More tariff announcements – but can market indifference continue?

USD: A new record for equities as investors reaction limited

The US dollar is modestly stronger today with continued signs of better two-way flows after a US dollar sell-off in H1 that was the largest since 1973. After such a scale of depreciation it is understandable that we have reached a point where demand and supply has fallen more into balance. That could also be evident over the short-term by an FX reaction to trade uncertainty that is not as negative for the dollar are it was earlier in the year. That seems to be the case at the moment with the dollar much more stable in the wake of the wave of tariff announcements we have had this week. But it is not just in FX – the S&P 500 closed at a record high yesterday and the S&P future is currently down a mere 0.3%. The 10-year UST bond yield at 4.35% is unchanged from the closing level last Thursday after the jobs report had lifted yields.

The latest letter sent to Canada yesterday confirmed a tariff rate of 35% on all goods not impacted by the sector-specific tariffs, effective 1st August. The letter does not specify whether USMCA-compliant goods are excluded but a separate official who did not speak on the record stated USMCA-compliant goods will be excluded. The Budget Lab currently estimates 50% of US imports from Canada are USMCA compliant. However, that figure is likely rising quickly and could be a lot higher as more goods are formally registered as compliant. Given the tariff charge difference there’s a big incentive to get more goods complaint.

Trump added that further letters will be sent today – one of which is likely to include to the EU – and that many other countries will be hit with tariffs of between 15%-20%. The letter to Canada like all letters threatens each country that retaliates with the same level added again to the US import tariff. With the EU for example very likely to retaliate this could see a quick escalation. However, in the case of the EU, there remains optimism that a deal can be done by 1st August with active negotiations ongoing. If the EU, China, Canada (thru high USMCA compliance), India and the UK do not get hit with higher rates you quickly get to an annual import total of over USD 2trn not impacted by tariffs any higher than now.

So the size of the countries that may not be hit further by higher tariffs may be helping to limit the UST bond and equity market reaction. There is likely also an expectation that the extension to 1st August will also by then have allowed further deals with other countries currently hit with higher tariffs.

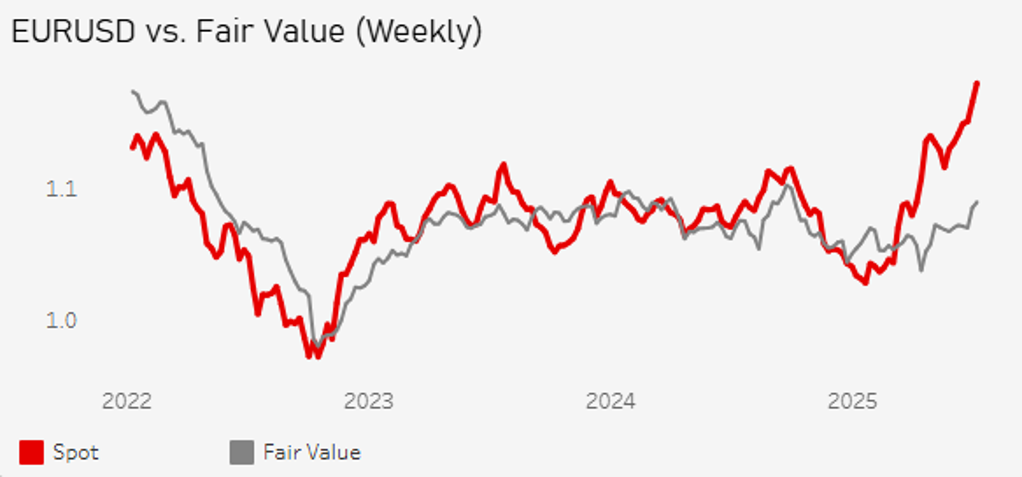

But there is little risk priced for this not panning out so well. The inflation risks remain high and the sector-specific tariffs, now including the 50% tariff on copper, will surely feed into inflation in a much more evident way that could make it difficult for the Fed to consider easing in September. With the US economy showing resilience and the labour market still holding up, we may start to see the dollar benefitting again from yields. Our G10 FX regression models indicate scope for the US dollar to recover further. Our EUR/USD model implies a 8% over-valuation that when we back test indicates a 65% probability of a retracement lower over a 4-week period.

SHORT-TERM REGRESSION MODEL INDICATES 8% EUR/USD OVERVALUATION WITH SCOPE FOR RETRACEMENT AHEAD

Source: Bloomberg, Macrobond & MUFG GMR

USD: FX Reserves data for Q1 shows big shifts in some non-dollar currencies

The IMF on Wednesday released its quarterly Composition of Foreign Exchange Reserves (COFER) for Q1 and we have released an FX Focus piece (here) covering the details of the latest data. We also include the key take-aways from the annual OMFIF Global Public Investor survey that highlights the thoughts of FX reserve managers in regard to future plans. The IMF data revealed the composition of reserves in USD remained basically unchanged with a marginal drop from 57.8% to 57.7%, slightly above the recent low of 57.3% in Q3 last year, which was the lowest level since 1995. So the USD composition remains low but given the dollar weakened 4% in Q1 (DXY) the composition could have fallen by more given the non-dollar portion of reserve increased in value. The fact that USD reserve were little changed indicated some increased dollar buying to offset the valuation impact.

The key take-aways outside of the US dollar were far more revealing. There was a substantial decline in the composition of JPY reserves – the 0.7ppt drop to 5.1% was a record one-quarter dropped matched once before in Q1 2009. Because USD/JPY dropped 4.4% the value of JPY reserve would have gone up all-else-equal. So the drop implies hefty selling by reserve managers. Indeed reserves in JPY fell over 10% versus Q4 last year. The drop in JPY reserves was significant being one of the larger reserve currencies but the decline in AUD reserves was even larger – there was a huge near 30% Q/Q drop in reserves that saw the composition drop from 2.05% to 1.44%, just below the previous record low of 1.45% when the AUD reserve composition was first reported back in Q4 2012.

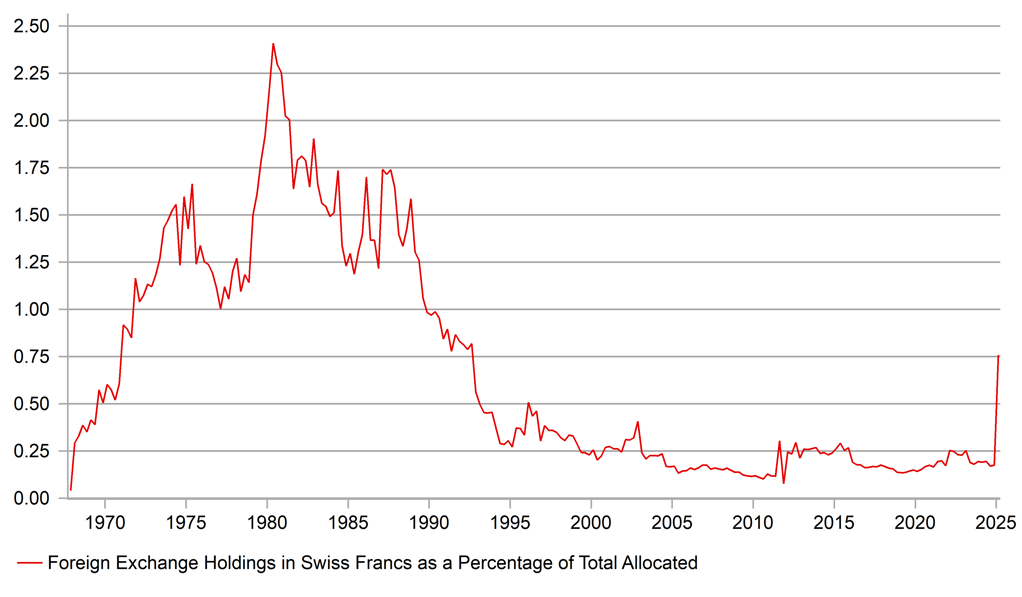

The primary beneficiary of these declines was CHF – with a huge more than four-fold increase in the value of reserves. The composition jumped from 0.18% to 0.76% in one quarter. The scale of CHF buying was unprecedented and begs the question was there a technical factor. We don’t believe so but it could be that perhaps one big reserve manager undertook a shift out of JPY and/or AUD and into CHF. In the FX Focus piece we explore the potential macro factors that may be behind such a move. The EUR composition also went higher but reserve managers were sellers into EUR appreciation so the entire composition increase from 19.8% to 20.1% was down to valuation.

The OMFIF GPI survey does point to the potential for better demand for EUR coming from reserve managers going forward. Over the next 2-year period, EUR is the top currency for plans to increase holdings with a net 16% of respondents citing EUR, a 7ppt jump from the same survey a year ago. The survey also highlights the concerns over US economic policy that could well discourage USD buying going forward. The Q2 COFER data will be telling in that regard given the ‘Liberation Day’ tariff announcements at the start of Q2.

IMF FX RESERVE DATA (COFER) IN Q1 REVEALED A SURGE IN CHF BUYING

Source: IMF COFER, Macrobond & MUFG GMR

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

US |

09:00 |

IEA Monthly Report |

-- |

-- |

-- |

!! |

|

EC |

09:00 |

ECB's Panetta speaks |

!! |

|||

|

EC |

09:40 |

ECB's Vujcic speaks |

!! |

|||

|

EC |

12:30 |

ECB's Cipollone speaks |

!! |

|||

|

UK |

13:00 |

NIESR Monthly GDP Tracker |

Jun |

-- |

0.4% |

!! |

|

GE |

13:00 |

German Current Account Balance n.s.a |

May |

-- |

23.5B |

! |

|

CA |

13:30 |

Avg hourly wages Permanent employee |

Jun |

-- |

3.5% |

! |

|

CA |

13:30 |

Building Permits (MoM) |

May |

-1.5% |

-6.6% |

!! |

|

CA |

13:30 |

Employment Change |

Jun |

0.9K |

8.8K |

!!! |

|

CA |

13:30 |

Full Employment Change |

Jun |

-- |

57.7K |

! |

|

CA |

13:30 |

Part Time Employment Change |

Jun |

-- |

-48.8K |

! |

|

CA |

13:30 |

Participation Rate |

Jun |

-- |

65.3% |

!! |

|

CA |

13:30 |

Unemployment Rate |

Jun |

7.1% |

7.0% |

!!! |

|

US |

19:00 |

Federal Budget Balance |

Jun |

-41.5B |

-316.0B |

!! |

Source: Bloomberg & Investing.com