Weak CPI & trade uncertainties open up scope for new lows for the US dollar

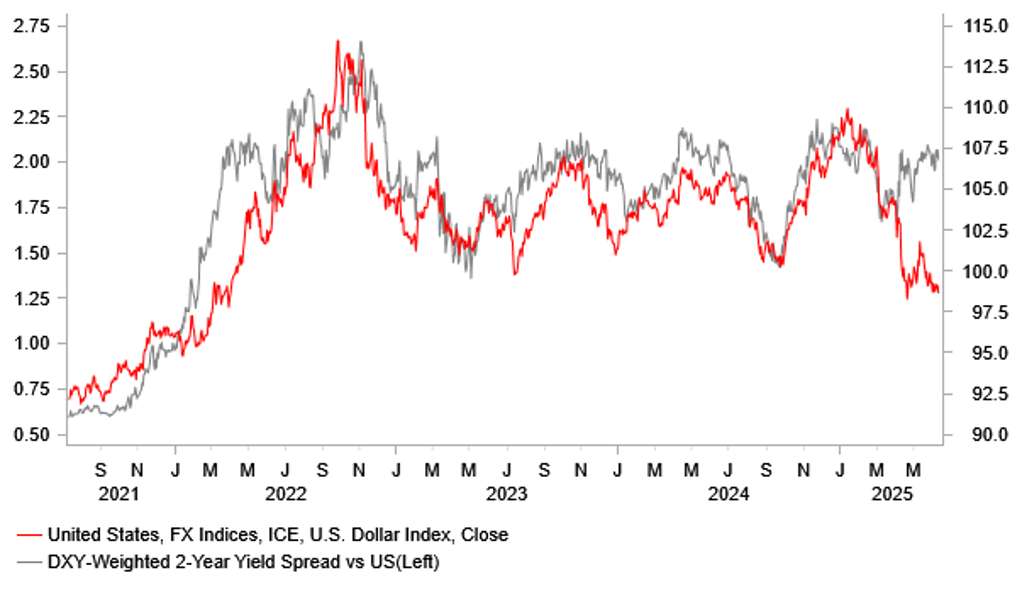

USD: No tariff inflation impact yet opens up rate cuts

If it weren’t for the uncertainty created by the Trump administration’s trade tariff policies, the FOMC may well have cut rates already or certainly could be setting the financial markets up for a cut next week. As it stands though, there is zero pricing for a rate cut next week and only 5bps of cuts priced for the July FOMC meeting. By September, the market is now priced at over 80%, which follows the CPI report yesterday that was much weaker than expected. The US dollar in DXY terms has just hit new lows not seen since 22nd April in part on the weaker inflation print but also more importantly some increasing concerns over trade policy uncertainties. While the 2-year yield declined yesterday, the yield is well above the lows hit in April after ‘Liberation Day’ and again at the start of May. The dollar was clearly hit overnight by the comment from President Trump just before midnight BST that letters would be sent to trading partners within the next two weeks informing them of reciprocal tariffs that will go live on 9th July. This of course only adds to confusion and uncertainty given reciprocal tariff rates have already been set so quite what the letters will contain isn’t exactly clear but the comment certainly points to renewed escalation in trade tensions ahead of the official deadline date set back in April. Understandably, this is becoming more alarming for investors given the lack of progress generally with trading partners. The only ‘deal’ done has been with the UK while the ‘deal’ done this week with China to revert back to the deal reached to de-escalate on 12th May is vague and could quickly unravel. China today confirmed that it’s easing of rare earth export controls would be time-limited with licenses only granted for a maximum 6mth period. Japan PM Ishiba today stated that he would not compromise Japan’s interests to reach a deal quickly while an opposition party leader stated that the government still felt there were large gaps in details for reaching a deal suggesting a Japan-US deal is not imminent. Howard Lutnick stated yesterday that the EU would likely be one of the last to reach a deal highlighting the high probability of reciprocal tariffs being implemented. All that said though Treasury Secretary Bessent stated that the administration was likely to delay reciprocal tariffs for top trading partners in order to reach deals.

So the lack of clarity is not helping while risks have risen that actions could be taken in the coming two weeks confirming reciprocal tariff rates. Investors’ risk appetite has taken a hit with JPY, CHF and EUR the top three performing G10 currencies today while the dollar is down sharply against a number of Asian currencies highlighting a renewed deterioration in dollar sentiment. The dollar move lower remains modest though although we would expect that to change and for the sell-off to intensify if the DXY index was to breach the 97.921 low from 21st April, an obvious key support. A breach of that level would take the dollar to levels not seen since March 2022

USD CLOSE TO HITTING NEW LOWS AS YIELDS REMAIN ELEVATED

Source: Bloomberg, Macrobond & MUFG GMR

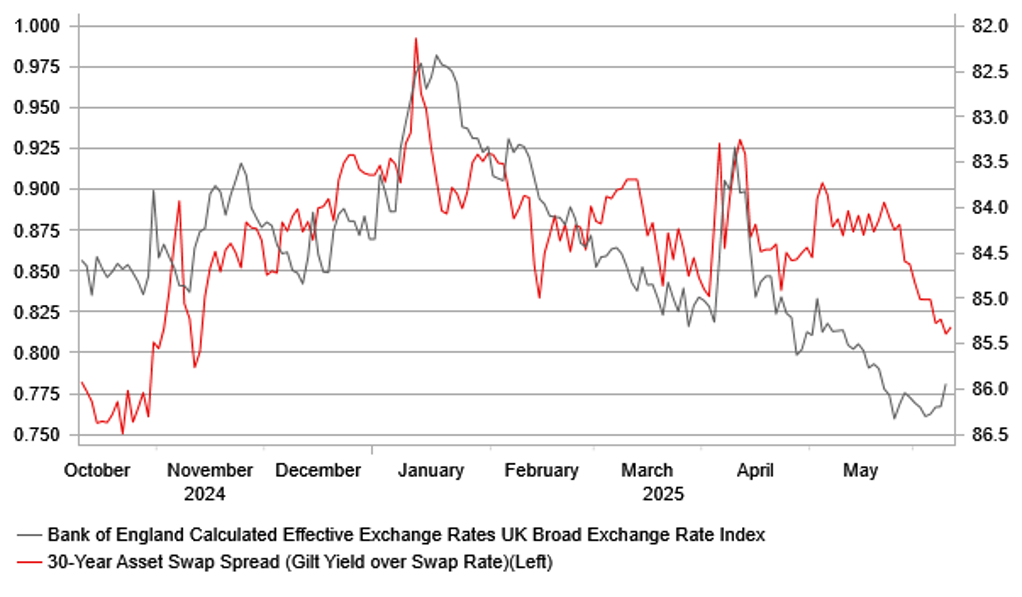

GBP: Spending review merely highlighted the perilous fiscal outlook

There has been understandable muted reaction in the financial markets to the Spending Review by Chancellor Rachel Reeves yesterday. The Spending Review, as the title implies, focuses on spending and outlines how spending will be allocated over the remainder of the UK parliament – out to fiscal year 2028-29 for departmental day-to-day spending and 2029-30 for capital spending. Crucially for the financial markets what is more important is how these spending plans will be paid for. The Spring Budget Statement allocated a buffer of GBP 9.9bn but recent u-turns by the government on the winter fuel allowance for pensioners and the child benefit cap means the buffer is close to non-existent and hence leaving the government with little option but to raise taxes, possibly breaching one of its key election manifesto promises. Yesterday’s Spending Review therefore hasn’t altered the uncertainties over the fiscal outlook but has provided clarity on where spending goes. The dominant factor therefore for Gilt yields yesterday was nothing to do with the Spending Review and everything to do with the weaker US inflation data – the 30-year Gilt yield declined by about 4bps in response to the data. There was limited volatility around the Spending Review.

Science, Innovation and Technology was the big winner with departmental spending up 7.4% from FY25/26 to FY28/29 followed by Health and Social Care, up 2.8%. Chancellor Reeves gave a lot of attention to the GBP 113bn of increased capital investment relative to the plans for the last government with this expenditure outside the fiscal rule of only borrowing to invest and day-to-day spending being met by revenues. Defence as expected was the big winner in capital spending plans followed by transport. But the large capital spending plans underline the vulnerability. While the spending is outside the fiscal rule related to day-to-day spending, it is still debt that needs to be serviced. There is a notable risk that higher than expected yields to finance that expenditure would exacerbate the worsening fiscal outlook, which could be reinforced further if growth falls short of forecasts. With the OBR generous with its growth projections (due to optimistic productivity projections) there is plenty of scope for fiscal slippage. Given current global debt sustainability risks that points to ample downside risks for the pound going forward.

This morning, we had monthly GDP data released along with industrial production, services and trade, all for the month of April capturing the initial impact from increased trade policy uncertainties following the US reciprocal tariff announcement. GDP contracted by 0.3% m/m in April with manufacturing activity and services activity weaker than expected. There was a notable widening of the UK trade deficit (ex-precious metals) with goods exports to the EU down 4.3% m/m but down a very large 12.6% m/m to non-EU countries highlighting the initial impact of reciprocal tariffs. There has been limited FX reaction but weaker GDP will only reinforce fiscal slippage concerns and increase expectations of a more active BoE in cutting rates. GBP underperformance versus EUR seems likely in these circumstances.

UK 30-YEAR GILT YIELD OVER SWAP RATE VERSUS BOE GBP TWI – SOME RECENT EASING OF SOVEREIGN RISK HELPS GBP

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

EC |

10:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!!! |

|

EC |

13:00 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

EC |

13:20 |

ECB's Schnabel Speaks |

! |

|||

|

US |

13:30 |

PPI (MoM) |

May |

0.2% |

-0.5% |

!!! |

|

US |

13:30 |

PPI (YoY) |

May |

2.6% |

2.4% |

! |

|

US |

13:30 |

Core PPI (YoY) |

May |

3.1% |

3.1% |

!! |

|

US |

13:30 |

Core PPI (MoM) |

May |

0.3% |

-0.4% |

!!! |

|

US |

13:30 |

PPI ex. Food/Energy/Transport (MoM) |

May |

-- |

-0.1% |

!!! |

|

US |

13:30 |

PPI ex. Food/Energy/Transport (YoY) |

May |

-- |

2.9% |

! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

242K |

247K |

!!! |

|

US |

13:30 |

Jobless Claims 4-Week Avg. |

-- |

-- |

235k |

! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

-- |

1,904K |

!!! |

Source: Bloomberg & Investing.com