USD rebound could extend further over the short-term

USD: Falling inflation optimism fades & USD advances

Just like the 2nd February was an important day in terms of the break higher for rates and the US dollar, yesterday was another important day in that regard with DXY breaking above early-February highs to set new year-to-date highs and the highest levels since DXY was heading lower in November last year in response to weaker than expected CPI data. From the DXY high on 1st November last year to the low in December, DXY has now broken back above the 61.8% retracement level having broken the 50% retracement after the payrolls report earlier this month. This rebound for the US dollar since the start of the year is what we expected from a seasonal bias perspective but the fundamental factors have been compelling as well. This CPI data and the tightening of financial conditions that has continued is not good news for the economy or the banking sector. Higher for longer was dismissed in Nov/Dec but that move is now reversing although the retracement in UST bond yields remained less than in FX. Equities also have barely retraced although the S&P 500 did drop 1.4% yesterday. Overall, financial conditions remain much easier than in October but this inflation print certainly reinforces the prospect of financial conditions tightening further over the near-term.

Still, we would certainly maintain the view expressed here yesterday that the bigger picture backdrop remains intact – disinflation momentum is still likely to persist and yesterday’s disappointing CPI report doesn’t really change the more favourable outlook ahead. The biggest disappointing factor lifting inflation yesterday was in housing and rents. Other elements that were behind the higher inflation print were insurance, medical care and education. They are hardly the high cyclical-sensitive components and actual rents are already falling notably. It is also the PCE data that the Fed look at the medical services component and rents have a smaller weighting in the PCE so the PCE data should be more contained. PPI data on Friday will also include components to calculate the PCE data.

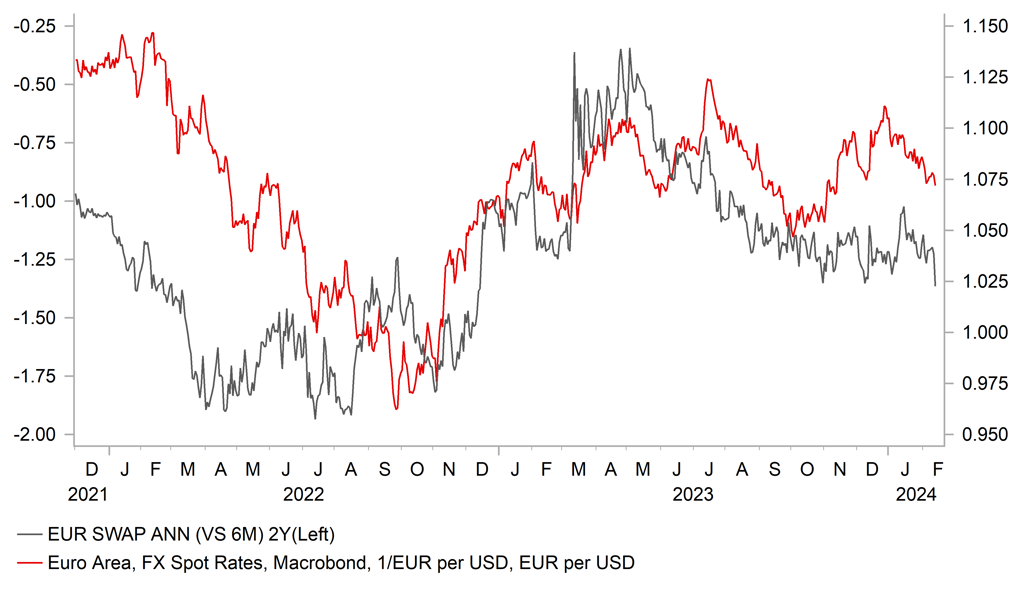

However, the CPI data has done some real damage to the prospects of a rate cut by May. The OIS market now has just 10bps of cuts priced for May. At the end of January the market had 33bps priced. June is now just about priced for a 25bp cut. With two more CPI report before 1st May, we would be surprised to see that implied probability drop notably further for now. We did also get the NFIB Small Business Optimism survey data yesterday and the overall index fell 2pts to the lowest level since May last year. The Plans to Hire index fell to 14%, the lowest level since May 2020 during the worst period of the pandemic. So OIS pricing has adjusted to what we would describe as reasonable pricing but 2yr spreads on government bond yields and swap rates have moved notably in favour of the US dollar implying continued dollar upside risks for now.

EU-US 2YR SWAP SPREAD BREAKS TO WIDEST SINCE DEC 2022

Source: Bloomberg, Macrobond & MUFG GMR

CHF: The clear underperformer in G10 – more to go?

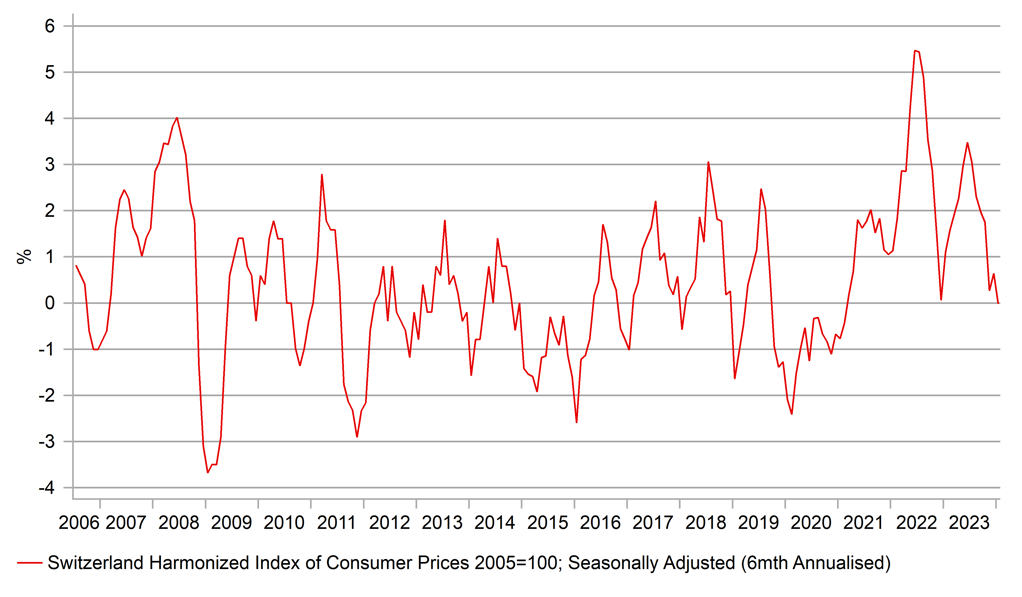

In contrast to the CPI release in the US, inflation data from Switzerland yesterday came in much weaker than expected. The headline EU harmonised rate gained just 0.1% MoM, which dragged the annual rate down to 1.5%, well below the market consensus of 2.0%. It was the lowest level since January 2022. The SNB in December in its updated Monetary Policy Assessment showed inflation picking up from 1.6% in Q4 to 1.8% in Q1 so this January reading already places that forecast in some doubt. The OIS pricing moved markedly yesterday with March now showing 19bps of rate cuts priced, from just 10bps on Monday. Given Switzerland regulated utility prices meant there was an increase in January. VAT also increased so the overall weakness of the CPI data underlined the weak underlying inflationary pressures.

Of course the SNB could refrain from cutting rates so soon and could feasibly turn to FX intervention like in the past. However, the huge loss on its FX portfolio in 2022 means there are political repercussions from returning to a policy of CHF selling for foreign currencies. But what we can be sure of is that CHF buying to fight inflation risks is now over and there is certainly the potential for CHF selling, albeit on a more modest scale than in the past. That reluctance to expand FX reserves could expedite a decision to cut rates.

SWISS EU HARMONISED INFLATION 6MTH ANNUALAISED AT ZERO PERCENT

Source: Macrobond & Bloomberg

JPY: BoJ window to hike opens a little more

One consequence of the stronger than expected US inflation is the re-emergence of concerns in Tokyo over the level of the yen. The surge in USD/JPY yesterday prompted expressions of concern today in Tokyo with Vice Finance Minister for International Affairs Masato Kanda stating that while “some of the recent rapid moves are in line with fundamentals”, some were “clearly speculative”, adding that the latter “aren’t desirable”. Again Japan finds itself in the position of expressing concerns but it in a difficult position to argue credibly against a weak yen given the monetary stance in Japan.

Could this move, certainly if extended, offer the BoJ the justification to move a little earlier than expected. Currently the OIS market indicates between 3-4bps are priced for March and 7-8bps in April. So there’s a reasonably high probability of a 10bp hike in April and if the yen extends further weaker we should see market conviction increase further too. With USD/JPY now more or less in intervention territory, a March hike is more feasible. This is political too and the government certainly will not want to be seen to be doing nothing given its unpopularity due to the cost of living crisis. US developments as we saw yesterday take precedence but at higher USD/JPY levels, the threat of intervention and speculation on a March hike should limit yen selling.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:30 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

UK |

09:30 |

House Price Index (YoY) |

-- |

-1.8% |

-2.1% |

! |

|

EC |

10:00 |

Employment Change (QoQ) |

-- |

0.3% |

0.2% |

! |

|

EC |

10:00 |

Employment Change (YoY) |

-- |

1.1% |

1.3% |

! |

|

EC |

10:00 |

Employment Overall |

Q4 |

-- |

168,734.0K |

! |

|

EC |

10:00 |

GDP (QoQ) |

-- |

0.0% |

-0.1% |

!!! |

|

EC |

10:00 |

GDP (YoY) |

Q4 |

0.1% |

0.0% |

!! |

|

EC |

10:00 |

Industrial Production (MoM) |

Dec |

-0.2% |

-0.3% |

!! |

|

EC |

10:00 |

Industrial Production (YoY) |

Dec |

-4.1% |

-6.8% |

! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

3.7% |

! |

|

US |

14:30 |

Fed Goolsbee Speaks |

-- |

-- |

-- |

!! |

|

UK |

15:00 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!! |

|

US |

15:00 |

Thomson Reuters IPSOS PCSI |

Feb |

-- |

52.90 |

! |

|

CA |

15:00 |

Thomson Reuters IPSOS PCSI (MoM) |

Feb |

-- |

49.46 |

! |

|

US |

21:00 |

Fed Vice Chair for Supervision Barr Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg