Japan record buying of foreign equities helped curtail JPY gains

JPY: April flows highlight large foreign currency buying

In the period following the reciprocal tariff announcements on 2nd April through to the low-point for the US dollar, the yen was close to the top performing G10 currency along with the euro with only the Swiss franc clearly outperforming – the yen gained by about 6% over the period 2nd April through to 21st April. Since that low-point, the yen has given back close to 5% versus the US dollar and is the worst performing G10 currency. This is understandable from the perspective of US recession risks have now receded following the tariff de-escalation and the stronger payrolls at the start of May have also helped ease recession risks. The 2-year UST bond yield is 45bps higher from the low on 1st May, the day before the payrolls report.

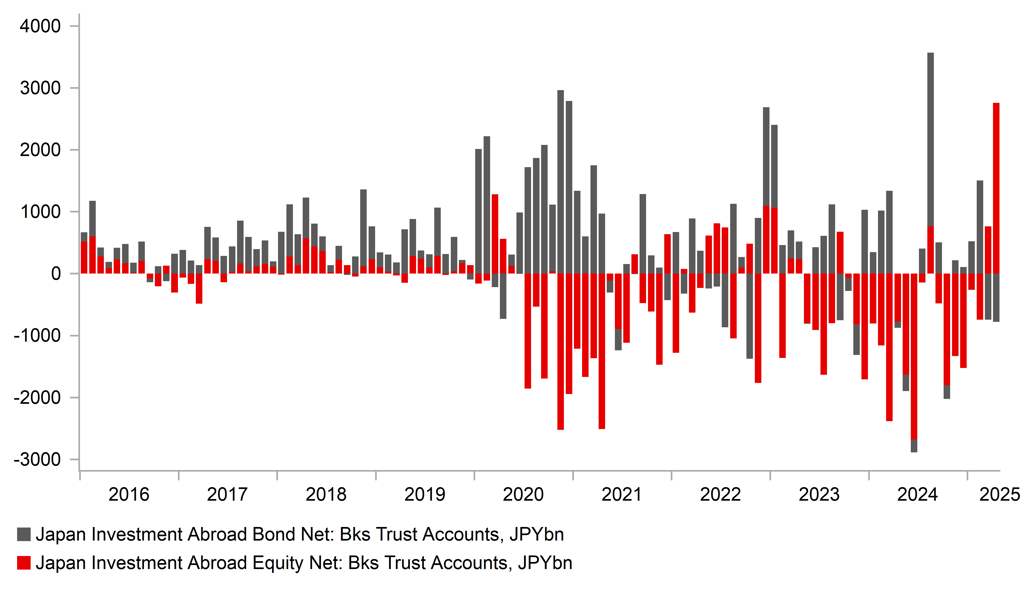

But monthly International Transactions in Securities data from the MoF, released on Monday was revealing in highlighting another flow that looks to have helped fuel the sharp rebound in USD/JPY. It looks like certain Japanese investors may have seen an opportunity for buying foreign securities at more opportunistic levels – both foreign equities and FX. The data for all Japanese investors revealed purchases of foreign equities totalling JPY 3,272bn in April – that’s a record total in a data series going back to 2001. The data series also breaks down the monthly flow by investor type and hence we can see that it was Japan Trusts that were the active buyers of foreign equities, buying JPY 2,762bn. As the chart above shows, this is an off-the-charts record total in the data series back to the start of 2005.

As can be seen above, Japan’s Trust sector (this sector would capture GPIF flows and other pension, real money flows) has been switching out of foreign equities and into foreign bonds. That may well have run its course now although again this may merely reflect opportunistic purchases given both FX and global equity moves at the start of the new fiscal year when the likes of the GPIF may have been undertaking some rebalancing or adopting re-weightings of portfolios. Taking the average USD/JPY for April, the buying of foreign equities by Japanese investors was substantial at around USD 25bn. Much of the equity buying would tend to much less hedged than purchases of foreign bonds.

Speculators could also have played a role in the scale and speed of reversal as well. The widely-tracked CFTC data that combines positioning from Asset Managers and Institutional Investors along with Leveraged Funds showed a record long JPY position of 150k contracts in data going back to 2007 as of last Tuesday. That highlights the high level of conviction of yen appreciation ahead which looks to have been sharply pared back in the week since given USD/JPY has jumped around 6 big figures.

JAPAN TRUSTS’ PURCHASES OF FOREIGN EQUITIES IN APRIL WAS BY FAR A RECORD TOTAL

Source: Bloomberg, Macrobond & MUFG GMR

EUR: ECB official dismisses dollar reserve status concerns

ECB Governing Council member Klaas Knot spoke yesterday on a day when the US dollar sold off and doubts quickly returned over the outlook for the dollar despite the sharp reversal of US-China tariff rates. On monetary policy, we heard more of what has been stated by other ECB members – that the trade uncertainty was growth and inflation negative over the short-term. Klass added that it was less clear over the medium-term which of course reflects the uncertainties and to what degree of retaliation the EU would adopt. We still expect the 20% reciprocal tariff rate to be adopted by the US as it seems unlikely, given the construct of the EU, that we will get any quick trade deal negotiated with the US. US Treasury Secretary Scott Bessent this week said as much when he cited a “collective action problem” in hampering the EU’s ability to negotiate with the US. Given our view that trade uncertainties will remain elevated and that the US economy will slow more notably through the second half of the year, we see scope for the ECB to lower the key policy rate by more than currently priced, to a level of 1.50% by year-end. Although we admit that following the trade de-escalation this week that two more cuts to 1.75% is a growing risk.

Klaas also spoke about the US dollar and was quick to dismiss the idea that the US dollar was losing its reserve status stating that the dollar was a “long way” from losing its status despite price action in recent weeks highlighting a decline in confidence in US assets. BoE’s Catherine Mann has also played down the demise of the dollar.

We agree with that and there are certainly examples of longer-term periods of US dollar depreciation that does not necessarily mean the dollar’s reserve status is being lost. Still, reserve holdings could well continue to decline gradually going forward. US dollar depreciation and less dollar-buying intervention by Asian central banks due to US opposition certainly reinforces that prospect.

But there is still ample scope for the dollar to weaken without having to take the view that its reserve status is under threat. The extraordinary period from 2014-15 through to the global inflation shock saw a peak USD 18.5trn worth of global fixed income trade with a negative yield. That was a key catalyst for the dollar in REER terms hitting a level not seen since around the period of the Plaza Accord in 1985. Negative yielding fixed income is a thing of the past now and that will allow for the dollar to retrace from historically over-valued levels. The euro stands to be a key beneficiary of that.

THE END OF NEGATIVE YIELDS GLOBALLY WILL ALLOW FOR USD OVER-VALUATION TO RETRACE

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

08:15 |

BoE Breeden Speaks |

-- |

-- |

-- |

!! |

|

GE |

09:15 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

CH |

10:00 |

M2 Money Stock (YoY) |

Apr |

7.2% |

7.0% |

! |

|

CH |

10:00 |

New Loans |

Apr |

710.0B |

3,640.0B |

!! |

|

CH |

10:00 |

Outstanding Loan Growth (YoY) |

Apr |

7.4% |

7.4% |

! |

|

CH |

10:00 |

Chinese Total Social Financing |

Apr |

1,220.0B |

5,890.0B |

!! |

|

US |

10:15 |

Fed Waller Speaks |

-- |

-- |

-- |

!!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

11.0% |

! |

|

US |

12:00 |

OPEC Monthly Report |

-- |

-- |

-- |

! |

|

CA |

13:30 |

Building Permits (MoM) |

Mar |

-0.7% |

2.9% |

!! |

|

CA |

13:30 |

New Motor Vehicle Sales (MoM) |

Mar |

-- |

125.4K |

! |

|

US |

14:10 |

Fed Governor Jefferson Speaks |

-- |

-- |

-- |

!! |

|

US |

16:00 |

Thomson Reuters IPSOS PCSI |

May |

-- |

52.80 |

! |

|

CA |

16:00 |

Thomson Reuters IPSOS PCSI (MoM) |

May |

-- |

45.35 |

! |

|

US |

22:40 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com