All eyes on ECB policy meeting after limited FX reaction to US CPI report

USD: Stronger core US CPI fails to inject fresh upward momentum into USD

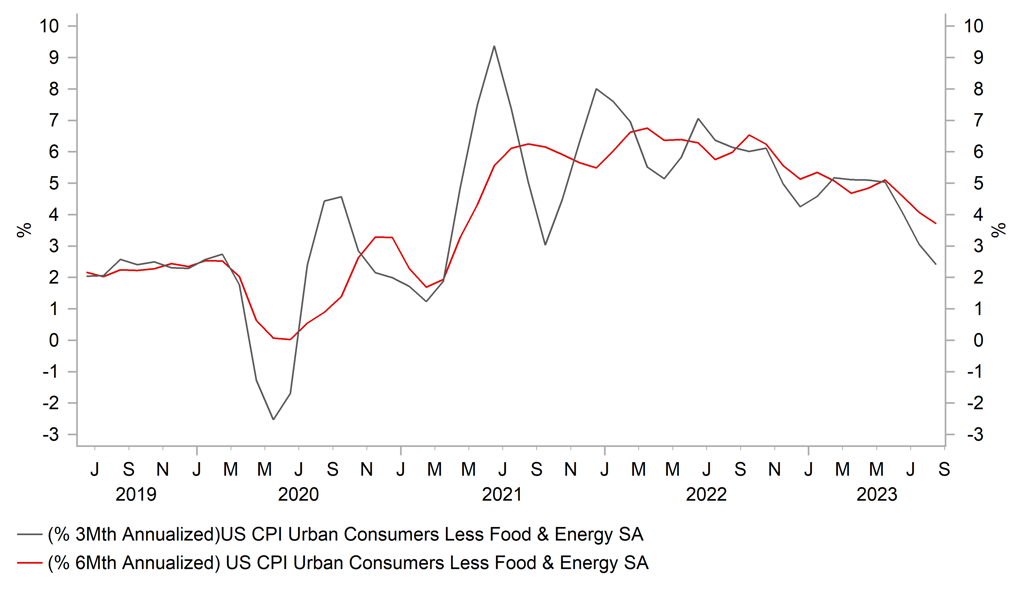

The relative stability for the major foreign exchange rates has continued ahead of today’s ECB policy meeting. The release yesterday of the latest US CPI report for August has had only a limited impact on FX performance. The dollar index initially strengthened just after the release of the US CPI report hitting an intra-day high of 104.97 but has since fallen back towards 104.60. The dollar index attempted earlier this year to break above the 105.00 on a sustained basis back in late February and early March and failed before correcting back into the 100.00 to 105.00 range where it has been trading for most of this year. The US dollar initially rallied after the US CPI report was released as it revealed that core inflation picked up by 0.3%M/M from increases of 0.2%M/M in the previous two months. The pick-up was even more marked for the super core measure of core services inflation less housing which jumped by 0.37%M/M up from 0.19%M/M in the previous month. However, there is still clear evidence of a slowdown in core inflation over the last three months even after taking into account the stronger reading for August. Over the last three months core inflation has increased by an annualized rate of 2.4% which compares to a rate of 5.0% in May. Even over a longer period of the last six months there has been a clear slowdown in core inflation to 3.7% in August from 5.1% in February. It helps to partly explain why the initial hawkish repricing in the US rate market and stronger US dollar reaction have failed to be sustained. Core inflation would have to pick-up further in the coming months to increase pressure on the Fed to raise rates further. US rate market pricing is even less hawkish now than prior to the CPI report release. A rate pause for the Fed is priced as a done deal for this month, around 11bps of further hikes by the end of this year, and 93bps of cuts priced in for next year. The stronger core CPI reading for August was mainly driven by the overshoot relative to expectations for vehicle insurance up 2.4%M/M and airline fares up 4.9%M/M. Market participants are assuming that the Fed will put more weight on the slowing trend for core inflation when setting policy and continue to look through upside risks to headline inflation for rising energy prices. In August headline inflation increased sharply by 0.6%M/M driven by a 10.6% jump in gasoline prices.

US CORE INFLATION TREND IS STILL SLOWING

Source: Bloomberg, Macrobond & MUFG Research calculations

EUR: Reuters report increases likelihood of ECB hike today

The market’s focus will now shift today to the ECB’s latest policy update. Market participants have raised expectations for another hike today with around 16bps priced in now. Market expectations for another hike were encouraged by a report from Reuters yesterday stating that the ECB expects inflation in the euro-zone to remain above 3% next year, “bolstering the case” for a tenth consecutive interest rate increase today according to a source with direct knowledge of the discussion. The ECB’s updated quarterly projections will reportedly show inflation north of 3.0% in 2024 in comparison to the 3.0% forecast from back in June. The source did also say though that the decision was “still a close call and formal proposals for the meeting have not yet been presented”. The report also downplays the importance of the 2025 inflation forecast that is expected to see “no fundamental change”. In light of the poor accuracy of the projections in recent years, the updated 2025 inflation projection is “not a major item” in the debate for policymakers. The report if accurate could tip the ECB in favour of delivering another hike even if the growth forecasts for this year and next “will be downgraded” in line with market expectations.

It poses upside risks to our call for the ECB to leave rates on hold although we have been acknowledging that there is a high risk of a final hike in the tightening cycle. In our latest FX Weekly report we outline our thoughts on the likely impact of today’s ECB policy meeting on the euro (click here). If the ECB hikes rates today we expect EUR/USD to stage a short-lived rally up towards the 1.0800-level. There are two reasons why we expect support from a hike to prove short-lived. Firstly, we expect the ECB’s updated forward guidance to provide a stronger signal it could be the last hike in the cycle as they shift their focus towards keeping rates higher for longer to get inflation down. Secondly, hiking rates into a weak economy with growth likely to contraction again in Q3 is not as favourable for the euro. It has been the relative growth performance that has helped to drag down EUR/USD recently.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

13:15 |

Deposit Facility Rate |

Sep |

3.75% |

3.75% |

!!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

225K |

216K |

!!! |

|

US |

13:30 |

PPI (YoY) |

Aug |

1.2% |

0.8% |

! |

|

US |

13:30 |

Retail Sales (MoM) |

Aug |

0.2% |

0.7% |

!!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!! |

Source: Bloomberg