Short-term outlook is favourable for the US dollar

USD: Higher US yields and diminished risk appetite to help dollar

The failure of yields to decline in the wake of the US CPI report last Thursday has underlined the solid support for US yields that looks set to persist over the short-term. Yield support has been helped by the higher than expected PPI data on Friday also while the rhetoric from Fed officials indicates that there remain divisions over whether the FOMC has reached the end of the its tightening cycle. Demand for US Treasuries looks solid after the three auctions that took place last week although the deteriorating budget position means greater support for longer-term yields than previously, or in a situation of weakening growth that would translate into greater downward pressure on the US dollar. The budget deficit is now at USD 1.6trn over the first ten months of the fiscal year, compared to USD 726bn in the same period of the previous year.

If there is a source of renewed volatility and risk aversion over the short-term it looks like that could come from China. Economic data continues to be weak with increased concerns of late over the property market. Those concerns have now increased further after a company linked to a key China private wealth manager (Zhongzhi Enterprise Group Co.) missed making payments to three separate firms. These were payments relating to maturing wealth products. Zhongzhi has assets under management totalling CNY 1 trillion (USD 138bn). These reports of missed payments from within the shadow banking system in China certainly has the potential to trigger a further notable deterioration in sentiment and if yield differentials and carry is disrupted as a market driver it will likely come from increased risk aversion in China and this unfolding development needs close monitoring.

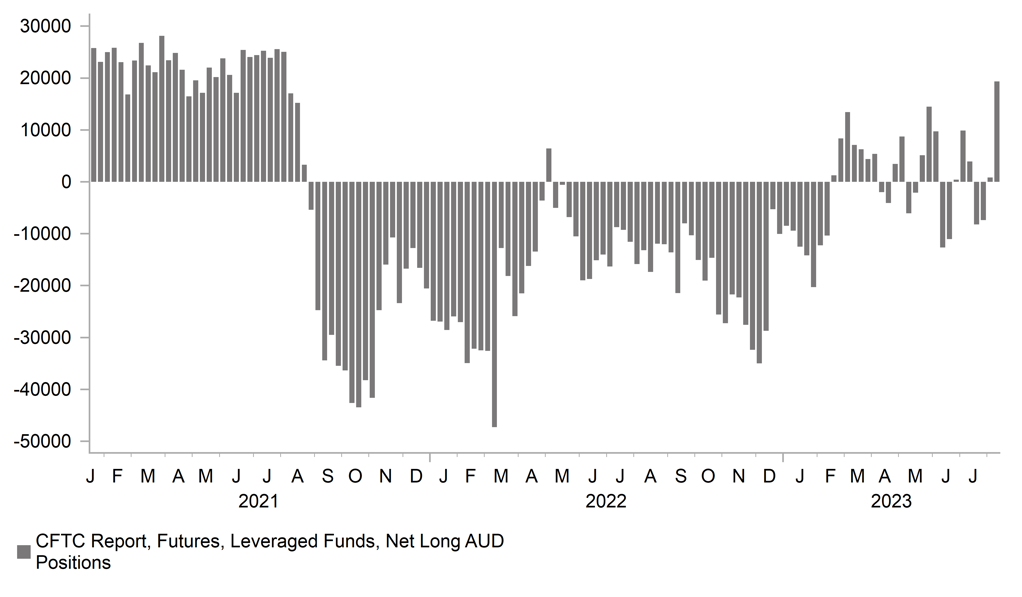

LEVERAGED FUNDS’ LONG AUD POSITION LARGEST SINCE 2021

Source: Bloomberg, Macrobond & MUFG GMR

It is notable that the IMM data on Friday evening revealed a big jump in long AUD positions amongst Leveraged Funds. AUD/USD dropped notably to last Tuesday and hedge funds may have seen an opportunity to buy. What this means now though is that if China sentiment worsens further from here, these long AUD positions could be quickly unwound leading to a further underperformance. The Hang Seng China Enterprise Index is down 2.4% today and is now 7.5% lower in August. Increased concerns over global growth will likely reinforce broad US dollar support over the short-term, especially against the higher-beta, global growth sensitive G10 currencies. We have published a new FX trade idea – short EUR/USD – in our FX Weekly published on Friday (here).

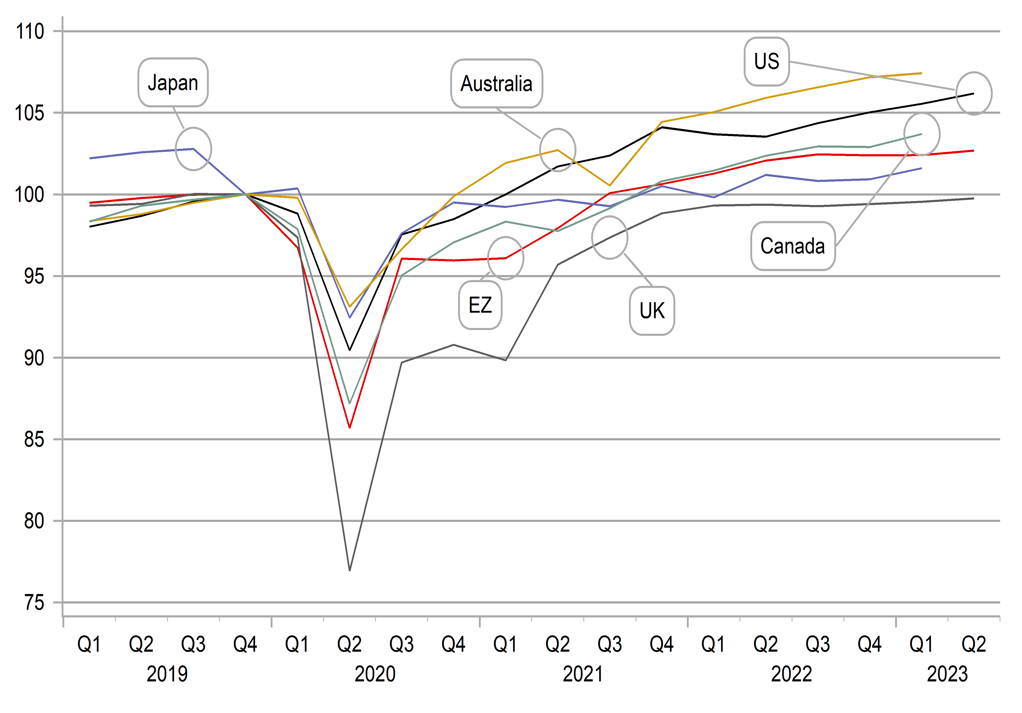

UK REAL GDP REMAINS BELOW THE PRE-COVID Q4 2019 LEVEL

Source: Macrobond & Bloomberg

GBP: Key week for UK after strong GDP data

The week ahead is going to be relatively quiet in regard to central bank speakers with the summer vacation period leaving the speaking calendar very light. Fed President Kashkari speaks tomorrow at 4pm BST – that’s it this week.

After last week’s US inflation data, the key data releases this week will be in the UK. The jobs and wages data will be released tomorrow followed by the CPI data on Wednesday and the retail sales data on Friday. The heavy week of data releases follows on from the GDP data on Friday which was much stronger than expected and saw UK Gilt yields advance well ahead of yields in the US and core Europe. The pound weakened last week against the US dollar but was the next best performing G10 currency. The data was certainly good news although the 0.5% m/m increase in GDP in June reflected a surge in manufacturing that was partly distorted by working days relative to May when there was the extra bank holiday. But the Q/Q data was also stronger at 0.2% with strength in household spending, government spending and business investment. The 0.2% gain was also better than the 0.1% estimated by the BoE. Still, it is worth adding that the UK remains the laggard within G7 as it remains the only economy to be still smaller than before covid hit in Q4 2019.

But in the context of this week it does mean that any upside surprises in the employment data tomorrow or of course in the CPI data on Wednesday will only reinforce further the likelihood of a BoE rate hike in September. The OFGEM energy price cap cut of 17% explains a lot of the -0.5% m/m consensus for CPI with the core rate only expected to slow 0.1ppt to 6.8% and with services CPI set to remain above 7.0%. The 3mth YoY wage data is also set to remain elevated (7.4% from 6.9%) but this partly is explained by weak March data dropping out of the calculation, so we will be looking to see whether the one-month data has slowed from last month to gauge the trend. The unemployment rate has now increased from 3.5% to 4.0% and any further rises would help reinforce expectations of slower wages ahead.

We suspect the data this week might not show enough evidence of easing upside inflation risks to deter the BoE from hiking in September and in those circumstances following the stronger GDP data, we may well see some scope for further GBP strength. However, with the dollar also looking on a more solid footing, selling EUR/GBP may prove a better avenue for pound gains.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CA |

15:30 |

BoC Senior Loan Officer Survey |

Q2 |

-- |

11.3 |

! |

|

US |

16:00 |

Consumer Inflation Expectations |

-- |

-- |

3.8% |

! |

|

US |

16:30 |

3-Month Bill Auction |

-- |

-- |

5.290% |

! |

|

US |

16:30 |

6-Month Bill Auction |

-- |

-- |

5.265% |

! |

Source: Bloomberg