US-China “trade deal” struck in Geneva lifts confidence further

USD: US-China set to ease tariffs helping US dollar

The US dollar is stronger at the start of the new week following positive comments yesterday from US Treasury Secretary Scott Bessent and trade representative Jamieson Greer that point to an imminent de-escalation in trade tariff tensions. The White House released the comments made under the heading “US announces China Trade Deal in Geneva” although Bessent spoke of “substantial progress” rather than a deal. Greer cited that the “deal we struck” will help “us work toward resolving that national emergency”. So the deal struck likely is a stepping strong toward negotiations with a probability of lower tariff rates being announced this morning that will allow for further negotiations to take place. An announcement in Geneva is expected this morning at 9am Geneva time. This initial deal to be detailed this morning may include purchase commitments by China and steps to strengthen coordination on the control of fentanyl coming into the US. The larger the number of trade-specific commitments made over the weekend the greater the positive sentiment should be over the short-term which should mean a further extension of risk appetite.

Asian equities are higher across the board with the S&P 500 future 1.5% higher. We would expect more of what we are seeing so far this morning – the US dollar to advance versus core G10 currencies like JPY, CHF and EUR but to underperform the high-beta commodity currencies like AUD, NZD and NOK. Comments made by both the US side and the Chinese side suggest a concerted effort to show mutual respect something the Chinese had insisted on in the aftermath of the start of the trade tensions even before the 2nd April announcements.

But as we have stated before, there will still likely be limits to the FX moves now taking place. The yen underperformance is understandable given the outperformance during the trade escalation period but the dynamics in the yen market continue to shift, favouring the yen over the medium-term. It is notable today that the 30-year JGB yield has advanced to the highest level in 25yrs at just under 3.00%. With hedging costs still relatively high for covering USD exposure, there are increasing incentives for more investments to remain in Japan.

The additional issue for the US dollar centres around what damage has already been done. In that regard, the extent of de-escalation will of course be important and an indication of how quickly and urgently the US and China will move to further more detailed negotiations. With President Trump there will always be a high degree of caution in interpreting the details of deals done. We would expect investor caution to limit the extent of risk taking after today’s announcement.

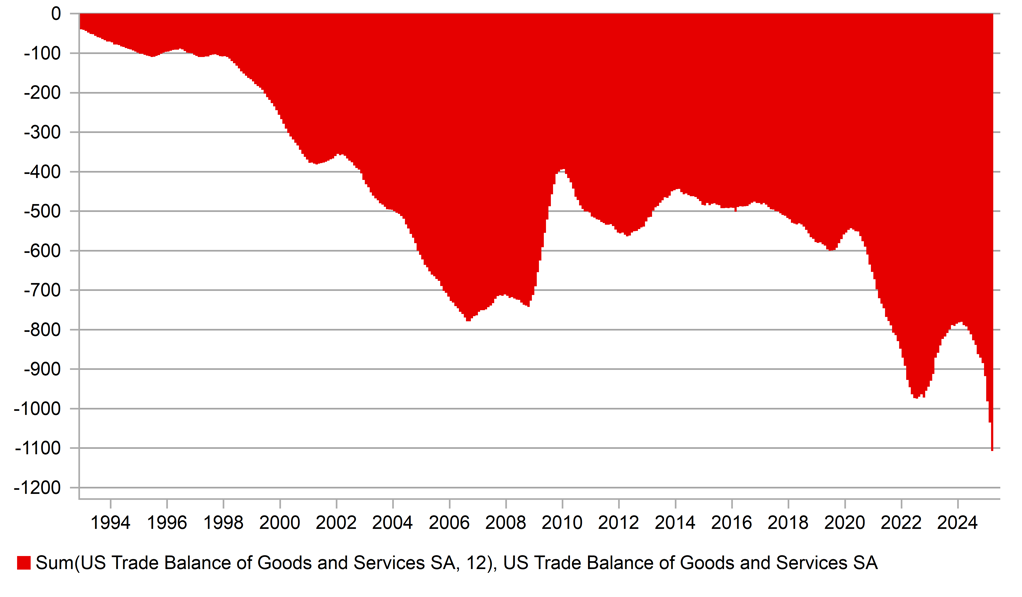

US ROLLING 12MTH TRADE DEFICIT HITS ANOTHER RECORD usd 1.1TRN

Source: Bloomberg, Macrobond & MUFG GMR

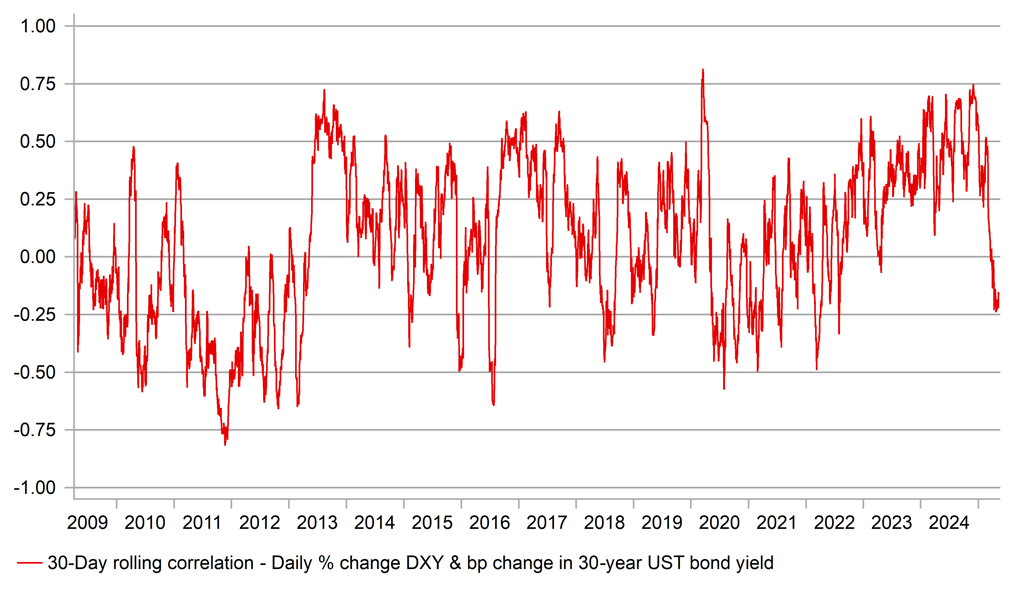

USD: CPI in focus after yields rebound

The news of substantial progress in US-China trade negotiations with some kind of deal reached has given the financial market participants further reason for increasing risk that will likely further support yields this week. The reaction in FX to yields has been negative of late with the 30-year UST bond yield negatively correlated with the US dollar. Often that negative correlation is a sign of the US dollar’s safe-haven status when yields fall and the dollar rise due to safe-haven flows. The period following the GFC and following covid are obvious examples in the chart above. But on this occasion it does not reflect that as it is due to US dollar weakness and higher yields. If this deal to be announced later today is more substantial than expected, then there is a chance that we could see this correlation revert back into positive territory. Growth concerns will at least over the short-term ease and that should help bring back ’US exceptionalism’ optimism and provide some support for the dollar.

This week will be important data-wise given the CPI data for April will be released tomorrow. Inflation data in February and March have been encouraging and showed a marked slowdown but the consensus for tomorrow is for both the headline and core m/m readings will accelerate to 0.3%. That won’t be too concerning from an annual rate of change perspective given in April 2024 there were also 0.3% increases. But the details will be important for investors in observing whether the tariff rates announced but then postponed plus the sector-specific tariffs are already having an impact. Throughout most of April the US had tariffs of 145% of China imports and 10% on the rest of the world and then sector-specific tariffs on autos, steel and aluminium. While it might be too soon to see the direct impact of tariffs, the indirect uncertainty and disruption may have fuelled expectations of shortages to come that may have lifted demand and hence prices.

A sharper increase in CPI tomorrow could lift UST bond yields further although depending on what has been agreed in Geneva between the US and China, the negative reaction to a strong CPI report will certainly be diluted. We now of course have to be mindful of some improved sentiment if investors believe we are about to see a rapid reversal of these elevated tariff rates which should help the dollar to advance further over the short-term. We still believe there are risks through the damage already been done to some extent, and it also at this stage seems unlikely that tariffs will not continue to be used as a threat. We believe the world order is shifting and geo-economics is likely here to stay. Ultimately, if that is true, the scope for a sustained rally of the dollar remains limited.

30YR UST YIELD MOVES CORRELATING NEGATIVELY ON A 30-DAY PERIOD WITH THE US DOLLAR

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

09:00 |

BoE's Lombardelli speaks |

!! |

|||

|

UK |

11:30 |

BoE's Greene speaks |

!! |

|||

|

UK |

13:50 |

BoE's Mann speaks |

!!! |

|||

|

US |

15:25 |

Fed's Kugler speaks |

!! |

|||

|

UK |

17:00 |

BoE's Taylor speaks |

!! |

|||

|

US |

19:00 |

Federal Budget Balance |

Apr |

$256bn |

$160.5bn |

!! |

Source: Bloomberg & Investing.com