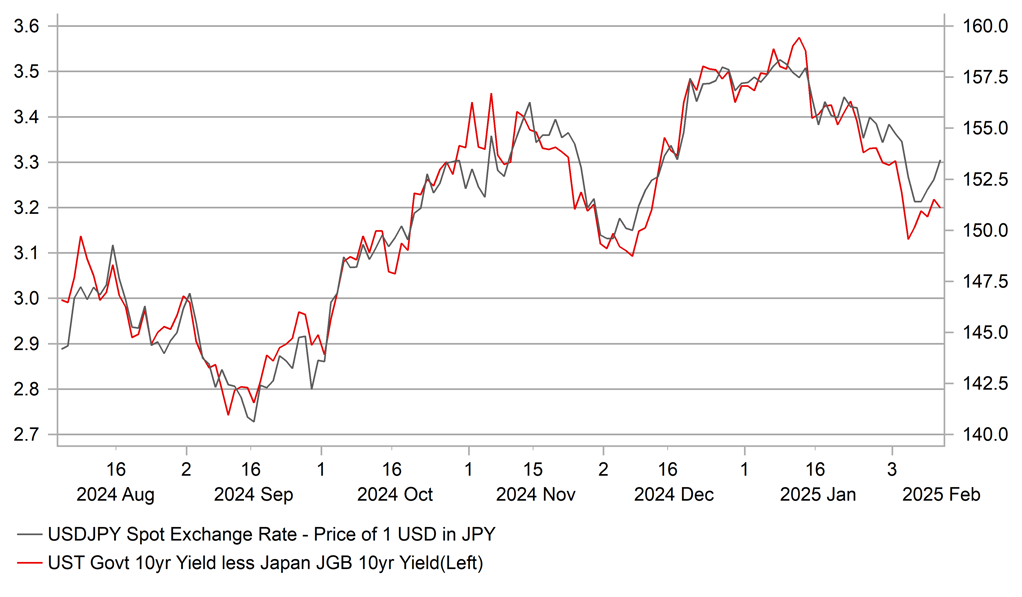

JPY giving back some of recent gains alongside pick-up in US yields

USD/JPY: US tariff risk and higher US yields provide support

The yen has underperformed during the Asian trading session resulting in USD/JPY rising up to a high of 153.73 as it moves further above the low of 150.93 set on 7th February. USD/JPY upside has accelerated overnight after the pair broke back above resistance provided by the 200-day moving average at around 152.75. The rebound for USD/JPY in recent days has coincided with a pick-up in US yields. Similar to USD/JPY, the 10-year US Treasury yield put in place a low on 7th February at 4.38% and has since risen back up to 4.55%. The release of the stronger nonfarm payrolls report for January and President Trump’s plans to raise tariffs on steel & aluminium alongside unspecified “reciprocal” tariffs have helped to provide support for US yields following the correction lower during the second half of last month. The 10-year US Treasury yield is still around 25bps lower than the peak from 14th January.

Upward pressure on US yield was also encouraged yesterday by hawkish comments from Fed Chair Powell when he testified on monetary policy in front of Congress. He reiterated that with the Fed’s policy stance now “significantly less” restrictive than it had been and the economy remaining “strong”, “we do not need to be in a hurry” to adjust their policy stance. He acknowledged the risk that reducing policy restraint “too fast or too much” could hinder progress on inflation. While on the other hand, reducing policy restraint “too slowly or too little” could unduly weaken economic activity and employment. The Fed will continue to remain in data dependent mode to assess when to cut rates further as well as watching President Trump’s plans for the US economy to assess how they could alter the outlook. He added that “if the economy remains strong and inflation does not continue to move sustainably toward 2.0%” then the Fed can maintain policy restraint for “longer”. However, “if the labour market were to weaken unexpectedly or inflation were to fall more quickly than anticipated” then the Fed could ease policy accordingly. Overall the comments are consistent with the Fed keeping rates on hold for longer at the start of this year unless softer labour market and/or inflation data provides justification for an earlier cut. Last week’s strong nonfarm payrolls report for January supported market expectations for the Fed to leave rates on hold until at least the middle of this year. The next focus for assessing Fed rate cut expectations will be the release today of the last US CPI report for January. The report is expected to reveal that core inflation picked up by 0.3%M/M in January following the softer increase of 0.2%M/M in December. The wildfires and residual seasonality are expected to be the main driver of the inflation pick-up which if confirmed should allow the Fed to look through the stronger prints but is unlikely to provide justification for an earlier rate cut.

At the same time, yen weakness in recent days could reflect some concern that Japan’s economy will be negatively impacted by President Trump’s tariff hikes. Japan accounted for around 20.7% of total US steel imports in 2024 up from 18.6% in 2020 making it one of the largest sources of US steel imports along with Canada and Mexico. Bloomberg has reported overnight that Japan has asked President Trump to exclude Japanese companies from the steel and aluminium tariffs. Japanese Prime Minister Ishiba has expressed optimism as well that Japan can avoid higher tariffs after meeting with President Trump in person for the first time at the end of last week. He stated that President Trump had “recognised the fact that Japan has been the world’s largest investor in the US for five straight years, and is therefore different from other countries”. According to media reports, they did not specifically discuss auto tariffs although Prime Minister Ishiba stated that he did not know whether Japan would be subject to “reciprocal tariffs”. President Trump pressed Prime Minister Ishiba to close Japan’s trade surplus with the US that totalled USD68.5 billion last year but also expressed optimism that that this could be done “quickly”. Prime Minister Ishiba has since identified liquefied natural gas, steel, AI and autos as areas that Japanese companies could invest in.

USD/JPY VS. LONG-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

13:00 |

German Current Account Balance n.s.a |

Dec |

-- |

24.1B |

!! |

|

US |

13:30 |

Core CPI (MoM) |

Jan |

0.3% |

0.2% |

!!! |

|

US |

13:30 |

CPI (MoM) |

Jan |

0.3% |

0.4% |

!!! |

|

US |

15:00 |

Fed Chair Powell Testifies |

-- |

-- |

-- |

!!! |

|

GE |

17:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

CA |

18:30 |

BOC Summary of Deliberations |

-- |

-- |

-- |

!! |

|

US |

22:05 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg