Middle East tensions provide timely test of USD’s safe haven appeal

USD: Heightened geopolitical tensions in Middle East trigger flight to safety

The main development overnight has been the decision by Israel to launch a wave of airstrikes against Iran’s nuclear program and ballistic-missile sites which represents a major escalation of geopolitical risks within the region. It initially triggered just over an 11% spike higher for the price of oil as Brent hit a high of USD78.50 before dropping back below USD75/barrel. It has reversed all of the losses for the price of oil since President Trump announced his “reciprocal” tariffs in early April. In the FX market the initial response has been a flight to safety which has benefitted the Swiss franc, yen and US dollar. The developments could provide a timely test of the US dollar’s traditional safe haven appeal after it hit fresh year to date lows yesterday prior to Israel’s military strikes. On the other hand the flare up in geopolitical tensions in the Middle East and heightened risk of an oil price shock has triggered a reversal lower for high yielding carry currencies such as the Hungarian forint, South African rand and Mexican peso which have benefitted recently from the reduction in financial market volatility. The more growth sensitive commodity currencies of the Australian and New Zealand dollars have been hit the hardest amongst G10 currencies.

Market participants will now be watching closely to see how the conflict develops and whether it will have an actual disruptive impact on global supply chains including importantly the supply of oil. Israel Prime Minister Netanyahu has already stated that the operation “will continue for as many days as it takes to remove this threat”, and that the opening strikes were “very successful”. He warned Israelis would need to prepare for retaliation and to spend long periods in shelters. In response, Iran’s Supreme Leader Ayatollah Ali Khamenei has warned that Israel will “pay a very heavy price” and should “expect a severe response from Iran’s armed forces”. According to Israel, Iran has already launched 100 drones in retaliation. The comments suggest that disruption is likely to continue in the near-term which will encourage investors to cut back on risk heading into the weekend.

US Secretary of state Marco Rubio has stated that the US was “not involved” in the strikes against Iran. Hours after the strikes, US President Trump stated that he was aware of Israel’s actions before they happened and that he hoped Iran would continue negotiating a nuclear deal. He told Fox News that “Iran cannot have a nuclear bomb and we are hoping to get back to the negotiating table”. The US and Iran were scheduled to meet for their next round of talks on Sunday in Oman but it is now unclear if those negotiations will proceed. The two sides have failed to reach an agreement at the start of Trump’s second term with Iran insisting it must retain the right to enrich uranium at least to a low level to fuel nuclear power plants. Iranian officials announced just yesterday that they inaugurate a new Iranium-enrichment facility. The International Atomic Energy Agency recently warned that Iran was not complying with its international obligations.

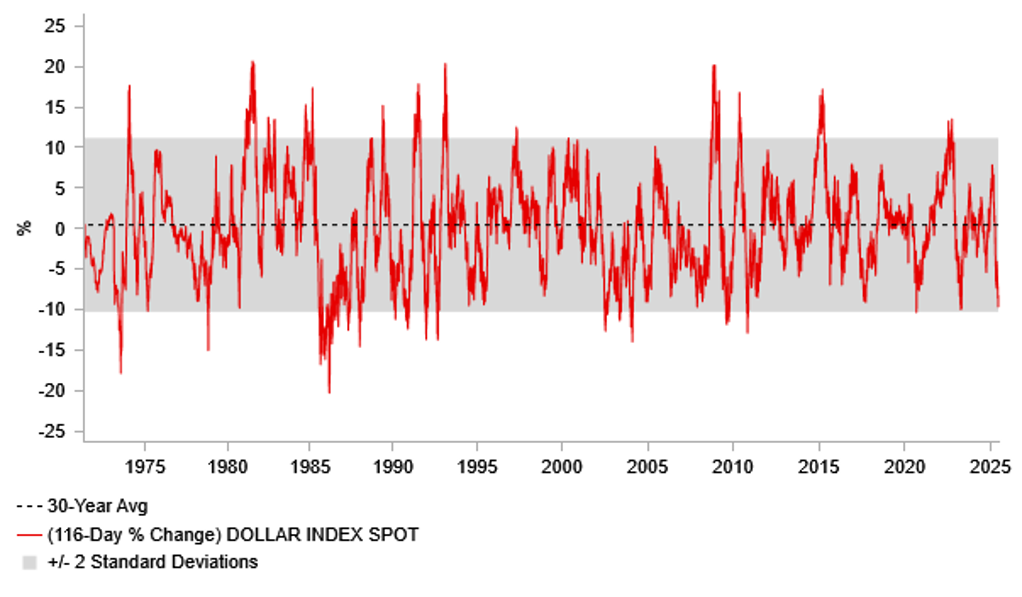

YEAR TO DATE USD SELL-OFF HAS BEEN EXTREME

Source: Bloomberg, Macrobond & MUFG GMR

USD: Softer US data contributes to USD hitting fresh year to date lows

Prior to the military strikes overnight in Iran, the US dollar had fallen to fresh year to date lows yesterday. The US dollar sell-off accelerated after it broke below support from the lows in April. As a result, the dollar index extended its year to date decline to almost 10%. The last time the dollar index weakened by almost 10% over a similar time period was between September 2022 and April 2023 which marked the start of the weakening trend. It has now fallen in total by almost 15% since the peak in late September 2022.

The latest US dollar sell-off was triggered both by key support levels breaking and the release of US economic data encouraging expectations for the Fed to resume rate cuts. the latest US CPI and PPI reports for May revealed that the disinflation trend remined in place in the first five months of this year even though tariffs are expected to filter through more to lifting inflation in the coming months. When combined the CPI and PPI reports indicate that the core PCE deflator has likely increased by just 0.1%M/M in May. It begs the questions of whether the Fed would now be in a position to resume rate cuts at the next FOMC meeting if President Trump had not made the economic outlook much more uncertain at the start of his second term. As a result, we still expect the Fed to be reluctant to cut rates at upcoming policy meetings in June or July until they have more clarity over US trade policy and impact on inflation and labour market. At the same time, the release yesterday of the latest weekly initial and continuing claims have added to concerns that the US labour market is continuing to soften in response to trade disruption and heightened policy uncertainty. Continuing claims rose to their highest level since November 2021 potentially marking a upward break out from the narrow range that has been in place over the past year although it would need to be backed up by further higher prints in coming weeks to strengthen the bearish signal for the US labour market.

The latest softer US inflation and labour market data has prompted President Trump to double down on his criticism of the Fed Chair Powell for his reluctance to cut rates sooner to support growth and bring down US debt costs. President Trump is now calling for a 2 percentage point rate cut up from his previous call for a 1 percentage point cut which he claims could save the US government USD600 billion per year. However, he did at least reiterate that “I’m not going to fire him” even though he doesn’t know why it would be so bad if he was fired. Instead President Trump has indicated that he could announce a successor for Chair Powell soon well ahead of his term ending in May 2026. Nominating a successor so far ahead of Chair Powell’s term ending could potentially undermine decision making by the Fed especially if the new nominee publicly begins to actively voice their own opinions on monetary policy before taking over. Bloomberg reported earlier this week that US Treasury Secretary Scott Bessent is a leading candidate to become the next Fed Chair.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CA |

08:30 |

Manufacturing Sales (MoM) |

Apr |

-2.1% |

-1.4% |

! |

|

US |

10:00 |

Michigan 1-Year Inflation Expectations |

Jun |

-- |

6.6% |

!! |

|

US |

10:00 |

Michigan 5-Year Inflation Expectations |

Jun |

-- |

4.2% |

!! |

|

US |

10:00 |

Michigan Consumer Sentiment |

Jun |

52.5 |

52.2 |

!! |

|

EC |

11:00 |

ECB's Elderson Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg & Investing.com