Paring back of speculation over more immediate BoJ policy shift weighs on JPY

JPY: New BoJ Governor dampens speculation over immediate YCC changes

The yen has continued to trade at weaker levels overnight following yesterday’s sell-off that resulted in USD/JPY rising to an intra-day high of 133.87 as it moved further above the intra-day low of 129.64 from 24th March. The yen sell-off was triggered by dovish comments from new BoJ Governor Ueda that have dampened expectations for a more immediate shift in BoJ policy as soon as the next meeting on 28th April. He said that the continuation of the current Yield Curve control (YCC) was appropriate considering current economic, inflation and financial conditions. The comment has raised the bar for further YCC adjustments later this month. He also added that the shape of the yield curve has generally been getting smoother but noted that the will need to keep closely monitoring the effect of measures implemented up to now and market trends. He expressed the view that any major revision to YCC should be based on fundamentals of economic, inflation and financial conditions, and not solely driven by the perspective of market functioning. He did though leave open the possibility of

making further adjustments to YCC when he stated that it might be necessary to look for a more sustainable monetary easing framework that addresses side effects. Overall, the comments support the recent decision by our analysts in Tokyo to push back their forecasts for further YCC adjustments to the June policy meeting although there is a higher risk now that it could take even longer. The paring back of expectations for a more immediate shift to BoJ policy settings under new Governor Ueda will take some of the wind out the yen’s sails, and make it harder for the yen to extend its advance ahead of the BoJ’s policy meeting later this month. We are still of the view though that the BoJ will abandon yield curve control this year so any yen weakness on the back of maintaining current policy settings is unlikely to prove sustainable. Furthermore with US yields having peaked out, it should help dampen upside potential for USD/JPY in the near-term with important resistance levels coming in between 135.00 and 137.00.

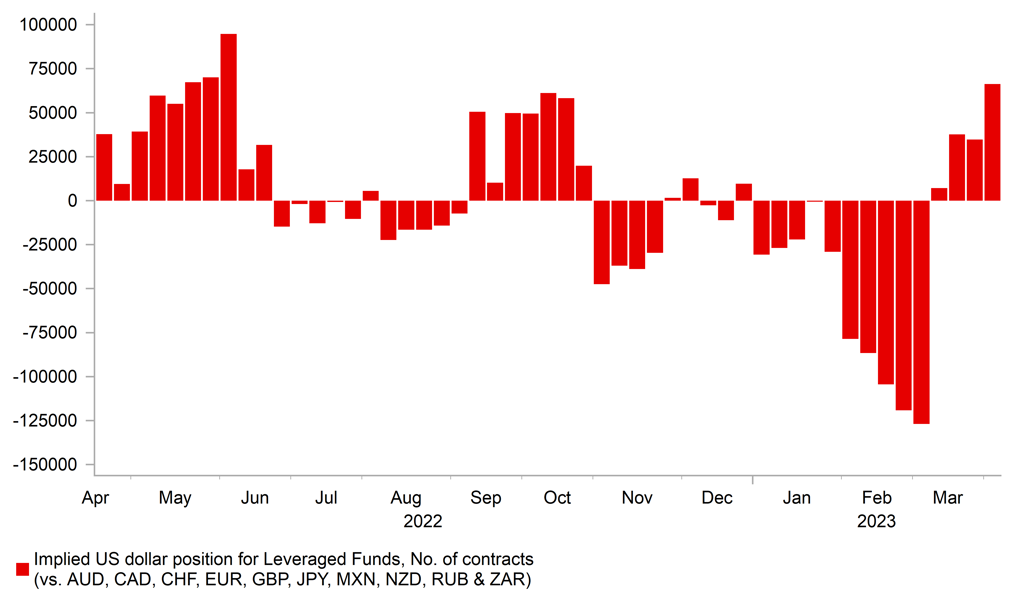

LEVERAGED FUNDS HAVE BEEN REBUILDING USD LONGS

Source: Bloomberg, Macrobond & MUFG GMR

USD: US data provides only temporary & modest relief

The recent move higher in USD/JPY has also been supported by a broader rebound for the US dollar. After hitting an intra-day low of 101.42 on 5th April, the dollar index has since risen back up to an intra-day high yesterday of 102.81. The US dollar has derived more support since late last week by the release of the latest NFP report on Friday that has helped to ease more immediate fears over a sharper slowdown/recession for the US economy. While the labour market is a lagging indicator, the NFP report did provide some reassurance to investors by revealing that the US labour market remains healthy. Employment growth has been slowing but remains strong having added 315k jobs/month on average over the last six months compared to 345k on average over the last twelve months. The March reading of 236k jobs gains was though the weakest reading since the end of 2020. We expect the labour market to weaken more notably in the coming quarters. There was also further encouraging news for the Fed as the NFP report revealed that average hourly earnings growth continued to increase at a slower pace as it has done since late last year. Over the last four months average hourly earnings have slowed to an annualized pace of 3.5% as it moved further below the peak from the start of this year at 6.6%. It should help to further dampen the Fed’s fears over the risk of a wage price spiral. The next focus for market participants will be the release tomorrow of the latest US CPI report for March that is expected to show core inflation continuing to run at an uncomfortably strong pace that will challenge market expectations for the Fed to end their rate hiking cycle soon and to then begin cutting rates later this year. The US rate market has scaled back expectations for the amount of Fed rate cuts priced in to around 45ps by the end of this year. It provides only a temporary and modest lift for the US dollar while expectations remain deeply ingrained that tighter credit conditions will eventually force the Fed in to a bigger dovish policy pivot.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:30 |

Sentix Investor Confidence |

Apr |

-9.9 |

-11.1 |

! |

|

EC |

10:00 |

Retail Sales (MoM) |

Feb |

-0.8% |

0.3% |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

Mar |

89.0 |

90.9 |

! |

|

US |

21:00 |

FOMC Member Harker Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg