EUR continues to consolidate at stronger levels ahead of ECB update

USD: Will US inflation data challenge dovish repricing of Fed policy outlook?

It has been a relatively quiet trading session overnight with most major currency pairs remaining within tight trading ranges. The biggest movers yesterday were the high beta currencies of the Norwegian krone and Australian dollar which have been supported by the ongoing improvement in global investor risk sentiment as evident by global equity markets rising to fresh record highs. At the same time, the Norwegian krone was supported by further evidence revealing inflation in Norway has firmed in recent months. The annual rate of headline inflation has picked up from a low of 2.5% in April up to 3.5% in August. While core inflation remained at 3.1% in line with the Norges Bank’s forecasts, those forecasts did not reportedly account for the reduction in kindergarten prices. According to Statistics Norway, CPI would have been 3.9% without the reduction in kindergarten prices. After the adjustment, the upside surprise for the Norges Bank has cast further doubt on whether they will cut rates at next week’s policy meeting. New Norwegian Prime Minister Store of the Labor party has stated that “the most important thing is that we maintain sound fiscal policies, so that interest rates can continue to fall and secure household finances”. The Norges Bank has lagged other G10 central banks in cutting rates delivering their first rate cut only in June. At the last policy meeting in August, the Norges Bank indicated that the “policy rate will be reduced further in the course of 2025”. Alongside the Swedish krona, the Scandi currencies have been the best performing G10 currencies this year as they have rebounded from deeply undervalued levels and benefitted from the broad-based improvement in investor sentiment towards Europe.

The outlook for inflation was also in focus yesterday over in the US. The latest PPI report for August was released yesterday ahead of the release today of the CPI for August. The PPI report has further helped to dampen concerns over a sharper pick-up in inflation pressures from higher tariffs. The report revealed that both headline and core PPI came in at -0.1%M/M which was well below consensus expectations. The slowdown was broad-based with both goods and services PPI inflation lower than in July. Trade services inflation which is a measure of gross margins turned negative (-1.7%) and the large positive increase from the prior month in July was revised sharply lower (from 2.0% to 1.0%). It suggests companies profit margins have been squeezed by the higher tariffs which have not been fully passed on to consumers through higher prices. However, many of the components of PPI that feed directly into the calculation of the PCE deflator were firmer than the headline figures. Current estimates of the core PCE deflator are currently running at around 0.3%-0.4% M/M for August ahead of the release of the CPI report later today. In light of recent soft US employment data, there is a higher hurdle for the US inflation data to trigger a reversal of the dovish repricing that has taken place in the US rate market. We continue to believe that lower US rates will encourage a weaker US dollar heading into year end.

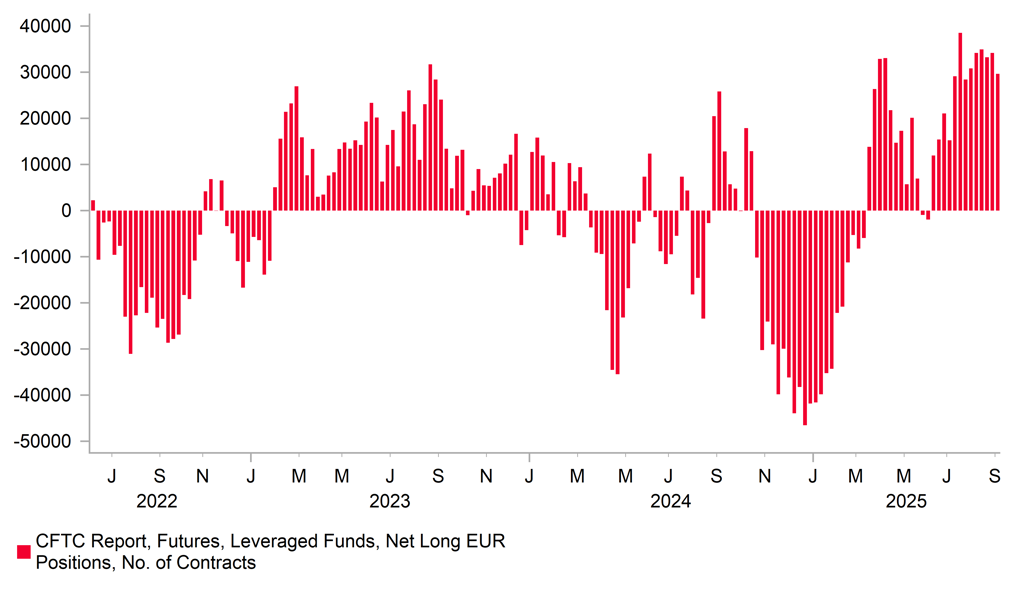

LONG EUR POSITIONS REMAIN POPULAR

Source: Bloomberg, Macrobond & MUFG GMR

EUR: Higher hurdle for further ECB easing providing support for EUR

The main event today will be the ECB’s latest policy meeting. Ahead of the meeting the EUR has been consolidating against both the US dollar and pound. For the last couple of months EUR/USD has been trading between 1.1500 and 1.1800 while EUR/GBP has just dropped back between 0.8600 and 0.8700. At today’s policy meeting the ECB is expected to leave their policy rate on hold for the second consecutive meeting. The updated ECB staff forecasts are expected to include modest upward revisions to the near-term growth and inflation forecasts supporting today’s decision to leave rates unchanged. At the last policy meeting the ECB signalled that their easing cycle is now closer to the end. We expect the ECB to stick to similar guidance today but believe it is likely too soon for the ECB to clearly signal an end to the easing cycle at the current juncture which would provide an upside surprise for the euro. Having said that the comments from President Lagarde are likely to indicate that there is a higher hurdle for further rate cuts. The euro-zone rate market has already moved along way to price out further ECB easing this year. There are currently only 6bps of rate cuts priced by December compared to 12bps a month ago. An unchanged ECB policy stance while the Fed resumes rate cuts should help to lift EUR/USD up towards the 1.2000-level by year end.

While President Lagarde is likely to be asked about renewed political uncertainty in France, it is unlikely to have a significant impact on ECB policy decisions in the near-term. President Macron has acted quickly to choose Sebastian Lecornu, a career politician who served as defence minister in the previous cabinet, to be the next prime minister. The conservative-turned-centrist reportedly prides himself in getting along with everyone except perhaps with one of the more fiery figures on the far left according to French daily Le Monde. Proposing a budget for next year will be one of the first major tests of the new premier. In his inaugural speech yesterday he pledged to change the way the government deals with opposition, stressing that negotiations must be more creative and technical. Previous plans for EUR44 billion of fiscal tightening next year will need to be scaled back to garner more political support in parliament.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

13:15 |

Deposit Facility Rate |

Sep |

2.00% |

2.00% |

!!! |

|

US |

13:30 |

Core CPI (YoY) |

Aug |

3.1% |

3.1% |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

235K |

237K |

!!! |

|

EC |

13:45 |

ECB Press Conference |

-- |

-- |

-- |

!!! |

|

US |

19:00 |

Federal Budget Balance |

Aug |

-305.7B |

-291.0B |

!! |

Source: Bloomberg & Investing.com