A setback for the USD after eight consecutive weeks of gains

USD: Pushback from China & Japan triggers correction lower for USD

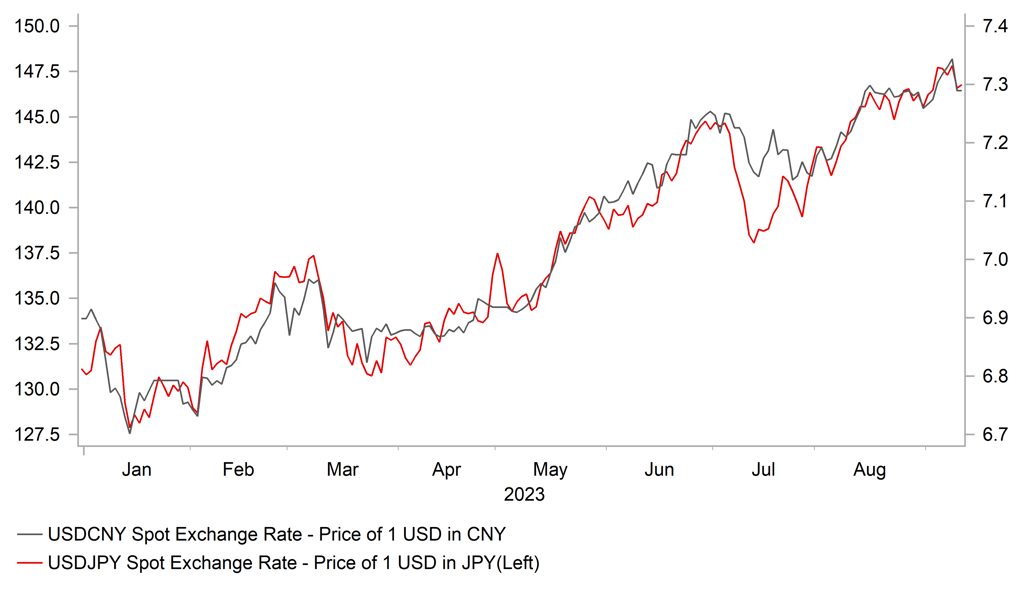

The foreign exchange market has stabilized after verbal intervention from China and Japan at the start of the week helped to support their currencies and triggered a broader correction lower for the US dollar. It has resulted in the dollar index dropping back towards the 104.00-level as it moved further below last week’s high of 105.16. As we highlighted in yesterdays FX Daily Snapshot report (click here), the comments from BoJ Governor Ueda which talked up the possibility of tightening policy through raising interest rates if conditions were judged to be met by the end of this year have helped to provide more support for the yen in the near-term. USD/JPY initially fell to an intra-day low yesterday of 145.91 but has since reversed around half of those gains rising back up to around 146.70. At the same time, the BoJ has allowed the 10-year JGB yield to rise above 0.7% after it had stabilized over the summer at around 0.65%. With the new YCC cap set at 1.00%, there is room for the BoJ to allow long-term yields to keep adjusting higher in an attempt to provide more support for the yen as well. The developments add to comments last week from Japan’s top currency official that have raised the risk of intervention to the highest level. The latest developments clearly signal that Japanese officials are significantly concerned by yen weakness and should at least help to slow the pace of further yen weakness in the near-term, although we are not yet convinced that fundamentals support a sustained rebound for the yen from deeply undervalued levels.

At the same time, the PBoC delivered a strongly worded statement yesterday in support of the renminbi after USD/CNY rose last week to its highest level since 2007. It has resulted in USD/CNY dropping back below the 7.3000-level at the start of this week after hitting a high of 7.3503 at the end of last week. In the statement, the PBoC warned those speculating in anticipation of a weaker renminbi that “we are capable and feel confident…in keeping the renminbi exchange rate at a reasonably stable level. We will act when we act, resolutely correcting one-sided appreciation.” With the China officially holding FX reserves of just over USD3 trillion, and the state banks reportedly having a USD1 trillion balance sheet, policymakers have the firepower to support the renminbi if they desire. However, it will require an improvement in investor sentiment towards China’s economy to create foundations for a more sustained rebound for the renminbi and/or fall in US yields as the Fed moves closer to cutting rates to bring down USD/CNY.

PERFORMANCES OF USD/CNY & USD/JPY HAVE BEEN TIGHTLY LINKED

Source: Bloomberg, Macrobond & MUFG Research calculations

EM FX: Rate cuts are hurting CEE-3 FX

It has been another difficult week for EM FX. The USD has extended it advance for the eighth consecutive week against other major currencies and it is continuing to place downward pressure on EM FX. Our equally-weighted EM FX index remains close to year to date lows against the USD. Over the past week, the best performing EM currencies have been the COP (+1.6% vs. USD), ZAR (+0.9%) and RUB (+0.8%). In contrast, the worst performing EM currencies have been the PLN (-4.1% vs. USD), CLP (-3.8%), and CZK (-2.2%).

The CLP and PLN have been hit the hardest driven in part by more aggressive monetary easing from domestic central banks, The Central Bank of Chile delivered a 75bps cut last week that has brought cumulative rate cuts to 175bps since late July. The Central Bank of Chile has had room to cut rates after the annual rate of headline inflation has fallen sharply from a peak of 14.1% in August of last year to a fresh low of 5.3% in August. It still leaves the real policy rate at just over 4.0% after adjusting for inflation.

The National Bank of Poland has since followed by delivering a larger than expected 75bps cut last week. It has triggered a sharp sell-off for the PLN resulting in EUR/PLN moving back above the 4.6000-level for the first time since April. It marks an abrupt turnaround for EUR/PLN after it had been threatening to break below the 4.4000-level heading into the summer. The negative initial market reaction highlights that market participants are not convinced that the improvement in the inflation outlook in Poland justified such a large rate cut. The annual rate of headline inflation has fallen sharply from a peak of 18.4% in February but remains well above target at 10.1% in August. It has resulted in the real policy falling further into negative territory at just over 4.0% after adjusting for inflation. The proximity of elections next month (15th October) in Poland in which the ruling Law and Justice party are facing a bigger challenge to remain in power has fuelled speculation as well that the larger rate cut was politically motivated.

The larger rate cut in Poland has had negative spill-overs for the CZK with the CNB expected to begin their own rate cut cycle later this month (27th September). EUR/CZK has already extended its advance back above the 24.500-level for the first time since November of last year. The direction of the price action is in line with our forecast for Central European currencies to weaken although the pace of the adjustment lower is happening quicker than we had anticipated. Please see our latest EM EMEA Weekly for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

German ZEW Current Conditions |

Sep |

-75.0 |

-71.3 |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

Aug |

91.6 |

91.9 |

! |

|

UK |

12:00 |

NIESR GDP Estimate |

-- |

-- |

0.3% |

!! |

|

GE |

13:45 |

German Current Account Balance n.s.a |

-- |

-- |

29.6B |

! |

Source: Bloomberg