Yen outperforms driven by BoJ rate hike speculation

JPY: BoJ rate hike speculation encourages stronger yen

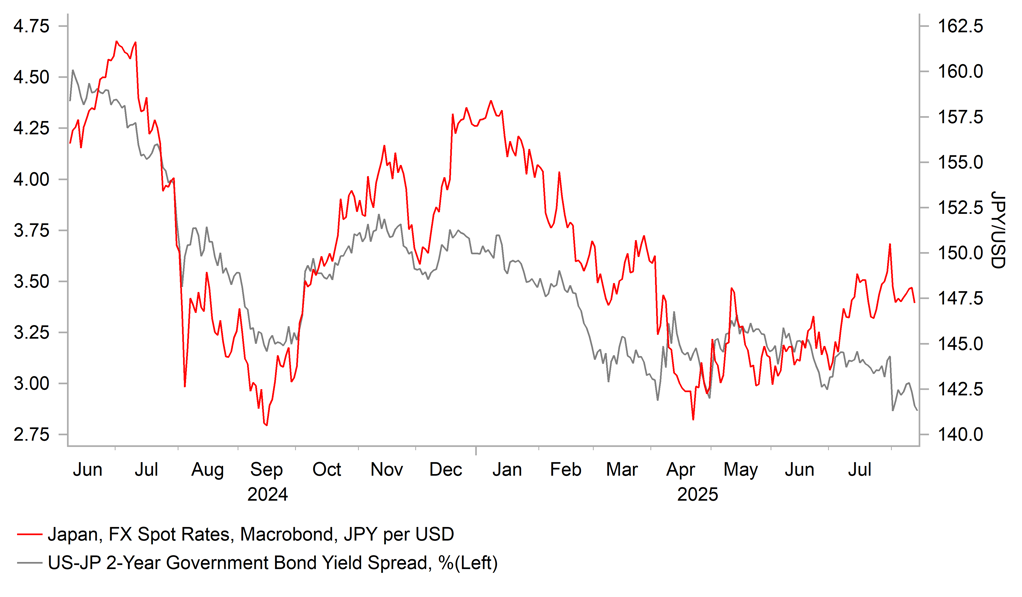

The yen has been the best performing currency overnight resulting in USD/JPY falling back closer to the 146.000-level. The main trigger for broad-based yen strength overnight have been comments from US Treasury Secretary Scott Bessent who told Bloomberg News yesterday that the BoJ is “behind the curve” while stating that “they’re going to be hiking and they need to get their inflation problem under control”. He added that he discussed inflation in Japan with BoJ Governor Ueda. A BoJ spokesperson has since replied overnight stating that US Treasury Secretary Bessent and BoJ Governor Ueda regularly exchange views at international conferences. Nevertheless, US Treasury Secretary Bessent’s comments have created the impression that the Trump administration is attempting to put more external pressure on the BoJ to tighten monetary policy further which would encourage a stronger yen.

At the same time the Trump administration is continuing to intensify pressure on the Fed to cut rates. US Treasury Secretary Bessent also stated yesterday that “I think we could go in series of rate cuts here, starting with a 50bps cut in September. If you look at any model…it suggests that we should probably be 150, 175 basis points lower. He believes that if the Fed had the revised weaker employment data available at prior meetings in June and July they would have already started to cut which creates the justification for starting with a larger 50bps cut in September to play catch up. A similar outcome to what happened last year when the Fed started to cut rates by delivering a larger one-off 50bps rate cut. While the US rate market has already moved to fully price in a 25bps rate cut in September, it is not convinced that a larger 50bps cut in necessary. Turning back to Japan, the US Treasury had already stated back in June in their semi-annual currency report that “BoJ policy tightening should continue to proceed in response to economic fundamentals including growth and inflation, supporting a normalization of the yen’s weakness against the dollar and a much-needed structural rebalancing of bilateral trade”. However, currency policy was not a focus point in the recent trade agreement reached between the US and Japan.

Reuters also released a news report yesterday indicating that the BoJ are weighing up potential changes to the way they communicate their plans to normalize policy. It follows the release of the minutes from the July policy meeting. The Reuters report stated that pressure is building on the BoJ to drop their focus on “underlying inflation” of which there is no single indicator. As the minutes rom the July policy meeting showed, one member noted that “we’re at a phase where we should shift the core communication away from underlying inflation to actual price moves and their outlook”. The Reuters reports adds as well that some members of the government’s top economic council have warned the BoJ this month that it might be too complacent over upside inflation risks. A potential shift in communication could encourage expectations for further BoJ hikes and a stronger yen.

USD/JPY VS. SHORT-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

GBP: Stronger UK GDP data further dampens BoE rate cut expectations

The pound is continuing to trade on stronger footing since last week’s hawkish MPC policy update. After hitting a high of 0.8769 at the end of last month, EUR/GBP has fallen back closer towards the 0.8600-level encouraged by the scaling back of BoE rate cut expectations. The current bullish trend for the pound has been supported this morning by the release of the latest UK GDP report for Q2. The report revealed that the UK economy slowed in Q2 but less than feared. Real GDP expanded by 0.3% in Q2 down from strong growth of 0.7% recorded in Q1. At the BoE’s last policy meeting, the Bank’s staff had been estimating GDP growth of 0.1% in Q2 followed by a pick-up in growth to 0.3% in Q3. The monthly data revealed that growth picked up more strongly than expected by 0.4%M/M in June following contractions of -0.1% in both April and May, and in doing so shows stronger growth momentum heading into Q3. The sector by sector breakdown revealed that services expanded by 0.4% in Q2, construction by 1.2% while production contracted by -0.3%.

However, the positive impact on the pound from stronger headline growth has been dampened somewhat by the less favourable breakdown of expenditure in Q2. As the ONS highlighted growth was mainly driven by increases in government consumption (1.2%) and the other category of gross capital formation which includes changes in inventories, acquisitions less disposals of valuables and expenditure alignment adjustment. In contrast, private consumption and business investment were weaker than expected. Private consumption increased by just 0.1% in Q2 down from 0.4% in Q1. Business investment was even weaker although it is volatile and prone to revisions. It contracted by -4.0% in Q2 following an increase of 3.9% in Q1. Overall, the report is unlikely alter market expectations that the BoE is becoming more cautious over delivering further easing this year. The BoE indicated earlier this month that it is less confident it will continue to cut rates every quarter. The UK rate market is now pricing in less than a 50:50 probability of another 25bps BoE rate cut in November.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

NO |

09:00 |

Interest Rate Decision |

-- |

4.25% |

4.25% |

!! |

|

UK |

09:30 |

Labour Productivity |

Q1 |

-0.5% |

0.2% |

!! |

|

EC |

10:00 |

Employment Change (QoQ) |

Q2 |

0.2% |

0.2% |

! |

|

EC |

10:00 |

GDP (QoQ) |

Q2 |

0.1% |

0.6% |

!! |

|

EC |

10:00 |

Industrial Production (MoM) |

Jun |

-0.9% |

1.7% |

!! |

|

EC |

11:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

Jul |

-- |

0.2% |

!! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,960K |

1,974K |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

225K |

226K |

!!! |

|

US |

13:30 |

PPI (MoM) |

Jul |

0.2% |

0.0% |

!!! |

|

US |

18:00 |

U.S. President Trump Speaks |

-- |

-- |

-- |

!!! |

|

US |

19:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,641B |

!! |

Source: Bloomberg & Investing.com