SVB crisis knocks USD & Fed rate hike expectations

Lee Hardman

Senior currency Analyst

Global Markets Division for EMEA

T: +44 (0)20 7577 1968

MUFG Bank, Ltd.

A member of MUFG, a global financial group

USD: US authorities take decisive action to contain SVB crisis

The US dollar has continued to weaken sharply overnight following on from the sell-off at the end of last week that was primarily driven by the Silicon Valley Bank crisis. It has seen the dollar index fall to an intra-day low overnight of 103.68 as it moves further below last week’s high of 105.88. The traditional safe have currencies of the Swiss franc and yen have been the best performing G10 currencies since the US dollar put in place a peak last week followed by the pound and euro. After Silicon Valley Bank was closed by regulators at the end of last week, the US authorities have reacted quickly and forcefully over the weekend to prevent contagion and a wider loss of confidence in the banking system. The US regulators have since announced that Silicon Valley Bank depositors will be fully repaid and will have access to their money today as will those of Signature which was closed by the New York Department of Financial Services before being placed under FDIC control and marketed for sale. No losses stemming from the resolution of either SVB or Signature’s deposits would be borne by the taxpayer. Any shortfall would be funded by a levy on the rest of banking system. In contrast, shareholders and certain unsecured debtholders will not be protected. According to the FT, Signature was similar to SVB in that had a concentrated customer base, significant exposure to cryptocurrencies and technology companies and a high proportion of uninsured deposits.

The Fed has also announced a new lending facility providing extra funding to eligible institutions to ensure that “banks have the ability to meet the needs of all their depositors”. The “Bank Term Funding Program” will offer one-year money at an attractive rate of OIS +10bp. The new facility will take high quality collateral based on par value rather than market value which makes it much less likely that banks will run out collateral and be forced to sell bonds and thereby realize losses. The Fed has provided reassurance that the new facility will be enough to cover all uninsured US deposits, and is backstopped by the Treasury that has put up USD25billon to cover any potential losses. Together with the decision to fully repay depositors, the two measures should help to reduce the risk of a deposit run at other regional banks.

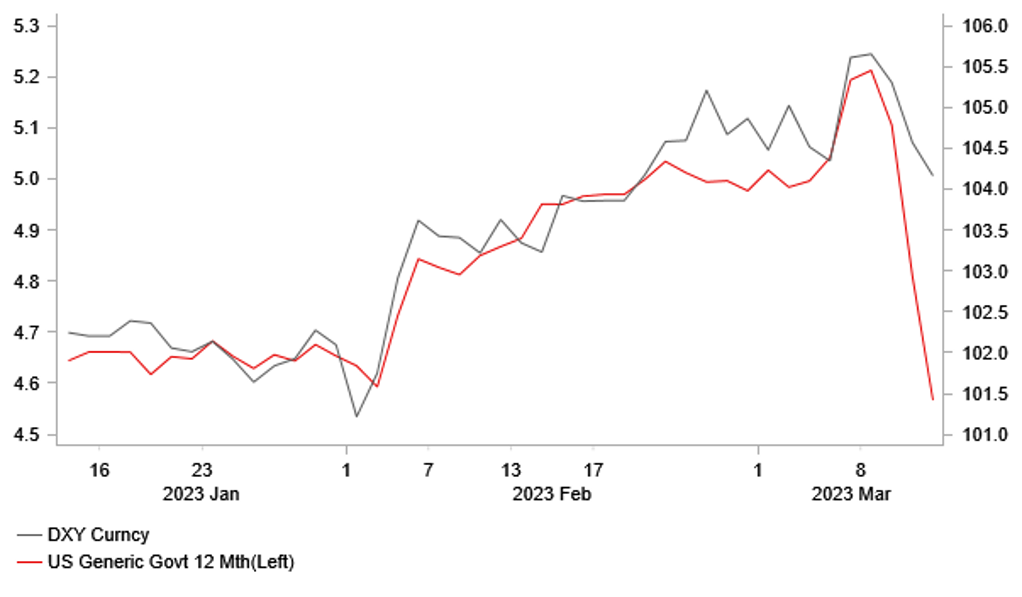

The Silicon Valley Bank crisis has taken the wind out the US dollar’s sails by highlighting risks associated with rising rates. The run on deposits forced SVB to realize losses on their securities portfolios that triggered a further loss of confidence in bank. It has made market participants more aware again that the Fed will eventually break something if it keeps raising rates. As a result, market participants now expect the Fed to be more cautious when they meet to set monetary policy at next week’s FOMC meeting on 22nd March. Prior to the FOMC meeting, market participants were speculating over whether the Fed will deliver another 25bps hike or switch back to a larger 50bps hike following the hawkish message from Fed Chair Powell in last week’s semi-annual testimony. The SVB crisis has triggered a quick reset in expectations with market participants now weighing up whether the Fed will deliver another 25bps hike or no hike at all. The US rate market is currently pricing in around 21bps of hikes for next week. A lot will depend upon whether the measures announced by the US authorities aimed at restoring confidence in the banking system prove effective in bringing back some relative stability in the week ahead.

We are continuing to stick to our call for another 25bps hike next week. The need for further monetary tightening by the Fed was backed up by the release of the latest NFP report on Friday that revealed that employment growth remains strong. There is little evidence yet that higher rates have triggered a sufficient slowdown in employment growth to satisfy the Fed that it has done enough. Employment growth even after stripping out the blow out employment readings of 500k+ in January and July of last year, has averaged 327k/month over the last twelve NFP reports. However, there was more encouraging evidence that people are continuing to return to the labour force in search of jobs which is helping to dampen upside risks to wages and ultimately inflation. The labour force participation rate increased for the third consecutive month in February while average hourly earnings (M/M) slowed for the third consecutive month. On balance we believe the latest labour market developments favour another 25bps hike rather than a larger 50bp hike. Market attention will now shift to the release of the latest US CPI report tomorrow. It would likely take a significant upside inflation surprise now to revitalize speculation over a larger 50bps hike at next week’s FOMC meeting and trigger a US dollar rebound.

Fed rate hike expectations have taken a dive

Source: Macrobond & Bloomberg

Source: Macrobond

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

14:00 |

CB Employment Trends Index |

Feb |

-- |

118.74 |

! |

|

UK |

18:05 |

BoE MPC Member Dhingra Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

14:00 |

CB Employment Trends Index |

Feb |

-- |

118.74 |

! |

|

UK |

18:05 |

BoE MPC Member Dhingra Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg