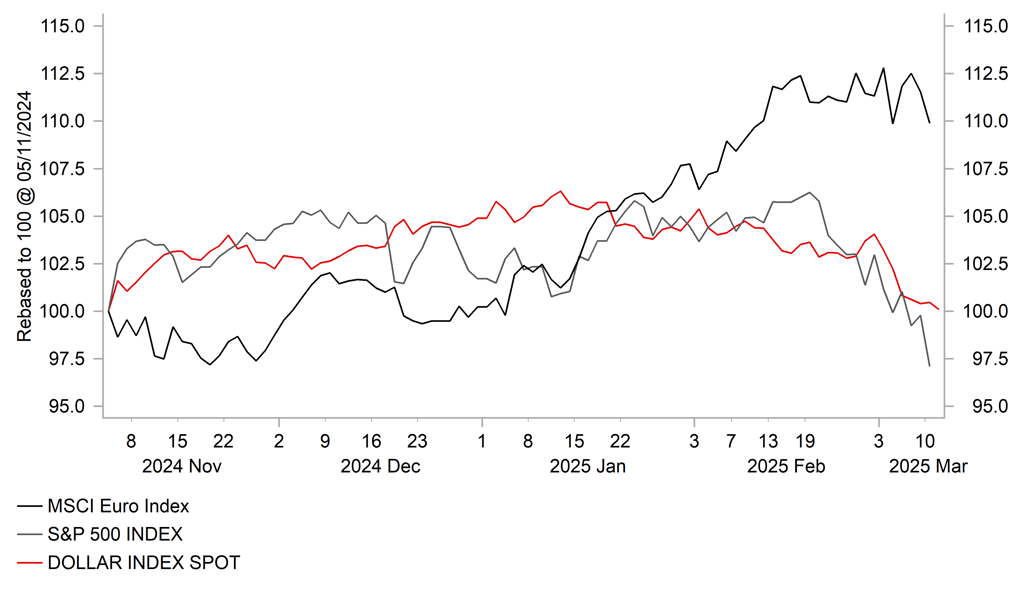

Limited spill-overs so far into FX market from sharp equity market sell-off

USD: Deepening equity market sell-off could trigger pick-up in FX volatility

The major FX rates have remained relatively stable at the start of this week in contrast to the deepening sell-off in the equity markets. One of the biggest movers yesterday was the Nasdaq composite index which fell sharply by 4.0% and extended its decline since the high in December to almost 14%. At the same time, the VIX measure of US equity market volatility has risen to its highest level since early last summer when carry trades unwound abruptly after the BoJ hiked rates in late July. The heavy sell-off for US tech stocks overnight and broad-based equity market weakness reflects building fears over the outlook for global growth. Comments from President Trump stating that there’s going to be transition period for the US economy and signalling that he still plans to implement further tariff hikes in the coming months have added to market concerns. Worsening conditions for risk appetite amongst investors have reinforced demand for US government bonds putting further downward pressure on US yields. It has resulted in the 2-year Treasury yield falling to fresh year to date low yesterday of 3.83% while the 10-year US Treasury yield fell back below support from the 200-day moving average which comes in at just above 4.20%. US rate market participants have moved to price in more Fed rate cuts in the coming years in response to building growth fears. However, the spill-overs into the FX market from the deepening sell-off in the US equity market have been limited so far. The commodity currencies of the Australian, New Zealand and Canadian dollars have all underperformed modestly at the start of this week while the Norwegian krone, yen and euro have outperformed. If the period of risk aversion continues to intensify it remains to be seen whether the US dollar will weaken further alongside the decline in US yields and US equities which has been the relationship that has been in place since the start of this year, or whether the US dollar begins to drive more support from a pick-up in safe haven demand. Heightened US policy uncertainty created by President Trump is raising doubts over the US dollar’s safe haven role alongside the unwinding of popular US tech trades.

The euro has benefitted at the start of the today’s European trading session from reports that the Green party in Germany are now ready to negotiate with Friedrich Merz over his plans to significantly boost government spending on defence on infrastructure, and are hoping to reach an agreement by the end of this week. The Green party’s co-head Franziska Brantner told Bloomberg news that “of course we are ready to negotiate” and added that “the situation is dire in Ukraine and we really need Europe to step up its defence spending”. While the Greens won’t be part of the next coalition government in Germany, their support is needed to pass legislation through parliament to unlock funds for a significant increase in government spending. The Greens have proposed raising the threshold for defence spending exemptions to 1.5% of GDP compared to Chancellor-in-waiting Merz’s plans to set at 1.0%. Market participants remain optimistic that a deal will be reached with the Greens to pass legislation before the newly elected Bundestag convenes by 25th March at the latest. The prospect of a significant fiscal support is helping to ease concerns over downside risks to the growth outlook for Europe.

ROTATION OUT OF US INTO EUROPE HAS TAKEN PLACE

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Positive growth impulse in Europe counters tariff hit to Asia

The pick-up in risk aversion at the start of this week amongst market participants has triggered a correction lower for emerging market currencies. The CLP (-1.7% vs. USD), COP (-1.2%), BRL (-1.1%), IDR (-0.9%) and THB (-0.7%) have weakened the most since the end of last week while the Central European currencies of the CZK (+0.3% vs. USD) and HUF (+0.1%) have continued to outperform.

The Central European currencies have benefitted over the past week from the positive growth shock in Europe. German Chancellor-in-waiting Friedrich Merz outlined plans to significantly loosen fiscal policy. One part of the plan would be to set up a EUR500 billion fund for public infrastructure investment over the next decade. The second part of plan involves modifying the debt brake to allow unlimited government spending on defence as well. The German government raised defence spending to just over 2% of GDP last year. If government spending on defence is raised further up to 3.0% or 3.5% of GDP over the next decade, it could result in another EUR500 billion plus increase in government spending. Overall, public debt as a % of GDP in Germany could increase in the ballpark of around 20ppts or higher over the next decade. It will provide a shot in the arm for the industrial sector in Germany that has been contracting over the last six years and significantly support economic growth in Europe. We expect German GDP growth to be closer to 2.0% next year rather than 1.0%. Stronger growth in Central European countries’ main export markets provides a further tailwind for the CEE3 FX alongside recent optimism over a Ukraine peace deal. However, the plans still need to be passed through parliament and require support from the Greens.

Investor optimism on German fiscal policy has helped to put a dampener on concerns over downside risks to global growth and trade from President Trump’s tariff plans. Still the underperformance of Asian currencies over the past week still highlights that escalating trade tensions between the US and China is having a negative impact. President Trump has now raised tariffs on imports from China by 20% which is bigger than during his whole first term. Last week’s NPC reiterated that the government plans to step up fiscal policy to support growth (click here) alongside looser monetary policy but current plans are not expected to be sufficient to prevent slower growth in the near-term. Broad-based USD weakness and falling US yields are though preventing a bigger sell-off for Asia FX. Please see our latest EM EMEA Weekly report for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

10:00 |

NFIB Small Business Optimism |

Feb |

100.9 |

102.8 |

! |

|

EC |

10:00 |

ECOFIN Meetings |

-- |

-- |

-- |

! |

|

EC |

10:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

US |

12:55 |

Redbook (YoY) |

-- |

-- |

6.6% |

! |

|

US |

14:00 |

JOLTS Job Openings |

Jan |

7.650M |

7.600M |

!!! |

|

JP |

23:50 |

BSI Large Manufacturing Conditions |

Q1 |

6.5 |

6.3 |

!! |

|

JP |

23:50 |

PPI (YoY) |

Feb |

4.0% |

4.2% |

! |

Source: Bloomberg