USD continues to rebound amidst heightened US policy uncertainty

USD: US policy uncertainty remains elevated as US dollar rebounds

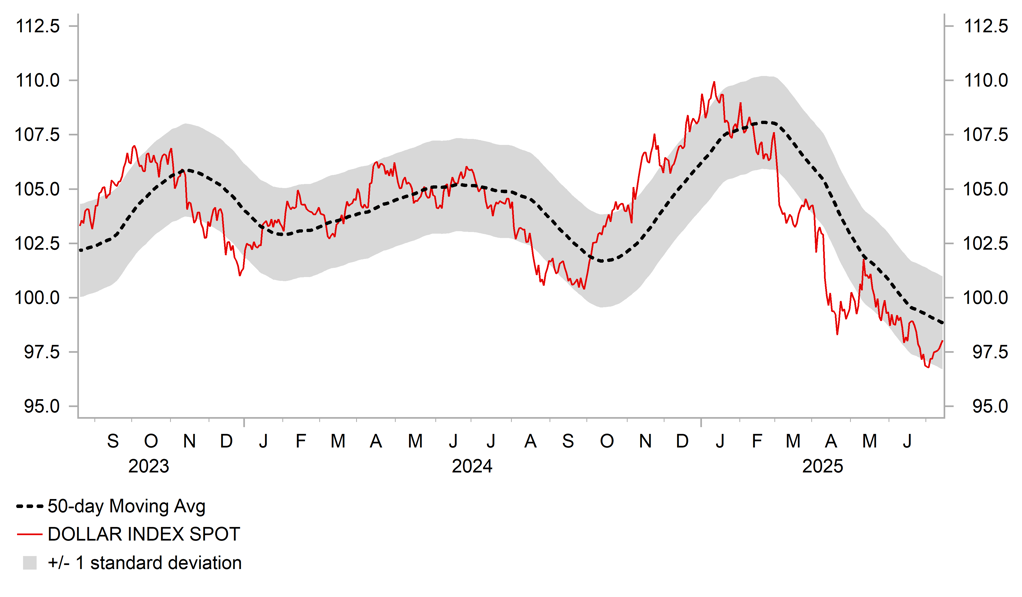

The US dollar has continued to strengthen at the start of this week after the dollar index recorded its ninth consecutive trading day of gains on Friday. The US dollar has strengthened over the past week as President Trump has reiterated threats to put in place higher tariffs on major trading partners while at the same time extending their delayed implementation by a shorter time period until 1st August. Over the weekend President Trump threatened to put in place 30% tariffs on the EU and Mexico. Similar to Canada the 30% tariff for Mexico is expected to apply only to non-USMCA compliant goods helping to limit potential disruption to trade between the US and Mexico. The Mexican Economy Minister Marcelo Ebrard has stated that he expects the proportion of Mexican exports to the US which are USMCA compliant to rise to between 85% and 90% as companies adjust their export practices to meet USMCA standards. In contrast the 30% tariff would be more disruptive for European economies although it remains to be seen what final rate of tariff will be implemented. President Trump has already threatened to impose a 20% tariff on Liberation Day which was then ratcheted up to 50% and has now been reduced back down to 30%. In response, European Commission chief Ursula von der Leyen has stated that the EU will extend the suspension of trade countermeasures against the US until 1st August to allow for further trade talks as they continue to seek a deal to avoid the higher tariff rate being implemented. The current list of countermeasures would impact about EUR21 billion of US imports while the EU has another package ready that would impact a further EUR72 billion. She also noted that “at the same time, we will continue to prepare further countermeasures so we are fully prepared” but downplayed the need to use the EU’s anti-coercion instrument at this point.

German Chancellor Merz has stated that he was coordinating closely with other European leaders to ensure the higher tariffs are not implemented which requires “unity in the EU” and “good lines of communication with the American president”. President Trump has since indicated that the EU and US are still in talks on trade which are expected to continue this week. It had been reported last week that the EU sought to conclude a tentative deal with the US to avoid the higher tariffs that could include keeping the current 10% tariff on most goods imported from the EU and lowering the 25% tariff on autos and 50% tariffs on steel & aluminium. Market participants are likely to remain optimistic that that a deal between the EU and US can be reached by 1st August helping to dampen downside risks for the euro and other European currencies.

The other main development for the US dollar has been the increased ferocity of attacks on Fed Chair Powell from the Trump administration. President Trump stated over the weekend that “he is very bad for our country…I hope he quits. He should quit”. There is growing criticism over renovation costs at the Fed which have risen to USD2.5 billion. Kevin Hassett, director of the national Economic Council at the White House has stated that Chair Powell’s future depends on how he answers questions about the renovation costs. He told ABC’s This Week that “It was never envisioned by the people that voted for the construction of the Fed that we currently see that the Fed could print money and toss it around willy nilly”. Former Fed Governor Kevin Warsh who is viewed as one of the favourites to be the next Fed Chair alongside Kevin Hassett has been even more critical calling for “regime change” at the Fed. He said “it’s not just about the chairman, it’s about a range of people”. The lack of negative US dollar reaction highlights that market participants are not expecting the talk to lead to the immediate removal of Powell as Fed Chair but it remains a significant downside risk for the US dollar that needs to monitored going forward.

USD IS STAGING MODEST REBOUND AFTER HEAVY SELL-OFF

Source: Bloomberg, Macrobond & MUFG GMR

JPY: Fiscal and monetary policies in focus ahead of Upper House election

The yen has weakened the most this month amongst G10 FX against the US dollar resulting in USD/JPY hitting a high overnight at 147.57. The yen has failed to derive support from rising yields in Japan. The sell-off at the longer end of the curve has resumed this month lifting the 30-year JGB yield back up to within touching distance of the high from 21st May at 3.20%. In contrast, yields at the short end of the curve have remained more stable. The main news overnight from Japan was that the BoJ are likely to consider raising at least one of their inflation forecasts at their policy meeting later this month. The inflation forecast for this fiscal year of 2.2% will probably be increased after food inflation proved stronger than expected back in early May. Higher oil prices provide another reason for considering an upward revision. However, the report went on to add that the BoJ sees little need to make any major changes to its big picture outlook for the economy and inflation. Trade policy uncertainty remains elevated after President Trump threatened last week to put in place 25% tariffs on Japan from 1st August. It should keep the BoJ cautious over hiking rates further until a trade deal is reached with the US which has been encouraging a weaker yen.

A the same time, the yen and long-term JGBs are coming under selling pressure ahead of this week’s Upper House election on 20th July. If the government were to lose its majority in the Upper House it would increase the risk of looser fiscal and monetary policies. Please see our latest FX Weekly for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

11:00 |

German Buba Monthly Report |

-- |

-- |

-- |

! |

|

CH |

11:00 |

Chinese Total Social Financing |

Jun |

3,650.0B |

2,290.0B |

! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

UK |

14:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com