USD resumes sell-off after US CPI report

USD: Downside risks from Trump administration back in focus after CPI report

The US dollar has continued to trade at weaker levels overnight following yesterday’s sell-off that resulted in the dollar index dropping back towards recent support at close to the 98.000-level. The initial trigger for a weaker US dollar was the release yesterday of the much anticipated US CPI report for July. Headline (+0.2%M/M) and core (+0.3%M/M) inflation were both in line with consensus expectations helping to dampen concerns over upside risks to the US inflation outlook from tariffs. The lack of upside inflation surprise has given market participants more confidence that the Fed will focus more on the slowdown in employment growth when they next meet in September, and resume cutting rates. The US rate market is now almost fully pricing in a 25bps rate cut by September and around 60bps of rate cuts in total by year end.

After the US CPI report was released yesterday it didn’t take long for President Trump to criticize Fed Chair Powell on Truth Social over his failure to cut rates this year. He posted that “Jerome “Too Late” Powell must NOW lower the rate”, and went on to add that he is considering allowing a major lawsuit against Powell to proceed because of the incompetent job he has done in managing the construction of the Fed buildings. It provides another worrying indication that President Trump continues to flirt with the idea of firing Fed Chair Powell. At the same time, US Treasury Secretary Scott Bessent stated in an interview with Fox Business News that “the real thing now to think about is should we get a 50bps cut in September” while noting that the Fed “could have been cutting in June and July”. He added that he was hopeful that Stephen Miran will have been approved by the Senate in time to take his position on the board of governors by the September FOMC meeting which he expects to “change the composition of the Fed”. Stephen Miran stated yesterday that he was “very happy to see inflation is well behaved” following yesterday US CPI report and sees “no evidence of inflation at the “aggregate level” and of tariff induced inflation.

Stephen Miran’s view that the inflation risks from tariffs are overstated was supported by yesterday’s CPI report. The pass-through from tariffs to consumer prices eased in July. Core goods prices after excluding autos increased by 0.2%M/M in July down from an increase of +0.5%M/M in June. In contrast, core services inflation surprised to the upside increasing by 0.4%M/M. It was driven by an outsized 4.0%M/M rebound in airline fares and another strong increase in medical care services. On the plus side, the cost of shelter continued to ease. The report has encouraged expectations that the Fed’s preferred measure of core inflation, the core PCE deflator will increase by around 0.3%M/M when it is released later this month.

Yesterday’s US dollar sell-off was reinforced by comments from E.J. Antoni who President Trump plans to nominate to be the next BLS Commissioner after he fired Erika McEntarfer following the weak nonfarm payrolls report for July. Bloomberg reported comments from a Fox News interview with E.J. Antoni in which he stated that “the BLS should suspend issuing the monthly job reports but keep publishing the more accurate, though less timely, quarterly data”. The comments have added to concerns that political interference could lead to a loss of trust/confidence in US economic data. The WSJ has since reported according to a White House official that the interview was conducted earlier this week before he knew he was going to be chosen as BLS commissioner, and his comments don’t represent official BLS policy. Taylor Rogers, a White House spokeswoman stated that Antoni will “prioritize increasing survey response rates and modernizing data collection methods to improve the BLS’s accuracy”. In a series of closed-door discussions in recent days, White House aides and Labor Department officials have reportedly weighed new options for data collection as well as new technologies that could make the process more efficient. White House aides have emphasized that the one goal is to improve response rates to the BLS surveys which have fallen rapidly to below 70% according to the WSJ.

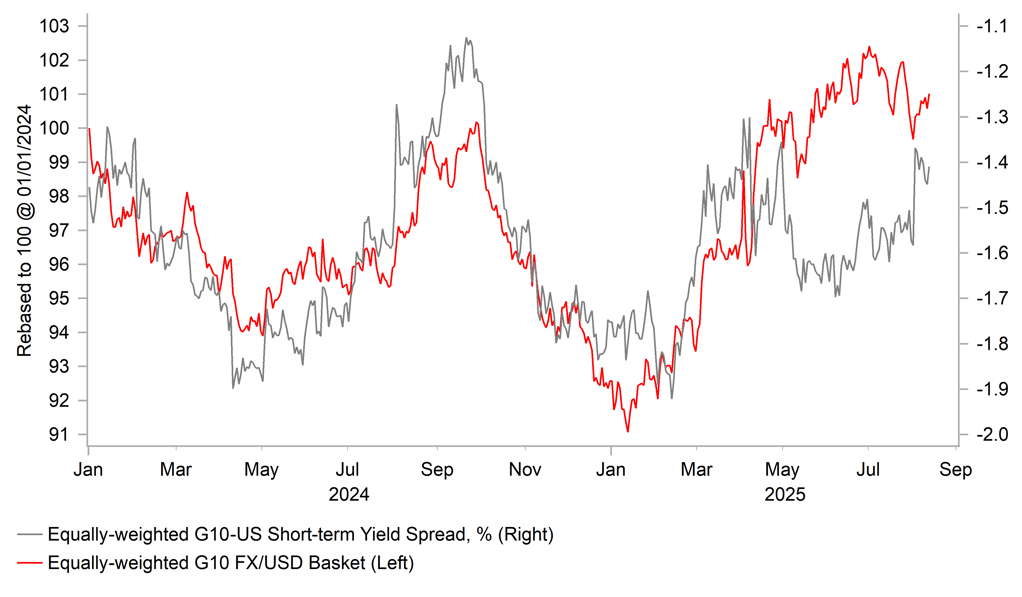

Ongoing uncertainty over a dovish shift in the make-up of the Fed board and Chair alongside fresh uncertainty over potential political interference in US economic data is encouraging market participants to maintain a higher risk premium priced into the US dollar despite the recent easing of US trade policy uncertainty. Yesterday’s US CPI report also left the door open for the Fed to resume rate cuts next month contributing to a weaker US dollar in the near-term. Carry currencies have been one of the main beneficiaries as they continue to benefit from the ongoing decline in financial market volatility. FX market volatility measures have fallen to their lowest levels in over a year.

USD RISK PREMIUM HAS NARROWED BUT OFFSET BY BUILDING FED RATE CUT EXPECTATIONS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

13:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

18:30 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

CA |

18:30 |

BOC Summary of Deliberations |

-- |

-- |

-- |

! |

Source: Bloomberg & Investing.com