JPY supported by BoJ rate hike signal

JPY: BoJ still considering rate hike amidst political uncertainty in Japan

The yen has been more stable against the US dollar overnight after a pick-up in volatility in recent days. After initially rising to a high of 148.58 at the start of this week following Prime Minister Ishiba’s resignation over the weekend, USD/JPY has since dropped to a low of 146.31 yesterday following reports the BoJ is still considering hiking rates this year despite political uncertainty in Japan. Bloomberg reported that BoJ officials are of the view that it may be possible to raise rates again this year regardless of domestic political instability, as economic conditions have developed in line with expectations, according to people familiar with the matter. The report added that the US-Japan trade deal has removed a key source of uncertainty, but the BoJ is still likely to keep rates on hold this month as officials continue to assess the economic impact of higher tariffs. The report did state though that some officials are even of the view that a hike maybe appropriate as early as October. Examining economic data and information will be critical in the coming months as the bank is likely to be able to judge whether economic conditions are suitable for a rate hike.

BoJ officials will reportedly be monitoring signals from the new government, particularly what sort of economic measures it might promise and then how those steps might affect economic growth, inflation and financial markets. The LDP plans for Diet members to vote on the next leader on 4th October as part of full-scale leadership election including rank-and-file members. The BoJ’s policy meeting takes place at the end of the month on 30th October so they could potentially be in position where they have more information on the new political set-up to give them confidence to hike rates if necessary. The BoJ is also closely watching the performance of the US economy to see if it can achieve a soft landing amid growing concerns over recent softer US employment data which alongside the pick-up in political uncertainty has dampened market expectations for the BoJ to resume rate hike sooner. In response to the Bloomberg report, the Japanese rate market has moved to price in a higher probability of a BoJ rate hike by the end of the year. There are now around 15bps of hikes priced in by the December policy meeting compared to 12bp on Monday just after Prime Minister Ishiba’s resignation. Market participants remain sceptical though that a hike will be delivered as soon as October with only 8bps of hikes priced in.

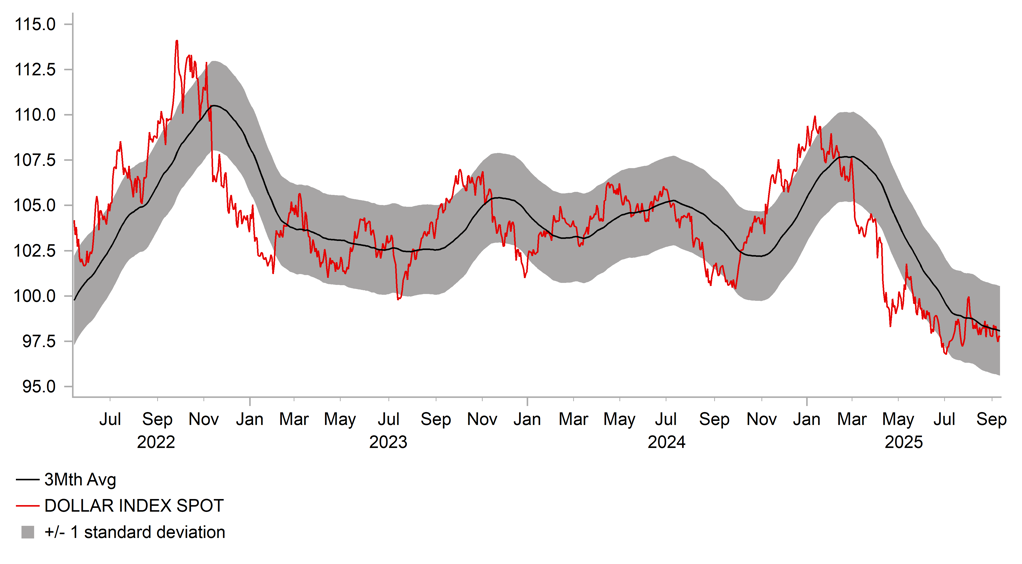

USD HAS BEEN CONSOLIDATING AT WEAKER LEVELS AFTER SELL-OFF

Source: Bloomberg, Macrobond & MUFG GMR

USD: US inflation data moving into focus after more weak labour market data

The US dollar has remained relatively resilient to the recent dovish repricing of Fed rate cut expectations. The dollar index has been consolidating at around the 98.000-level over the last three months and hasn’t hit a fresh year to date low since 1st July even as short-term US yields have fallen sharply since the start of August. The 2-year US Treasury yield has fallen by just over 40bps following the release of the last two weak nonfarm employment reports although yields did pick-up by around 6-7bps yesterday perhaps an indication that the US rate market has moved far enough for now to price in more aggressive Fed easing.

A 25bps rate cut is now fully priced in for this month’s FOMC meeting and there are around 67bps of cuts priced in by year end indicating that the market participants are more confident that the Fed will cut rates at all three remaining FOMC meetings this year. It creates a higher hurdle for the Fed to deliver a dovish surprise. The Fed would have to deliver a larger 50bps rate cut to encourage an even more aggressive dovish repricing of Fed rate cuts expectations heading into next year. While that can’t be ruled out given recent evidence of a weaker US labour market and the fact the Fed delivered a larger 50bps cut in September of last year. Market participants currently remain sceptical a larger 50bps cut will be delivered given that the Fed is also having to weigh up upside risks to the inflation outlook from higher tariffs. The release today and tomorrow of the latest US PPI and CPI reports for August will be scrutinized closely for further evidence that higher tariffs are feeding through to higher inflation. However, the Fed has signalled recently it is putting more weight on building downside risks to the US labour market. The release of the NFP report for August last week revealed that employment growth has slowed to around 27k over the last four months. It was also revealed yesterday that employment was revised down by a record 911k in the year through to March according to the government’s preliminary benchmark revision. The revision lowers the average monthly job gains over the period by more than half to 71k.

The other main development yesterday was the decision from US District Judge Jia Cobb that temporarily blocked President Trump from removing Fed Governor Lisa Cook. Judge Cobb concluded that the alleged mortgage misconduct likely didn’t amount to “cause” to fire Governor Cook under the Federal Reserve Act, and that the way she was fired likely violated her due process rights under the Constitution. Bloomberg reported that the Justice Department is likely to swiftly appeal the ruling and the US Supreme Court may ultimately have the final say. Governor Cook’s lawyer sated that Judge Cobb’s decision “recognises and reaffirms the Fed’s independence.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Jul |

0.1% |

0.2% |

! |

|

SZ |

12:45 |

SNB Vice Chairman Schlegel Speaks |

-- |

-- |

-- |

! |

|

US |

13:30 |

PPI (MoM) |

Aug |

0.3% |

0.9% |

!!! |

|

US |

18:00 |

Atlanta Fed GDPNow |

Q3 |

3.0% |

3.0% |

!! |

Source: Bloomberg & Investing.com