Yen rebounds on back of global trade risks & political developments in Japan

AUD & NZD: New phase of US-China trade escalation hits commodity FX

The worst performing currencies during the Asian trading session have been the G10 commodity currencies of the Australian and New Zealand dollars. It has resulted in the AUD/USD rate falling to a fresh low overnight as it moves closer to support from the 200-day moving average that comes in at around 0.6420. Weakness in the commodity currencies reflects renewed concerns amongst market participants that the new phase of escalating trade tensions between China and US could reinforce headwinds for the global economy. As IMF Managing Director Kristalina Georgieva noted last week, the global economy has been coping better than feared this year, but cautioned that global resilience has not yet been fully tested. President Trump’s threat to raise tariffs on imports from China by 100% from 1st November would pose a bigger challenge for the global economy to absorb. Risk sentiment has taken a hit overnight after China threatened further retaliatory measures against US curbs on its shipping sector, after sanctioning American entities of a South Korean shipping giant. China’s Ministry of Commerce announced it was placing limits on five US entities of Hanwha Ocean Company which is one of South Korea’s biggest shipbuilders. The Ministry of Transport is also conducting a probe into the impacts from the US Trade Representative’s Section 301 investigation into China’s maritime sector, and may implement retaliatory measures in due time.

The latest news will add to investor concerns that the Trump administration will follow through and implement higher tariffs in response to China’s recent decision to tighten controls on rare earth minerals and actions against US shipbuilders. There is a higher risk now that trade tensions between China and the US will escalate further in the near-term before de-escalating again. As we saw earlier this year, China and the US are unlikely to tolerate much higher tariffs above 100% for long which will put pressure on both sides to reach an agreement to de-escalate and reverse tariff hikes. The current escalation phase of trade tensions poses downside risks for Asian and commodity related currencies, and could trigger an unwind of popular carry trades as financial market volatility picks-up.

BREAKDOWN OF SEATS IN BOTH HOUSES OF THE DIET

Source: Nikkei & MUFG GMR

JPY: Japanese election uncertainty set to persist ahead of vote for next PM

The yen has benefitted from the pick-up in trade tensions between China and the US since the end of last week. It has helped to dampen the upward trend for USD/JPY that has been in place since Sanae Takaichi won the LDP leadership election. After hitting a high of 153.27 on Friday, USD/JPY dropped back to a low overnight at 151.62. However, the pair is still trading well above pre-LDP leadership election levels when USD/JPY was trading at around 147.50. Similarly, the Nikkei 225 equity index has given back around half of the initial strong gains (~5%) recorded after the LDP leadership election. Japanese equities rallied and the yen weakened after the LDP election victory for Sanae Takaichi reflecting investor optimism it would potentially lead to looser fiscal and monetary policies to provide more support for growth in Japan.

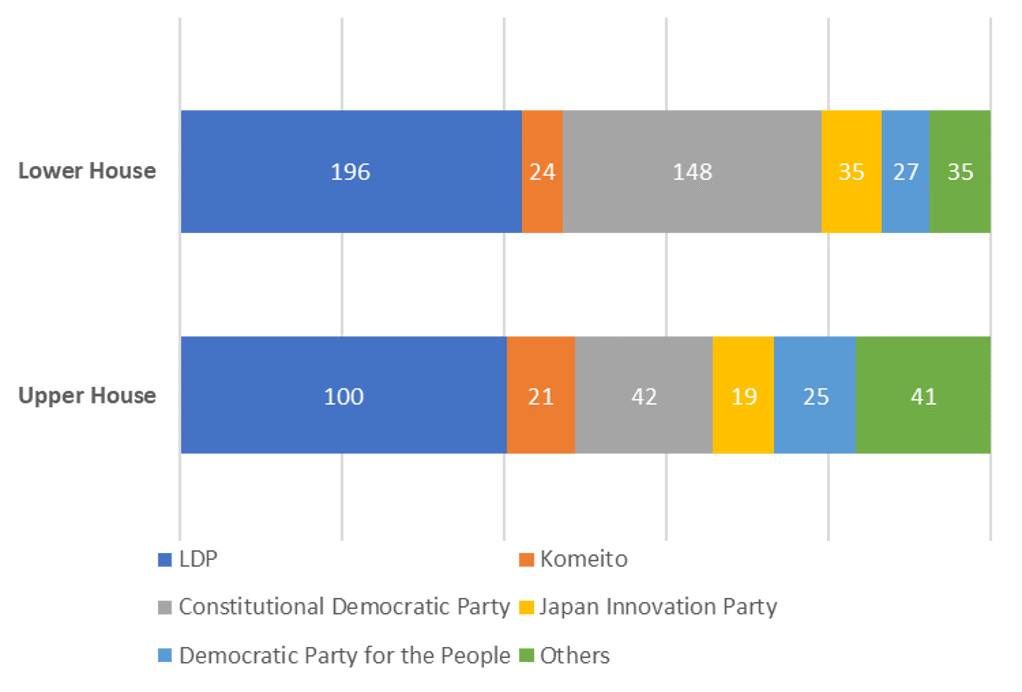

Yet there were already question marks over the ability of the new LDP leader to implement her policy agenda given the LDP recently lost it majority in the Lower and Upper Houses of the Diet for the first time while still being the ruling party. The LDP’s ability to hold on to power has been made even more challenging after their ruling coalition partner Komeito decided to formally withdraw from the government given concerns over primarily over political funding reforms and concerns new LDP leader Sanae Takaichi’s more hard-line conservative policy stance. Without support from the Komeito, the LDP is even further from having a majority in both Houses of the Diet. The LDP holds 196 out of 425 seats in the Lower House, and 100 seats out of 248 in the Upper House.

The LDP’s grip on power could be challenged when an extraordinary session of the Diet is expected to convene in the week of 20th October to vote on the next prime minister of Japan. Both houses of the Diet vote to choose the prime minister but if they make different choices, the lower house’s pick prevails. If no nominee wins a majority in the first round, then a runoff vote will be held amongst the two candidates who won the most votes. Without a majority in the Diet it is not a done deal that the new LDP leader Sanae Takaichi will become the next prime minister. The main opposition parties are in talks about whether they can unite around an alternative candidate for prime minister. Yoshihiko Noda who is the leader of the biggest opposition party the Constitutional Democratic Party of Japan has indicated that he is open to backing a prime minister not out of his own party. Yuichiro Tamaki who is the leader of the Democratic Party for the People is viewed as the most likely potential candidate to challenge new LDP leader Sanae Takaichi.

According to the Nikkei newspaper, there are three potential scenarios for how the selection of the next prime minister will play out. Firstly, if the opposition parties are unable to unite and Komeito refuses to vote for an opposition party then Sanae Takaichi could become prime minister leading an LDP minority government (196 seats in Lower House). Secondly, Sanae Takaichi could become prime minister securing support from other parties (Democratic Party for the People & Japan Innovation Party who have 27 & 35 seats respectively in the Lower House) and from unaffiliated lawmakers (7 seats in Lower House). Thirdly, the main opposition parties of the Constitutional Democratic Party of Japan (1488 seats in Lower House), Democratic Party for the People and Japan Innovation Party could join together to support DPFP leader Yuichiro Tamaki to be the next prime minister.

A more prolonged period of political uncertainty in Japan will deter the BoJ from resuming rate hikes as soon as at the end of this month unless the yen continues to weaken sharply increasing upside risks to their inflation target. However, the latest political developments have also increased the risk that initial market expectations for looser fiscal and monetary policies to boost growth in Japan could be disappointed if the next prime minister faces more of challenge to pass legislation in the Diet. Admittedly, it may also mean that they need to buy off support from opposition parties leading to looser fiscal policy. The yen could rebound further and the Japanese equity market continue to correct lower if there is any disappointment over pro-growth policy implementation.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:50 |

ECB's Cipollone Speaks in Brussels |

!! |

|||

|

SW |

09:20 |

Riksbank's Bunge Speaks in Stockholm |

!! |

|||

|

GE |

10:00 |

ZEW Survey Expectations |

Oct |

41.10 |

37.3 |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

Sep |

100.6 |

100.8 |

!!! |

|

CA |

13:30 |

Building Permits MoM |

Aug |

-1.0% |

-0.1% |

!! |

|

EC |

17:15 |

ECB's Villeroy Speaks in New York |

!! |

|||

|

US |

17:20 |

Fed's Powell Speaks |

!!! |

|||

|

NZ |

23:45 |

RBNZ Chief Economist Speaks |

!! |

Source: Bloomberg & Investing.com