FOMC push-back – how strong will it be?

USD: CPI fails to trigger volatility ahead of FOMC

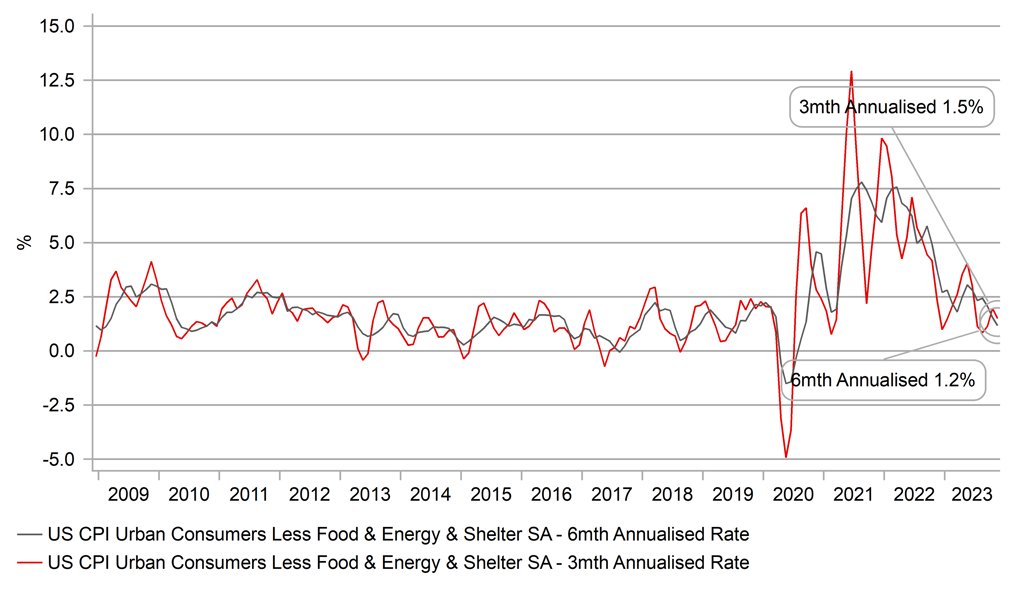

As the London trading day came to a close yesterday, the DXY index was down a mere 0.2%; the 2-year UST bond yield was around unchanged on the day and the 10-year yield was 1bp lower – evidence of a very subdued financial market reaction to the US CPI data for November. It was in sharp contrast to the big move weaker for the dollar and yields that followed the CPI print for October in November. The muted market reaction may also have reflected some reduced risk taking ahead of the key event of the week – the FOMC meeting this evening. The CPI data itself, was broadly in line with expectations and certainly did nothing to question the growing confidence that inflation will continue to subside. While the headline MoM rate was marginally stronger, the rest of the data was as expected. Some of the details still point to further disinflation ahead. Rents remain sticky and indeed, the rent of shelter MoM rate picked up from 0.3% to 0.5%. With actual rents a lot slower, we should see this component show disinflation going forward. Outside of shelter, core CPI is now running much lower on a 3mth and 6mth annualised basis which does point to more broad-based disinflation being captured in annual CPI going forward. Bar some external inflation shock, the outlook for inflation remains positive for 2024.

That should certainly be acknowledged tonight be Fed Chair Powell at the last FOMC meeting of the year. While Powell may have an incentive to talk tough (keep financial conditions from loosening further) he also must acknowledge reality. PCE inflation at 2.5% next year could get lowered in the Summary of Economic Projections along with the GDP estimate of 1.5%. Lower growth and inflation projections and possibly a higher unemployment rate all point to the possibility of an additional rate cut shown in the dots profile for 2024. That’s a close call however given the FOMC has hiked 25bps less than was assumed in September and hence by maintaining the two rate cuts from September will leave the implied fed funds are 25bps lower than in September. To add a third cut would take the fed funds projection to 4.63%, which is still higher than the 4.30% priced into the Dec 2024 fed funds future.

It’s a close call, but the individual FOMC members may have erred on the side of caution in setting their projections that could see the dots profile keep 50bps of cuts for 2024 rather than add a third cut. That would certainly help Powell in his expected efforts to push-back on the 100bps of rate cuts priced by the market. That could add some renewed upward momentum to yields and prompt another bout of dollar strength.

US CORE CPI, EX-SEHLTER ON 3MTH AND 6MTH ANNUALISED BASIS NOW RUNNING WELL BELOW 2.0%

Source: Macrobond

NZD: But inflation will be falling everywhere

While the US and Fed policy gets most attention and the extent of Fed rate cuts expectations will be important for the dollar, an impediment of US dollar depreciation is the fact that weak global growth means other central banks may not be far behind. EUR risks are certainly more skewed to the downside given the speed of inflation decline in the euro-zone may allow the ECB to begin cutting rates before the Fed and cut by at least as much as the Fed.

The New Zealand dollar is the big underperformer in G10 today with increased expectations that inflation will come down more notably than previously assumed and by more than the RBNZ forecasts. Disinflation is emerging in numerous different places and for the global growth sensitive high-beta currencies this spells potentially bad news. On a month-to-date basis, NOK and NZD are the two worst performing G10 currencies. Q4-to-date shows NOK, CAD, NZD and AUD as the four worst performing G10 currencies.

The Bloomberg Commodity Index has plunged so far this month, by 5.7%, and today has hit the lowest level since December 2021. Brent crude oil is now down 24% in Q4 to date. The commodity market moves certainly do not point to increased optimism for growth as inflation falls and tightening cycles end. If growth expectations deteriorate then the central banks that were most aggressive in tightening could be where expectations of more aggressive cuts emerge. The RBNZ was the most aggressive central bank, along with the Fed, lifting the policy rate by 525bps and has the highest policy rate in G10 at 5.50%. Intensifying disinflation globally will increase fears that the RBNZ overtightened.

There was further bad news for the higher beta G10 currencies today with China’s Annual Economic Work Conference disappointing markets given there was no indication of any particular focus on strong stimulus support which has dented China growth expectations. China equity indices are all underperforming today. These developments have reinforced our view that the US dollar will remain strong in H1 2024 given the global growth backdrop even as the Fed begins to ease its monetary stance.

BLOOMBERG COMMODITY INDEX HAS FALLEN SHARPLY SO FAR IN DECEMBER HIGHLIGHTING GLOBAL GROWTH FEARS

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CH |

08:00 |

M2 Money Stock (YoY) |

-- |

10.1% |

10.3% |

! |

|

CH |

08:00 |

New Loans |

-- |

1,300.0B |

738.4B |

!! |

|

CH |

08:00 |

Outstanding Loan Growth (YoY) |

-- |

11.0% |

10.9% |

! |

|

CH |

08:00 |

Chinese Total Social Financing |

-- |

2,600.0B |

1,850.0B |

! |

|

IT |

09:00 |

Italian Quarterly Unemployment Rate |

-- |

7.6% |

7.6% |

! |

|

EC |

10:00 |

Industrial Production (YoY) |

Oct |

-4.6% |

-6.9% |

! |

|

EC |

10:00 |

Industrial Production (MoM) |

Oct |

-0.3% |

-1.1% |

!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

2.8% |

! |

|

US |

12:00 |

OPEC Monthly Report |

-- |

-- |

-- |

!! |

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

-- |

-- |

0.1% |

!! |

|

US |

13:30 |

Core PPI (MoM) |

Nov |

0.2% |

0.0% |

!! |

|

US |

13:30 |

Core PPI (YoY) |

Nov |

2.2% |

2.4% |

! |

|

US |

13:30 |

PPI (YoY) |

Nov |

1.0% |

1.3% |

! |

|

US |

13:30 |

PPI ex. Food/Energy/Transport (MoM) |

Nov |

-- |

0.1% |

! |

|

US |

13:30 |

PPI (MoM) |

Nov |

0.1% |

-0.5% |

!!! |

|

US |

13:30 |

PPI ex. Food/Energy/Transport (YoY) |

Nov |

-- |

2.9% |

! |

|

US |

19:00 |

FOMC Economic Projections |

-- |

-- |

-- |

!!!!! |

|

US |

19:00 |

FOMC Statement |

-- |

-- |

-- |

!!!!! |

|

US |

19:00 |

Fed Interest Rate Decision |

-- |

5.50% |

5.50% |

!!!! |

|

US |

19:30 |

FOMC Press Conference |

-- |

-- |

-- |

!!!!! |

Source: Bloomberg