USD continues to trade at weaker levels ahead of US inflation data

USD: US tariff lift for US inflation in focus this week

The US dollar has continued to trade at weaker levels during the Asian trading session resulting in EUR/USD rising back up closer to the 1.1700-level. It follows the second consecutive weekly decline for the dollar index last week. The US dollar continues to trade on a weaker footing in the near-term reflecting increased speculation that the Fed will resume rate cuts as soon at the next FOMC meeting in September. The US rate market is currently pricing in around 22bps of rate cuts for the September FOMC meeting and around 58bps of cuts in total by year end. The main trigger for the dovish repricing of Fed rate cut expectations in recent weeks has been clearer evidence of US labour market weakness which will encourage the Fed to resume rate cuts sooner. At the same time, President Trump’s recent announcement that he has chosen Stephen Miran to temporarily fill the Fed Governor seat vacated by Adriana Kugler until 31st January will further increase his influence over Fed policymaking. Like President Trump, Stephen Miran has argued for lower rates in recent months although his confirmation to the Fed’s board by the Senate may not come in time for the next FOMC meeting on 17th September. At the last FOMC meeting it was notable that the two Fed Governors Christopher Walker and Michelle Bowman who he appointed during his first term as President both dissented in favour of a rate cut. Over the weekend, Governor Bowman stated that “with economic growth slowing this year and signs of a less dynamic labour market becoming clearer, I see it as appropriate to begin gradually moving our moderately restrictive policy stance toward a neutral setting”. She stated that she expects to support three rate cuts at the three remaining FOMC meetings this year. The main potential impediment to a rate cut as soon as at the next FOMC meeting in September would be a bigger than expected pick-up in US inflation over the summer. Market participants will be closely scrutinizing the release this week of the latest US CPI and PPI reports for July for further evidence of higher tariffs feeding through to a pick-up in inflation pressures. A significant upside inflation surprise could trigger a reversal of the current US dollar weakening trend.

One positive external development for the inflation outlook has been the renewed decline in energy prices so far this month. The price of Brent crude oil has dropped back towards USD65/barrel from a high at the end of last month of USD73.63. The price of oil dropped sharply at the end of last week after President Trump didn’t reveal additional sanctions on Russia or tariffs on buyers of its energy. President Trump had already announced a 25% tariff on India over its purchases of oil from Russia. It has been reported that Presidents Trump and Putin plan to meet in Alaska on 15th August as President Trump steps up his efforts to reach a ceasefire agreement to pause the conflict in Ukraine. However, the planned exclusion of Ukrainian President Zelenskiy from the talks casts doubts over whether any agreement would be sustainable. President Zelenskiy stated over the weekend that the Ukraine won’t cede territory to President Putin to bring an end to the conflict.

USD IS CONSOLIDATING AT WEAKER LEVELS

Source: Bloomberg, Macrobond & MUFG GMR

AUD: RBA set to act as AUD sentiment improves

One of the key macro events this week takes place tonight with the RBA policy decision. The OIS market is indicating a 100% probability of a 25bp cut and hence the potential for a market move is unlikely to come from the RBA confirming this and cutting as expected. The reasoning behind the markets conviction of a cut tonight is understandable. The Q2 inflation data saw the underlying measures of CPI – the trimmed mean and weighted median both falling to 2.7%, not far from the mid-point of the RBA’s inflation target range of 2.0%-3.0%. The jobs market, which has been one of the factors that has allowed the RBA to remain cautious showed clearer weakness in July also. The full-time employment reading fell 38.2k in June and the unemployment rate drifted up from 4.1% to 4.3%, the highest level since November 2021.

The OIS market is priced now for the RBA actively cutting through the remainder of this year and into Q1 with the policy rate reaching an implied terminal rate close to 3.00% by March 2026. That implies two additional rate cuts from the RBA following tonight’s cut. That suggests market participants will be expecting signals from Governor Bullock that there remains scope for further easing ahead. The justification for holding off from cutting in July to the surprise of the market was the need to assess further inflation data. With the Q2 data favourable the communication from the RBA should reveal greater confidence in achieving its goal that could be interpreted as the RBA being open to further cuts ahead. No doubt the RBA will emphasise the need for lowering rates in a “sensible, cautious way”.

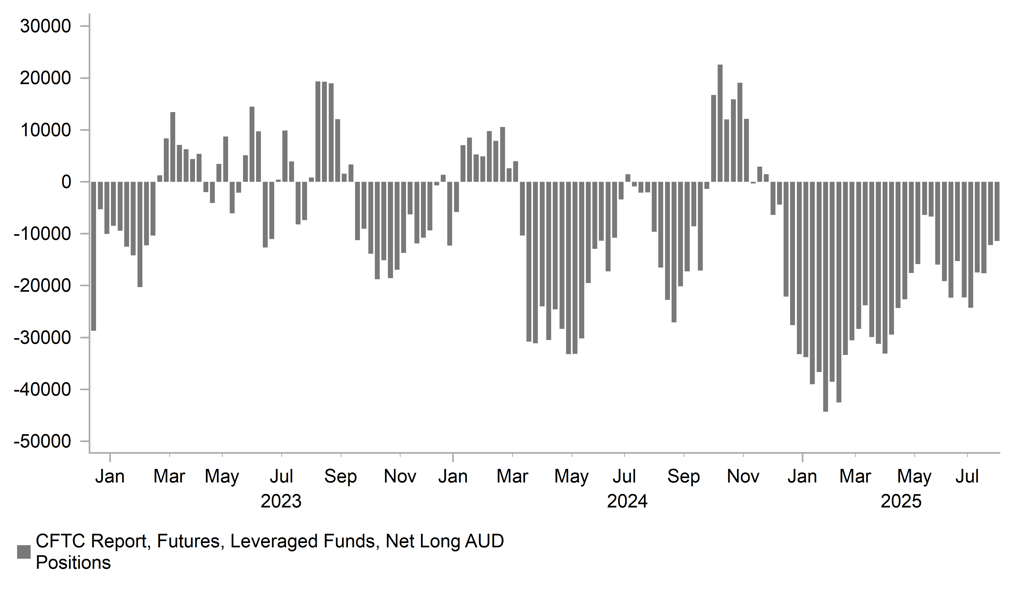

The RBA may be somewhat more confident about the international environment although tomorrow’s decision will be on the same day that we possibly get clarification on the status of the trade deal between the US and China. A 90-day extension in the trade truce looks more likely which should be supportive for AUD/USD. What is clear from the positioning data over the last month or so is that Leveraged Funds have turned more favourable toward AUD and have been reducing short positions. Indeed, shorts were significant at the start of the year when Trump was inaugurated but global trade fears have eased and this has helped provide AUD support. A rate cut tonight and a repeat cautious guidance is unlikely to result in much AUD depreciation. The outcome of the US-China trade relationship will probably prove more important.

AUD SHORTS HAVE BEEN STEADILY REDUCED AS GLOBAL TRADE FEARS EASE

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian CPI (YoY) |

Jul |

1.7% |

1.7% |

! |

|

IT |

10:00 |

Italian Trade Balance |

Jun |

7.120B |

6.163B |

! |

Source: Bloomberg & Investing.com