Higher yields if sustained will dampen need for further Fed hike

USD: Fed signals more discomfort over sharp move higher in US yields

The foreign exchange market has stabilized overnight as market participants continue to digest the flare up in geopolitical risks in the Middle East. The US dollar, the Swiss franc and yen were initially boosted yesterday by safe haven demand in response to the conflict between Hamas and Israel over the weekend. Yet the dollar index quickly gave back those gains and closed lower for the fifth consecutive day. Similarly, there has been some consolidation in the oil market overnight with the price of Brent trading at just below USD88/barrel as it remains around USD4/barrel higher than at the end of last week. Overall, there has been relatively a modest financial market reaction to the flare up in geopolitical tensions in the Middle East which appears consistent with the view from our analyst in Dubai that the conflict is unlikely to impact the balance of supply and demand in the oil market in the near-term, and that the conflict is unlikely to spread across the region and prove more destabilizing. That is clearly the main risk for financial markets that will need to be monitored carefully in the coming weeks.

At the same time, the US dollar has been undermined by further comments from Fed officials at the start of this week indicating that the recent sharp move higher in US yields if sustained will discourage the Fed from following through on plans to deliver one final rate hike later this year. Fed Vice Chair Jefferson stated yesterday that “looking ahead, I will remain cognizant of the tightening in financial conditions through higher bond yields and will keep that in mind as I assess the future path of policy”. He noted that Fed officials are “in a position to proceed carefully in assessing the extent of any additional policy firming that may be necessary”. The comments do not suggest that the Fed is in a rush to hike rates again as soon as next month.

It followed similar comments earlier in the day from Dallas Fed President Logan who provided a thorough analysis of the recent move higher in US bond yields and the likely impact on Fed policy. She noted that there had been a “substantial” tightening of financial conditions recently. It is important to distinguish between how much of the move higher in yields reflects stronger economic growth, a higher neutral policy rate and/or a rise in the term premium. She believes that a “clear role” has been played by an increase in the term premium which is estimated to be behind more than half of the move higher in yields since July. A higher term premium if sustained implies that the Fed needs to do less to tighten policy by raising rates further. The comments support our view that Fed policy is now on hold, and we expect the next move to be rate cuts next year in response to slowing growth and inflation. It is clear that there has been a change in tone from Fed officials since late last week who are now displaying more discomfort over the sharp move higher in US yields.

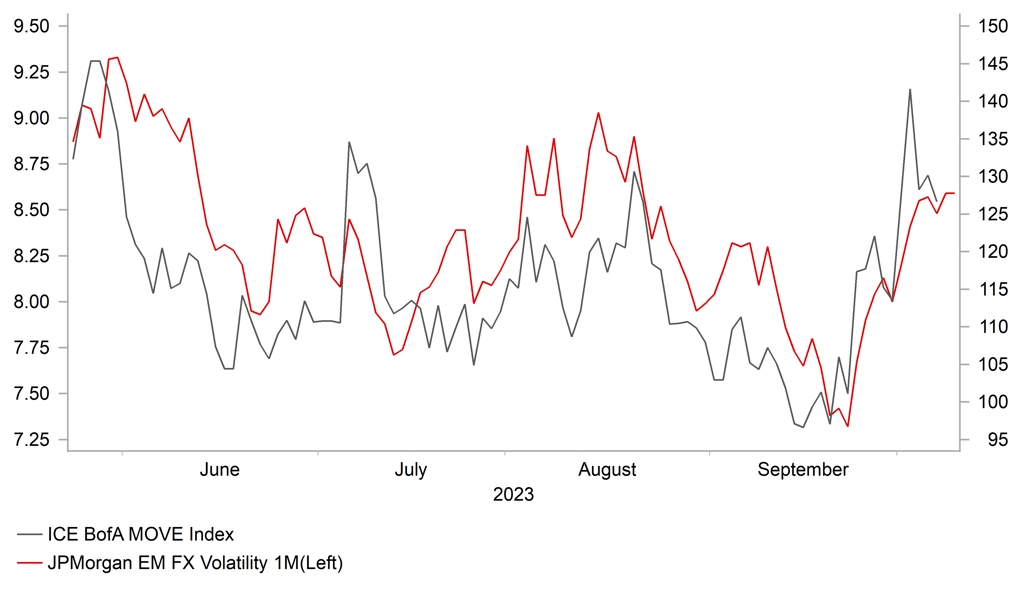

FINANCIAL MARKET VOLATILITY HAS PICKED UP BUT REMAINS LOW

Source: Bloomberg, Macrobond & MUFG GMR

EM FX: Rising US yields & Middle East geopolitical risks are lifting volatility

Emerging market currencies have continued to trade on a weaker footing against the USD over the past week even as the USD has lost upward momentum against other major currencies. The dollar index closed lower last week bringing an end to eleven consecutive weeks of gains. However, it has not brought much relief for emerging market currencies so far. The main beneficiaries have been the Central European currencies of the PLN (+2.0% vs. USD), HUF (+0.9%) and CZK (+0.7%). While most other emerging market currencies have continued to weaken against the USD. The worst performing EM currencies over the past week have been the COP (-3.7% vs. USD), MXN (-3.1%), and BRL (-1.5%).

The Latam currencies of the COP, MXN and BRL have been hit the hardest by the unwind of popular carry trades. The ongoing sharp sell-off in the US bond market has triggered a pick-up in financial market volatility that is disruptive for carry trades. US bond market volatility (MOVE index) and equity market (VIX) have both risen to their highest level since May, although in comparison the pick-up in FX market volatility has been more modest so far. The 10-year US Treasury yield hit a fresh cyclical hjgh at the end of last week at 4.89%. It has now risen by around 165bp since the low from May which is moving closer to the 183bps upward adjustment between August and October of last year. The USD’s failure to strengthen further on the back of the much stronger non-farm payrolls report for September is perhaps an early indication that the upward trend from recent months is starting to fade as momentum indicators have become stretched. The US rate market remains reluctant to price in more fully one final Fed hike. One reason is that Fed officials have indicated that the sharp tightening of financial conditions will be taken into account if sustained and will dampen the need for another hike. The release in the week ahead of the minutes from the September FOMC meeting and US CPI report for September could further dampen Fed rate hike expectations.

The pick-up in financial market volatility was reinforced at the start of this week as well by the flare up in geopolitical tensions in the Middle East. The conflict between Hamas and Israel has encouraged market participants to cut exposure to higher risk emerging markets that are more negatively impacted by rising energy prices. While our oil analysts do not expect an immediate impact to the supply and demand balance in the oil market, the price of oil has nevertheless increased by around USD4/barrel. It poses another downside risk for EM FX if the conflict escalates and broadens out in the region. Please see our latest EMEA EM Weekly for more details (click here).

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

Aug |

0.0% |

-0.7% |

! |

|

UK |

09:30 |

Labour Productivity |

Q2 |

0.7% |

-1.4% |

!! |

|

UK |

10:30 |

BoE FPC Meeting Minutes |

-- |

-- |

-- |

! |

|

US |

11:00 |

NFIB Small Business Optimism |

Sep |

91.4 |

91.3 |

! |

|

EC |

13:00 |

ECB President Lagarde Speaks |

-- |

-- |

-- |

!! |

|

US |

14:30 |

FOMC Member Bostic Speaks |

-- |

-- |

-- |

!! |

|

US |

18:30 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

US |

20:00 |

FOMC Member Kashkari Speaks |

-- |

-- |

-- |

!! |

|

US |

23:00 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg