Risk-off returns as government shutdown prospect rises

USD: More uncertainty as government shutdown looms

The US dollar has strengthened modestly today with the positive day for equities yesterday turning to a less favourable day today in Asia as investor concerns increase over the prospect of a government shutdown. In order to reach the 60-vote threshold in the Senate to pass stop-gap funding bill (continuing resolution) that passed the House on Tuesday night the Republicans require the support of at least seven Democrats and the Senate minority leader, Chuck Schumer confirmed last night that there would be no support for the bill. One Democrat has indicated support but in addition one Republican has indicated he would vote against the bill. The continuing resolution would essentially extend the funding to match current spending agreements for a 6-month period until 30th September, but would also allow for cutting back some non-defence spending and increase defence and immigration control spending. But the Democrats are concerned this provides too much scope and have offered a one-month extension to 11th April. This would allow the time for alterations to the current agreement. However, the House is now adjourned so getting the a new deal agreed seems unlikely ahead of the current funding expiry on Friday evening.

The last government shutdown was during Trump’s first term in office in December 2018 and was the longest ever at 35 days. With some appropriations bills passed back then the furloughed worker total of 380k was smaller than some in previous shutdowns. On this occasion the numbers would likely be larger and reinforce the uncertainty at a time when Doge and Elon Musk are taking action to aggressively cut federal government employees. Yields have not reacted to this potential disruption with yesterday’s CPI data highlighting the potential for the core PCE data to reveal another solid m/m gain.

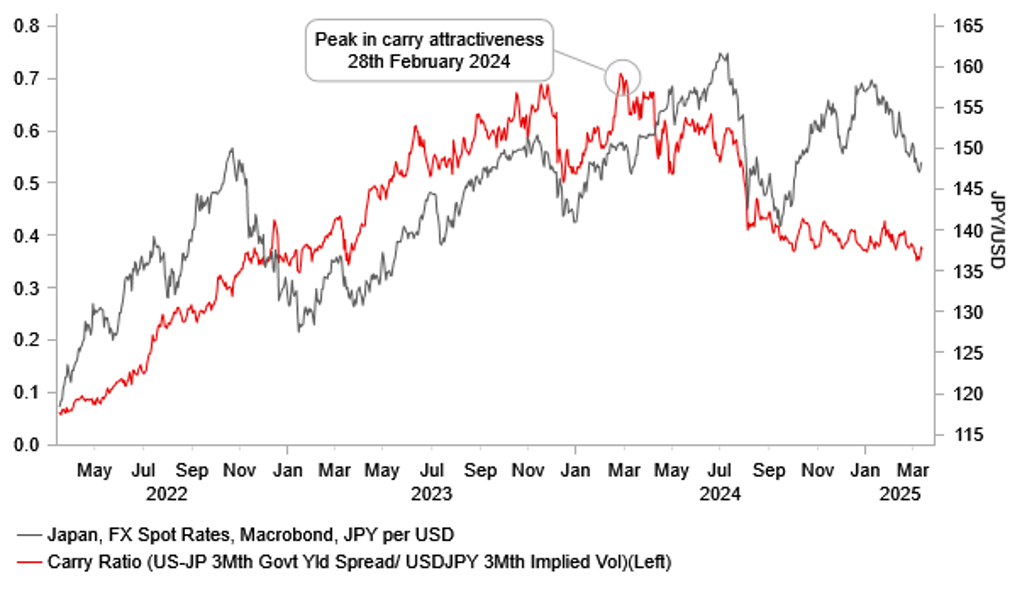

Still, US equity futures are down about 0.5% and we would expect risk appetite to remain fragile into the end of the week. That could well be to the benefit of JPY. JPY-crosses are all lower today with JGB yields higher. The JGB move was helped by news that one of Japan’s larger unions – UA Zensen – had agreed a 5.37% pay increase for workers. While down from the 5.91% level last year, it remains well above the long-term average and signals something similar on a national scale. 10-year US-JP yield spreads continue to signal JPY appreciation ahead with risk dynamics also reinforcing upside JPY risks.

VOLATILITY AND YIELD DYNAMICS CONTINUE TO POINT TO SCOPE FOR FURTHER USD/JPY DOWNSIDE SCOPE

Source: Bloomberg, Macrobond & MUFG GMR

CAD: BoC gives CAD a further lift

The Canadian dollar was the top performing G10 currency yesterday with the policy announcement and communication update ultimately helping to lift the currency. The 25bp cut was well telegraphed and fully priced so the 10bp intra-day jump in the 2yr swap rate was more down to the communications having a hawkish element. The guidance element of the statement – the last paragraph basically was what fuelled some paring of rate cut expectations. The BoC stated that “monetary policy cannot offset the impacts of a trade war” but then added “what it can and must do is ensure that higher prices do not lead to ongoing inflation”. The BoC would be “careful” in assessing the balance between downside risks to inflation from a weaker economy and upside risks stemming from rising costs.

This more nuanced interpretation is more reasonable from the standpoint of the BoC given how far along they are in easing the monetary stance. There is no need to appear in a panic given the potential level of the neutral rate is in sight. The cut yesterday was the seventh consecutive cut with a cumulative total easing of 225bps. Governor Macklem also confirmed that a discussion on cutting by 50bps did not take place. Prior to the cut today the OIS market was implying 13bps of cuts were priced for the April meeting, assuming a 25bp cut took place today. That pricing has shrunk slightly to 11bps while the end-year cumulative total of easing dropped by 6bps.

That’s not a particularly big adjustment and while CAD was the top G10 performer it advanced by a mere 0.4% versus USD. As we highlighted here yesterday, the Leveraged Funds’ positioning currently shows close to a record short CAD position in data going back to 2006 – so the market is certainly vulnerable to a squeeze although that positioning is a better explanation perhaps of the limited CAD depreciation from current levels given the scale of negative uncertainties.

In reality, tariff risks are untradeable. President Trump has already postponed twice the introduction of a 25% tariff on all imports from Canada and Mexico while how reciprocal tariffs would look is very unclear. In reality, if Trump proceeds with a 25% tariff a lot of those tariffs would be reversed under a true reciprocal tariff regime. But given the numerous factors Trump is using to set a reciprocal tariff, it is impossible to know what the end-game status would be. With Canada playing hard-ball with Trump (further retaliatory tariffs were announced yesterday – CAD 30bn of tariffs on US steel/aluminium-related goods imports to Canada) there are higher risks of more aggressive action. If action is taken by the US on 2nd April and that action holds, USD/CAD will trade higher toward levels closer to 1.5000 but investors may be reluctant to trade the macro impact until we start to see the actual impact anecdotally or in the official data.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Quarterly Unemployment Rate |

-- |

6.2% |

6.1% |

! |

|

EC |

09:50 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

Industrial Production (MoM) |

Jan |

0.5% |

-1.1% |

!! |

|

EC |

10:00 |

Industrial Production (YoY) |

Jan |

-0.9% |

-2.0% |

! |

|

US |

12:30 |

Initial Jobless Claims |

-- |

226K |

221K |

!! |

|

US |

12:30 |

Continuing Jobless Claims |

-- |

1,900K |

1,897K |

!! |

|

US |

12:30 |

PPI (MoM) |

Feb |

0.3% |

0.4% |

!!! |

|

US |

12:30 |

PPI (YoY) |

Feb |

3.3% |

3.5% |

!! |

|

US |

12:30 |

PPI ex. Food/Energy/Transport (YoY) |

Feb |

-- |

3.4% |

!! |

|

US |

12:30 |

PPI ex. Food/Energy/Transport (MoM) |

Feb |

-- |

0.3% |

!! |

|

US |

12:30 |

Core PPI (MoM) |

Feb |

0.3% |

0.3% |

!!! |

|

US |

12:30 |

Core PPI (YoY) |

Feb |

3.6% |

3.6% |

!!! |

|

CA |

12:30 |

Building Permits (MoM) |

Jan |

-5.3% |

11.0% |

!! |

Source: Bloomberg