US CPI report in focus after China trade truce extension

AUD: China trade truce extension provides offset to RBA rate cut

The foreign exchange market has been relatively stable overnight ahead of the release later today of the latest US CPI report for July. The US dollar strengthened modestly yesterday which could have been encouraged by the lightening of short positions to reflect the risk of a stronger than expected uplift to US inflation from higher tariffs in today’s CPI report. The Bloomberg consensus forecasts are for headline and core inflation to increase by 0.2%M/M and 0.3%M/M respectively in July. In the previous five CPI reports from March to June core inflation has surprised to the downside highlighting that so far this year, the pick-up in expected inflation in response to US tariffs has been less than expected. Recent trade deals have helped to dampen upside risks to US inflation through the rest of this year at least compared to initial fears when the Liberation Day tariff announcements were made in early April. Risks from trade disruption to both inflation and growth have eased further overnight after President Trump signed an executive order to extend the trade truce with China for another 90-days through to 10th November. All other elements of the previous trade agreement with China apart from the new deadline date were left unchanged. In a similar statement China noted that it would also extend its suspension of higher tariffs for a further 90-days. If the deal had not been extended, US “reciprocal” tariffs on goods from China would have jumped back up to at least 54%. President Trump is still imposing a 10% baseline tariff and 20% tariff related to fentanyl. According to Bloomberg, the signing may clear the path for President Trump to visit China to meet with President Xi Jinping in late October as they seek a broader trade agreement.

While the extension of the trade truce between the US and China was widely expected after recent trade negotiations, the final decision was up to President Trump. The initial market impact has been limited overnight. Within G10 FX, the high beta G10 commodity currencies of the Australian and New Zealand dollar have failed to strengthen on the back of reduced downside risks from US-China trade disruption. The Australian dollar has weakened modestly driven in part by the RBA’s decision to lower rates overnight by a further 25bps to 3.60%. The decision was widely as expected helping to dampen the negative impact for the Australian dollar. The update guidance from the RBA indicated that further gradual easing remains likely. Governor Bullock stated that the RBA’s updated economic forecasts are conditioned on a “couple” more rate cuts. She noted that the RBA would be “pre-emptive and data dependent” when setting policy, and noted that if they didn’t cut rates the RBA would miss their forecasts for inflation and unemployment. The decision to lower rates today was supported by the updated economic projections from the RBA. Economic growth for this year was revised down to 1.7% from 2.1% while core inflation is still expected to be around the mid-point of the RBA’s 2-3% target through most of the forecast horizon. The RBA also expect the unemployment rate hold at around 4.3%. A further loosening of labour market conditions would increase pressure on the RBA to be more active in cutting rates. Overall the developments are not sufficient to dislodge the AUD/USD rate out of the recent narrow trading range between 0.6400 and 0.6600.

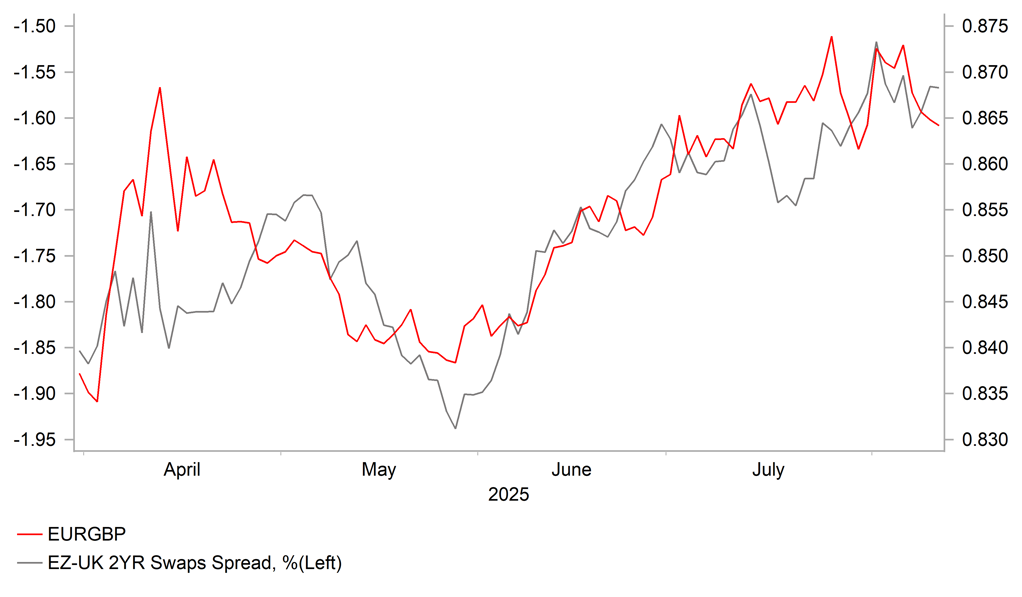

EUR/GBP VS. SHORT-TERM YIELD SPREAD

Source: Bloomberg, Macrobond & MUFG GMR

GBP: UK labour market report not weak enough to encourage BoE rate cuts

The pound is continuing to trade at stronger levels following last week’s hawkish BoE policy update which signalled that they are less confident over the need to continue cutting rates at the current quarterly pace. The UK rate market has moved to price in closer to a 50:50 probability of another 25bps rate cut being delivered in November. The hawkish repricing of BoE rate cut expectations has helped to provide more support for the pound resulting in EUR/GBP falling back below 0.8650 after hitting a recent high in late July of 0.8769. Upward momentum for the pound has been encouraged further this morning by the release of the latest UK labour market report.

Our European economist has noted that the jobs data is a bit firmer than expected. Payroll employment declined by less than expected (just 8k in July) and there was another upward revision to the prior month from -41k to -26k. It follows on from the upward revisions in last month’s report as well. As a result, employment is still down by around 150k over the past year but not nearly as alarming as suggested initially back in May. The July figure was the strongest since January indicating that the weakness in the labour market maybe starting to ease a little although one should never place too much importance on just one report. On the other hand, headline wage growth slowed more than expected to 4.6% down from 5.0%. The key measure for the BoE, private sector wage growth excluding bonuses also slowed but only modestly to 4.8% down from 4.9%.

Overall, the report is unlikely to alter the current hawkish policy shift taking place on the MPC. The UK labour market would need to show evidence of even looser conditions and/or a faster slowdown in wage growth for the UK rate market to price back in more rate cuts. MPC officials have indicated recently they are becoming more concerned over inflation persistence. Higher UK yields for longer remains a supportive factor for the pound although it didn’t prevent recent pound underperformance.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

GE |

10:00 |

German ZEW Current Conditions |

Aug |

-65.0 |

-59.5 |

!! |

|

EC |

10:00 |

ZEW Economic Sentiment |

Aug |

28.1 |

36.1 |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

Jul |

98.6 |

98.6 |

! |

|

US |

12:00 |

OPEC Monthly Report |

-- |

-- |

-- |

!! |

|

GE |

13:00 |

German Current Account Balance n.s.a |

Jun |

-- |

9.6B |

! |

|

US |

13:30 |

Core CPI (MoM) |

Jul |

0.3% |

0.2% |

!!! |

|

US |

13:30 |

CPI (MoM) |

Jul |

0.2% |

0.3% |

!!! |

|

CA |

13:30 |

Building Permits (MoM) |

Jun |

-3.9% |

12.0% |

!! |

|

US |

13:55 |

Redbook (YoY) |

-- |

-- |

6.5% |

! |

|

US |

15:00 |

FOMC Member Barkin Speaks |

-- |

-- |

-- |

! |

|

US |

15:30 |

Fed Schmid Speaks |

-- |

-- |

-- |

! |

Source: Bloomberg & Investing.com