Softer USD is anticipating that Fed will slow pace of hikes

USD: Will the Fed rock the boat in the week ahead?

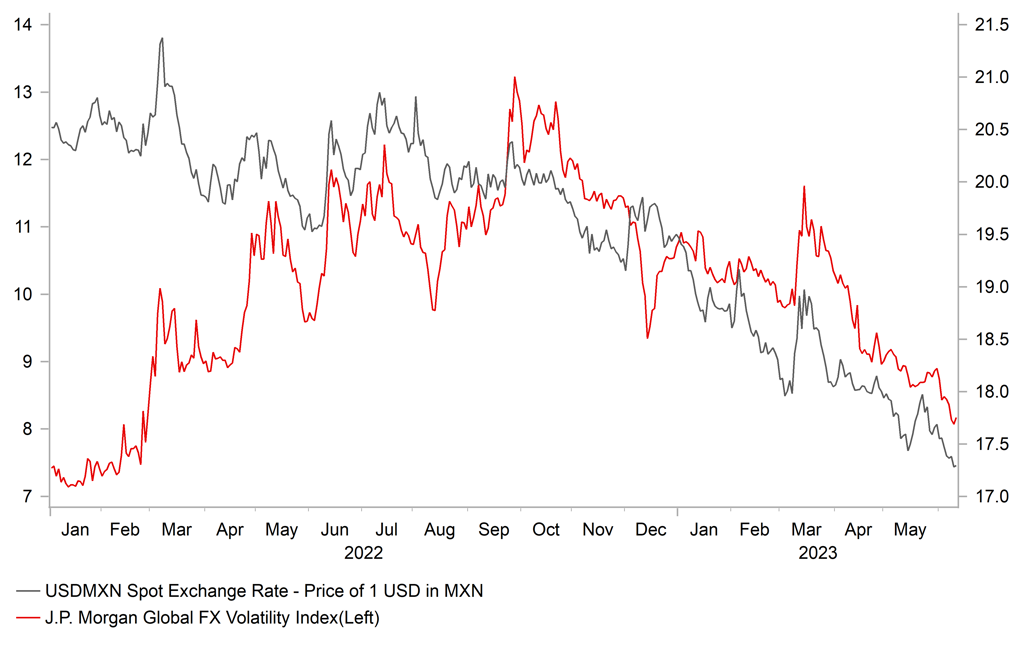

It has been a quiet start to the week for the foreign exchange market ahead of the latest policy updates from the Fed (Wed), ECB (Thurs) and BoJ (Fri) in the week ahead. The US dollar has corrected modestly lower ahead of the upcoming FOMC meeting. After hitting an intra-day high of 104.70 at the end of last month, the dollar index has since fallen back towards the 103.00-level. The US dollar has weakened against all other G10 currencies so far this month apart from against the yen. US dollar weakness has been most evident against the commodity-related G10 currencies. The Australian dollar (+3.7%), Norwegian krone (+3.00%), Canadian dollar (+1.7%) and New Zealand dollar (+1.6%) have been the best performing G10 currencies. The commodity-related currencies have benefitted from a relief rebound in commodity prices following the heavy sell-off between April in May. Bloomberg’s commodity price index has risen by around 3.5% from the year to date low at the end of May. At the same time, commodity-related currencies have been supported by the ongoing improvement in global investor risk sentiment. MSCI’s global equity index has regained upward momentum at the start of June and risen to its highest level since May 2022. The favourable developments have also seen a further decline in foreign exchange market volatility. According to Bloomberg, JPMorgan’s Global FX Volatility Index has fallen to its lowest level since the start of 2022 just before Russia invaded the Ukraine. The combination of improving global investor risk sentiment and falling FX volatility is making FX carry trades even more attractive. USD/BRL, USD/COP, USD/MXN which are popular carry trades and commodity currencies as well, all hit year to date lows at the end of last week.

The Fed’s upcoming policy meeting will be important in determining whether the current favourable set-up for high beta currencies continues in the week ahead. US yields have lost some upward momentum alongside the US dollar recently reflecting in part expectations that the Fed will slow the pace of hikes this week. The US rate market is currently pricing in around 7bps of hikes for this week’s policy meeting and around 21bps by the July FOMC meeting. The Fed usually meets market expectations and they have not sent a hawkish signal over the past week to readjust market expectations suggesting that they are currently comfortable with a pause. The last test will be the release tomorrow of the latest US CPI report for May just ahead of the FOMC meeting on Wednesday. Unless there is a significant upside surprise for core inflation measures, we expect the Fed to leave rates on hold this week but signal that it is not the end of the hiking cycle and leaving the door open for another hike as soon as July. It should help to dampen further downside for the US dollar. The most disruptive outcome for the FX market would another hike forcing the US rate market to price in a higher peak for the tightening cycle beyond 5.50%. It could trigger at least a temporary shake out of popular carry trade positions. Please see our latest FX Weekly report for more details (click here)

FALLING FX VOL BOOSTING APPEAL OF FX CARRY TRADES

Source: Bloomberg & Macrobond

NOK: CPI report reinforces concerns over pass through from weaker krone

The biggest mover last week amongst G10 currencies was the Norwegian krone when it strengthened by 2.6% against the US dollar, 2.2% against the euro and 2.1% against the Swedish krona. The broad-based rebound has brought some temporary relief for the krone following the heavy sell-off at the start of this year. Even after recent gains, the krone is still by far the worst performing G10 currency this year. It has fallen sharply this year by around -8.8% against the US dollar and -9.2% against the euro.

At their last policy meeting at the start of May, the Norges Bank signalled more concern over upside risks to their inflation target from a weaker krone. Governor Ida Wolden Bache stated clearly that “if the krone remains weaker than projected or pressures in the economy persist, a higher policy rate than envisioned earlier may be needed”. Those concerns will have been reinforced at the end of last week by the release of the latest CPI report from Norway for May that revealed a significant upside surprise both for headline and core inflation. Core inflation unexpectedly rose to a fresh cyclical high of 6.7% in May. The Norges Bank has already signalled that it plans to raise their policy rate further in June, and they will be under pressure to keep hiking for longer or even reverting back to delivering a larger 0.50 point in June. A hawkish policy reaction from the Norges Bank would help to provide more support for the krone, which has become more deeply undervalued at the start of this year.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

UK |

15:00 |

BoE MPC Member Mann |

-- |

-- |

-- |

!! |

|

US |

16:00 |

Consumer Inflation Expectations |

-- |

-- |

4.4% |

! |

|

US |

19:00 |

Federal Budget Balance |

May |

-236.0B |

176.0B |

!! |

Source: Bloomberg