USD continues to trade close to bottom of recent range

USD: Benign US inflation data leaves door open for Fed to resume rate cuts

The US dollar has continued to trade at weaker levels following the release yesterday of the US CPI report for August which has further helped to dampen concerns over upside risks to the inflation outlook in the near-term. The dollar index initially weakened by around -0.6% when the US CPI report was released falling back towards recent lows close to 97.500. In contrast, the yield on the 2-year US Treasury initially fell by around 8bps but has since reversed most of that move and currently stands only 2bps lower. The price action in the US rate market highlights that market participants had already moved along way recently to price in more active Fed easing. The US rate market is almost fully priced for the Fed to deliver 25bps rate cuts at all three remaining FOMC meetings this year, and for the policy rate to fall back towards the Fed’s estimate of the neutral rate next year at just below 3.00%. However, market participants remain reluctant to price in larger 50bps rate cuts from the Fed. There is still only 27bps of cuts priced in for this month’s FOMC meeting. The current pricing provides a higher hurdle for short-term US rates to keep moving lower in the near-term unless the Fed surprises market participants by communicating that it is seriously considering delivering larger 50bps cuts.

The releases of the US PPI and CPI reports for August this week will have given the Fed the green light to resume rate cuts this month in response to the weaker labour market. After yesterday’s US CPI report was released, forecasts for the Fed’s preferred measure of inflation, the core PCE deflator for August have been revised down from around 0.3%-0.4%M/M to a more modest print of +0.2%M/M which would bring the six-month annualized rate to 2.4%. The report suggests that that pass through to higher consumer prices from tariff hikes could be more gradual than widely anticipated. Core goods inflation remained firm up +0.3%M/M driven by a 1.0% M/M increase in used vehicle prices, but was softer than expected. Core services inflation increased by 0.4%M/M but by 0.3%M/M after excluding rents.

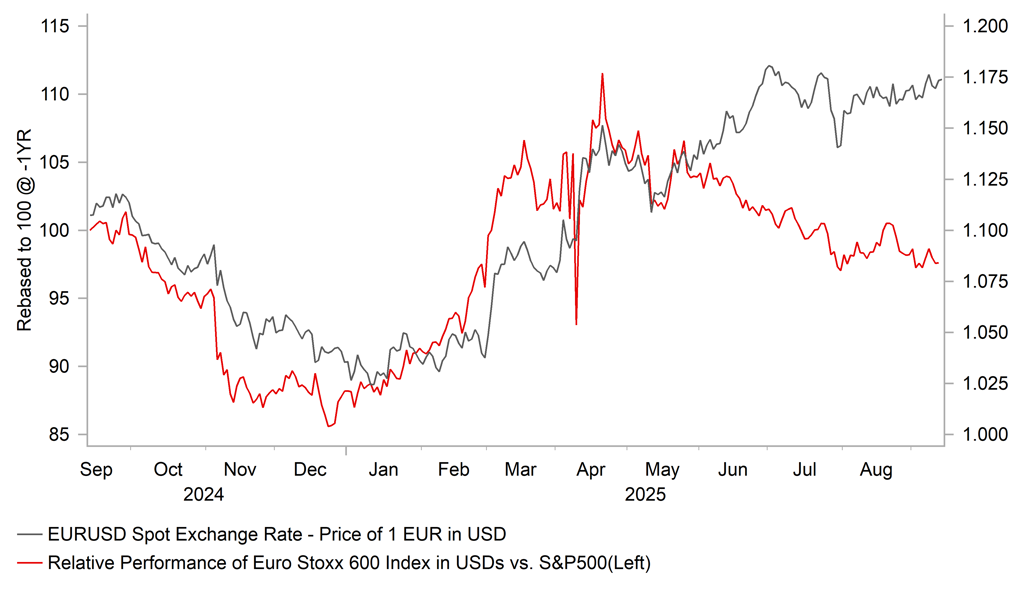

EUR/USD VS. RELATIVE EZ/US EQUITY MARKET PERFORMANCE

Source: Bloomberg, Macrobond & MUFG GMR

EUR/GBP: Hawkish comments from President Lagarde provide support

The euro initially weakened yesterday when the ECB released the policy statement from their latest meeting including the updated ECB staff forecasts. However, the sell-off proved to be short-lived as the euro rebounded on the back of the release of the softer US CPI report and more hawkish comments from President Lagarde in the press conference. As expected the forecasts for euro-zone growth (by 0.3ppt to 1.2%) and inflation (by 0.1ppt to 2.1%) for this year were revised up. However, the dovish surprises were that the forecasts for growth next year (by -0.1ppt to 1.0%) and inflation (by -0.1ppt to 1.9%) in 2027 were both revised lower. While they were only small revisions it did initially indicate less confidence in meeting the ECB’s inflation target.

However, the hawkish comments from President Lagarde quickly offset the impact from the updated ECB staff forecasts. President Lagarde stated clearly that she thinks the “disinflationary process is over”, and that officials did not want to “over-engineer” on policy. It sends a signal that there is now a higher hurdle for the ECB to cut rates and indicates they are willing to tolerate a temporary and modest inflation undershoot without over-reacting and cutting rates if not necessary. The euro-zone rate market had already moved along way recently to price out further ECB easing, and is currently pricing in only 10bps of cuts by the middle of next year. It helps to explain why the 2-year euro-zone government bond yield has only increased by around 2-3bps in response to yesterday’s ECB policy update. We continue to believe that the widening policy divergence opening up between the ECB and Fed heading into year end will help to lift EUR/USD up towards the 1.2000-level although the pair is currently struggling to break out of the recent trading range between 1.1500 and 1.1800.

The other main development in Europe has been the release of the latest monthly UK GDP report this morning. The report revealed that economic activity was flat in July indicating a loss of growth momentum after stronger growth in 1H of this year. It follows an increase of 0.4% in June. The BoE is currently forecasting GDP growth of +0.3% in Q3 after the UK economy expanded average by +0.5% Q/Q in the 1H of this year. The report is not weak enough to lift EUR/GBP out the current trading range between 0.8600 and 0.8700.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

12:15 |

NIESR Monthly GDP Tracker |

Aug |

-- |

0.2% |

!! |

|

US |

15:00 |

Michigan Consumer Sentiment |

Sep |

58.2 |

58.2 |

!! |

Source: Bloomberg & Investing.com