% |

!! |

|

US |

13:30 |

NY Empire State Manufacturing Index |

Aug |

-1.20 |

5.50 |

!! |

|

US |

13:30 |

Retail Control (MoM) |

Jul |

0.4% |

0.5% |

!! |

|

US |

13:30 |

Retail Sales (MoM) |

Jul |

0.6% |

0.6% |

!!! |

|

CA |

13:30 |

Manufacturing Sales (MoM) |

Jun |

0.4% |

-0.9% |

! |

|

US |

14:15 |

Industrial Production (MoM) |

Jul |

0.0% |

0.3% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Aug |

61.9 |

61.7 |

!! |

|

US |

21:00 |

Overall Net Capital Flow |

Jun |

-- |

311.10B |

! |

Source: Bloomberg & Investing.com