Contained FX moves as tariffs go live in a backdrop of high uncertainty

USD: Trade uncertainty versus peace hope

The US dollar has advanced by about 0.4% from the lows late in US trading yesterday after tariff escalation fears receded somewhat after President Trump reversed his earlier announcement to double Canada’s steel and aluminium tariff from 25% to 50%. This followed “constructive” talks between Canada and Howard Lutnick. But the broader 25% tariff has gone live – this also looks like it will hold unlike the Canada and Mexico tariffs of 25% on all goods that have been reversed twice and are now scheduled for 2nd April. So the steel and aluminium tariffs are likely to be the first act on all US trading partners and the first actions taken beyond China that are likely to stay. So escalation is more real now and points to probable action by the US on 2nd April which looks like the date when we could get a real significant uplift in the escalation of the trade conflict. Retaliation from Europe has been swift and EU Commission President Ursla von der Leyen has just spoken in Brussels to confirm that the EU has implemented tariffs on EUR 26bn worth of US exports into the EU and the tariffs are scheduled to go live on 13th April. The US action also includes a wider array of goods that includes steel and aluminium in their content and Reuters has cited 289 downstream products as being hit by the tariffs with a value of USD 150bn. Car, truck, bus and tractor parts is the sector that will be most impacted. Canada and Mexico will be the countries impacted most by the actions. It’s important to note that this action with such a large downstream impact is very different in scale than the tariffs in 2018.

The FX impact, which has been USD negative of course of late, has been muted following comments from President Trump dismissing the risks to the US economy and expressing confidence that there will be no recession. But those words are unlikely to have much lasting impact and uncertainty will remain very high especially into the 2nd April. While we understand the broader dollar performance is being negatively hit by the scale of uncertainty as the US economy shows signs of weakness, we would still have expected CAD and MXN to have been trading at weaker levels. More broadly, the dollar will likely be dictated by evidence on real economic conditions which will likely highlight the negative impact of uncertainty on US companies and households.

The impact in Europe will have been diluted by the potential progress toward a ceasefire in Ukraine. An offer agreed between Ukraine and the US is with Russia and if agreed would result in a 30-day ceasefire, presumably for more meaningful dialogue to take place. However, the energy impact is however limited with modest moves in TTF while crude oil prices are modestly higher after the IEA reduced notably its previously estimate of excess supply of crude this year and next.

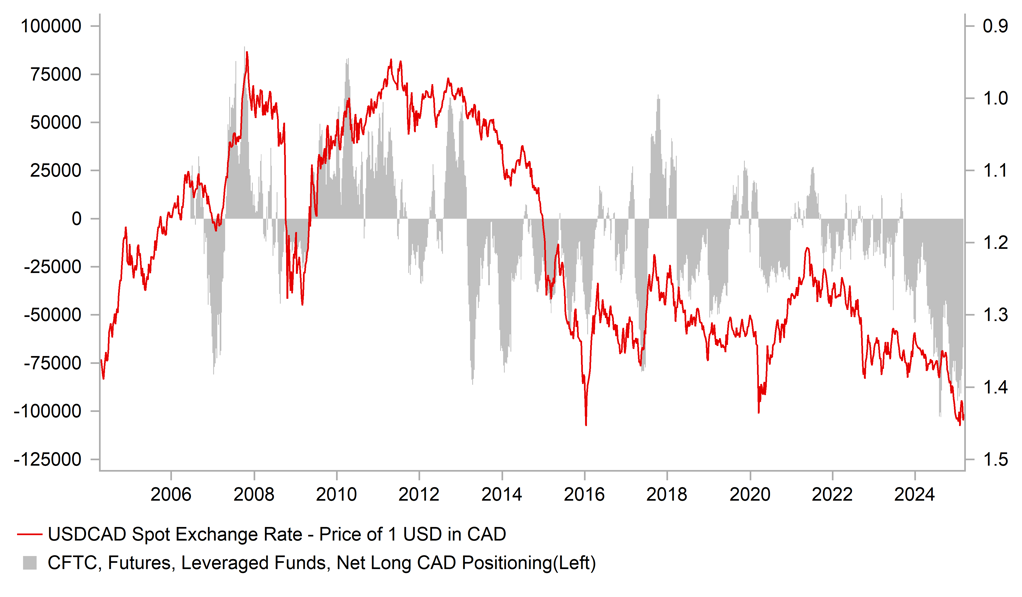

RECORD CAD SHORTS BY LEVERAGED FUNDS MAY BE LIMITING CAD DEPRECIATION AHEAD OF EXPECTED 25BP BOC CUT TODAY

Source: Bloomberg, Macrobond & MUFG GMR

GBP: UK working hard to avoid steel tariffs

The 25% steel and aluminium tariffs have hit the UK too today but the UK government is reportedly working hard to receive a carve-out from the tariff action. UK Business and Trade Secretary Jonathan Reynolds held a call with Commerce Secretary Howard Lutnick on Sunday about a possible carve-out and PM Starmer brought up the subject when he met President Trump last month. Chancellor Reeves on Monday also expressed confidence that a deal could be done with the US for the UK to receive an exception. The crux of the argument continues to be that the UK and US run goods trade that is broadly balanced. This may be the case but the UK government is probably more focused on the optics of a carve-out rather than the specific economic impact from these tariffs on the UK economy.

According to UK Steel, in GBP terms, the UK exported GBP 380mn worth of steel to the US in 2023, that down from GBP 490mn in 2017 before the first round of tariffs that hit in 2018. During the tariff period 2018-21 exports slowed to an average of GBP 320mn and under an agreed quota system, exports picked up and in 2023 totalled GBP 388mn. Total goods exports in 2023 totalled GBP 395bn, so from a total UK export perspective these steel exports are very small although it would still have a greater specific impact on the UK steel industry.

If the government was to receive a carve-out it would reinforce the prospect of the US treating the UK differently to other countries with the strongest argument being that UK-US trade is roughly balanced. It certainly looks likely that the UK, unlike the EU, will refrain from retaliation. Chancellor Reeves has indicated before that that would not be the approach given the negative impact on the UK and further dialogue would be most likely.

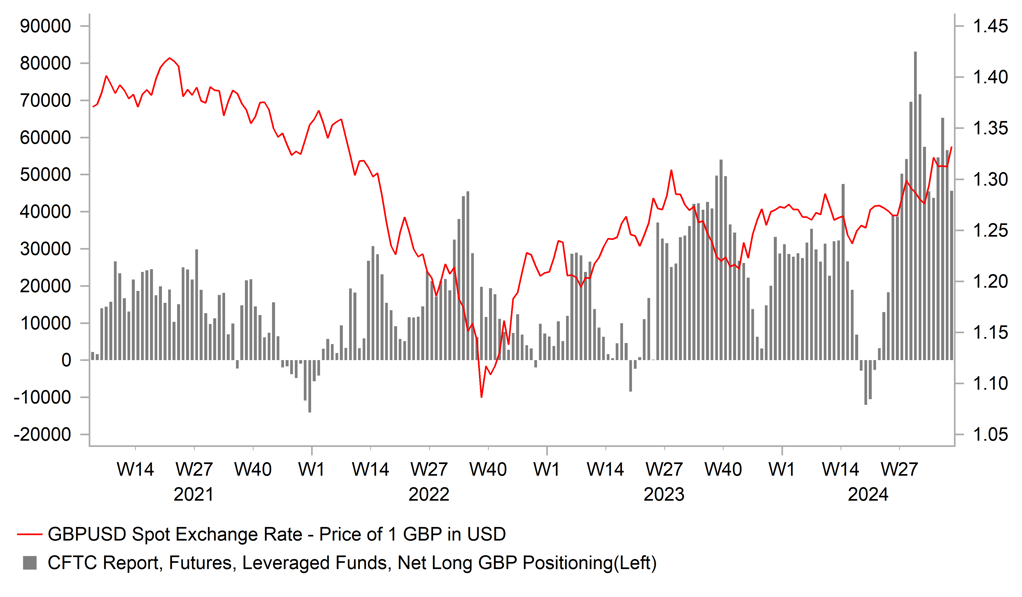

Pound performance has been driven in large part by the relative yield move with BoE caution helping the front-end of the UK curve relative to the US. The 2-year swap spread has jumped by about 50bps since the US CPI print in February. But optimism in relation to the US-UK relationship and the balanced trade providing the reasoning for less aggression from the US on UK imports. If the UK fails to get that carve-out even through the economic impact is marginal, the pound could suffer relative to where expectations are now.

GBP LONGS ELEVATED ON BOE CAUTION AND LESS TARIFF RISKS

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:45 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!!!! |

|

US |

11:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

20.4% |

! |

|

US |

12:30 |

Core CPI (YoY) |

Feb |

3.2% |

3.3% |

!!!! |

|

US |

12:30 |

Core CPI (MoM) |

Feb |

0.3% |

0.4% |

!!!! |

|

US |

12:30 |

CPI (MoM) |

Feb |

0.3% |

0.5% |

!!! |

|

US |

12:30 |

CPI (YoY) |

Feb |

2.9% |

3.0% |

!!! |

|

US |

12:30 |

Real Earnings (MoM) |

Feb |

-- |

-0.3% |

! |

|

CA |

13:45 |

BoC Rate Statement |

-- |

-- |

-- |

!!!! |

|

CA |

13:45 |

BoC Interest Rate Decision |

-- |

2.75% |

3.00% |

!!!! |

|

GE |

13:45 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

CA |

14:30 |

BOC Press Conference |

-- |

-- |

-- |

!!! |

|

US |

15:00 |

Cleveland CPI (MoM) |

Feb |

-- |

0.3% |

! |

|

EC |

15:15 |

ECB's Lane Speaks |

-- |

-- |

-- |

!! |

|

US |

17:00 |

10-Year Note Auction |

-- |

-- |

4.632% |

!! |

|

US |

18:00 |

Federal Budget Balance |

Feb |

-314.0B |

-129.0B |

!! |

Source: Bloomberg