US-China agreement prompts limited market reaction ahead of CPI

USD: US-China agreement lacks detail

The FX market remains broadly stable with limited moves for the US dollar and Chinese renminbi following an agreement on a framework that will help ensure the implementation of the deal reached in Geneva on 12th May. There was some modest market reaction just after midnight UK time when the agreement was confirmed but little was said beyond suggesting that export controls could now come down. But the agreement now needs to be signed off by both leaders although Howard Lutnick confirmed that President Trump had been briefed – so endorsement from the leaders is highly likely. But there was not much sense of positive momentum going forward. Jamieson Greer did state that he felt “positive about engaging with the Chinese” but there was nothing to announce about any future talks. There was no plan for the leaders to talk and nothing on a new round of negotiations beyond discussions over the coming days to ensure the details of this agreement are implemented. The muted reaction in the markets likely also reflects the announcement by the US Court of Appeals for the Federal Circuit that it would extend the stay on reciprocal tariffs until the case is heard on 31st July. This date is of course beyond the expiry of the postponement of the ‘Liberation Day’ reciprocal tariffs on 9th July ensuring that the much higher tariffs could indeed become reality before there’s a full decision on the legality of the tariffs. That was largely what was expected anyway as a loss for the Trump administration would have resulted in an appeal to the Supreme Court and hence the timing of the full final outcome to this question of legality was always likely to go beyond July-August. The EU stands to be one of the greatest losers given the reciprocal tariff could be set at 50% although it remains unclear whether the US would stick to that rate or the original 20% rate. If it was set at 50% and went live it would likely bring forward ECB rate cuts and potentially put downward pressure on the euro.

NZD and JPY are the two G10 currencies underperforming today. NZD/USD has been undermined by news that previous RBNZ Governor Adrian Orr had resigned in March due to a disagreement with the government over funding the central bank. USD/JPY continues to gradually drift higher given the renewed stability in the JGB market amid speculation that the BoJ next week will announce a reduction to the pace of cutting monthly JGB purchases. There was also speculation of the MoF buying back bonds but this has now been denied. The yen may drift further weaker on broad dollar gains although we see limited scope for a sustained sell-off with the BoJ likely to turn more hawkish and signal the potential for another rate hike to provide JPY support and counter further upside risks to inflation that have recently been building

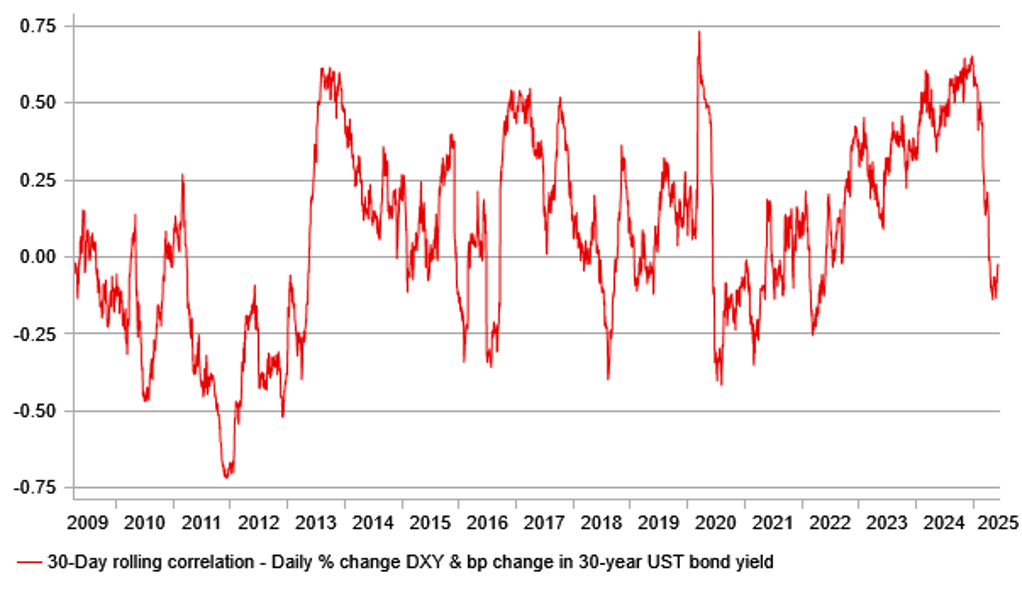

USD / 30YR UST YIELD POSITIVE CORRELATION HAS FALLEN SHARPLY

Source: Bloomberg, Macrobond & MUFG GMR

USD: Inflation in focus to assess tariff impact

There has been a lot of focus on the potential impact on inflation from the trade policy uncertainty created by the Trump administration and the CPI data today for May will go some way to revealing the potential impact. The data will be the first for assessing a full month of impact from the baseline reciprocal tariff of 10% and the impact of rising inflation expectations as businesses and consumers anticipate further tariff increases and deal with potential supply disruptions created by the trade uncertainty. The 1-year inflation expectation in the University of Michigan consumer sentiment report is at 6.6%, the highest level since 1981. The ISM manufacturing prices paid index has averaged 65.3 over the last 3mths, the highest since June 2022. We also had the NFIB Small Business Optimism data for May that did not reveal any sudden sharp jump in actual prices or planned prices which will be reassuring. The overall optimism index increased probably reflecting optimism that Trump’s tax cutting legislation will get passed following progress toward that in recent weeks.

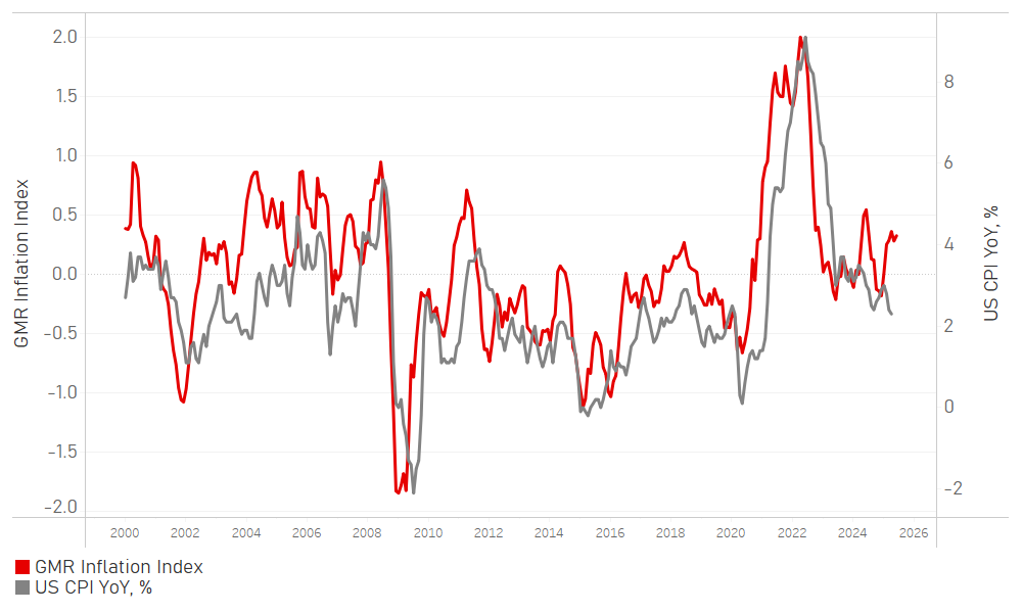

Our own in-house high-frequency indicator for CPI – compiled by 13 other inflation measures – shows the risk of an acceleration in the headline CPI YoY. The primary driver of our own inflation indicator picking up is the ISM services prices paid index, which accelerated sharply for the second consecutive month in May, to 68.7, the highest level since November 2022.

The consensus today is for a pick-up in the annual rates of both headline and core inflation. But that pick-up is more related to base-effects with the MoM headline consensus a benign 0.2%. So if we were to see clearer signs of tariff-related price increases being larger than expected, we could certainly see a larger financial market impact. The sensitivity to the data could well be reinforced by supply concerns. The USD 58bn worth of 3-year paper last night went ok – the results were broadly similar to recent auctions with the bid-to-cover falling to 2.52 times from 2.62. The results were weak enough to keep the markets nervous ahead of the USD 39bn worth of 10-year paper auctioned this evening and USD 22bn worth of 30-year tomorrow. Nervousness around the 30-year auction could be particularly high given the signs of investors steering clear of longer-dated paper due to both inflation and debt sustainability concerns.

We already know that there has been a sharp weakening of the positive correlation between long-term UST bond yields and the dollar. At the end of last year, the correlation between daily changes in 30-year yields (bps) and the daily percentage change in the dollar was +0.65. It’s now between 0.00 and -0.10. There were comments yesterday by Senate Budget Chair Lindsey Graham suggesting there could be major changes to the One Big Beautiful Bill that could certainly help long-end bond sentiment and limit the fallout to any upside inflation surprise. Senator Thom Tillis also stated he expected “a delay” to Section 899 due to widespread push-back. Some element of sense prevailing in the Senate in pushing back on this bill would certainly help reduce some of the current negative US dollar sentiment.

MUFG HIGH-FREQUENCY INFLATION INDEX POINTS TO BUILDING UPWARD INFLATION PRESSURES FOR HEADLINE YOY CPI

Source: Bloomberg, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:00 |

ECB Wage Tracker |

-- |

-3.90% |

! |

|

|

EC |

10:30 |

ECB's Lane speaks |

!!! |

|||

|

US |

12:00 |

MBA Mortgage Applications |

6-Jun |

-- |

-3.90% |

! |

|

US |

13:30 |

Real Avg Hourly Earning YoY |

May |

-- |

1.40% |

! |

|

US |

13:30 |

Real Avg Weekly Earnings YoY |

May |

-- |

1.70% |

! |

|

US |

13:30 |

CPI MoM |

May |

0.20% |

0.20% |

!!!! |

|

US |

13:30 |

CPI Ex Food and Energy MoM |

May |

0.30% |

0.20% |

!!!!! |

|

US |

13:30 |

CPI YoY |

May |

2.40% |

2.30% |

!!! |

|

US |

13:30 |

CPI Ex Food and Energy YoY |

May |

2.90% |

2.80% |

!!! |

|

CA |

13:30 |

Building Permits MoM |

Apr |

2.00% |

-4.10% |

! |

Source: Bloomberg & Investing.com