USD to consolidate at weaker levels after sharp sell-off?

USD: Will softer US data & US equity market weakness curtail Trump’s plans?

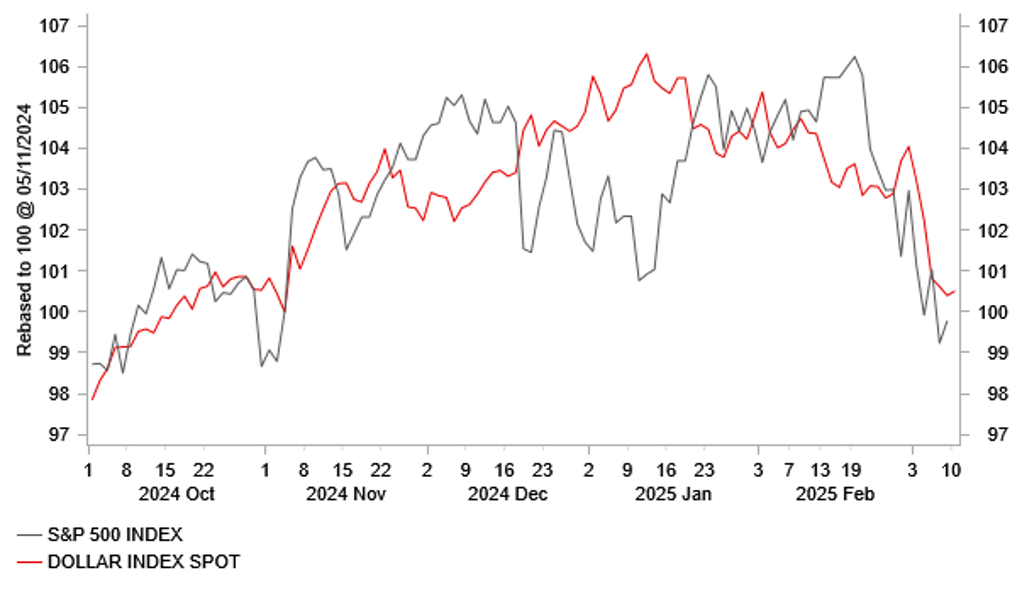

The US dollar is little changed at the start of this week as it continues to trade at weaker levels following last week’s sharp sell-off. The dollar index has fallen back below the 104.00-level giving back all of its gains since the US election victory for President Trump. Comments from President Trump over the weekend will attract market attention at the start of this week, he stated that the US economy faces “a period of transition”. He has previously acknowledged that there may be an “adjustment period” as tariffs take effect providing reassurance that “it won’t be much”. At the same time, he has dismissed the idea that he’s even looking at the looking at the stock market. Similar to the US dollar, the S&P 500 equity index has given back all of its gains since the US election falling back to support from the 200-day moving average at around 5,730. It has prompted speculation that further evidence of US economic weakness and/or US equity market weakness could prompt President Trump to scale back his plans to implement more broad-based and aggressive tariffs in the coming months. However, he does not appear to be unduly concerned by the recent softer run of US economic data and/or recent sell-off in the US equity market so far although tariffs on Canada and Mexico were partially rolled back at the end of last week.

The release of the latest nonfarm payrolls report on Friday provided another negative economic surprise. The report revealed that the US economy added 151k jobs in February representing a pick-up from the downwardly revised increase of 125k in January. Net of downward revisions nonfarm payrolls surprised modestly to the downside by -11k. Employment growth has slowed at the start of this year averaging 138k jobs/month compared to robust job growth averaging 292k/month in the final two months of last year immediately following the US election. It is too early to say though whether this is the start of a much weaker trend or just volatility in the monthly data. The underlying trend for job growth over the last six months remains strong averaging 191k/month which suggests that US political uncertainty over that period has not significantly weakened. The latest nonfarm payrolls report for February did reveal though that Federal government job losses totalled 10k which was the biggest monthly decline since June 2022. Perhaps the first evidence of DOGE’s efforts to shrink the size the state by cutting public sector jobs. The Washington Post has reported that President Trump has put limits on DOGE, telling Cabinet secretaries that they had control over which workers their agencies fire and not Elon Musk.

Fed Chair Powell is not yet overly concerned by recent softer US economic data either. He stated on Friday that “despite elevated levels of uncertainty, the US economy continues to be in a good place” and that “ we do not need to be in hurry, and are well positioned to wait for greater clarity”. He added that “it remains to be seen how these developments might affect future spending and investment”. It stands in contrast with the US rate market expectations that have moved to price back in more Fed cuts. The US rate market has recently brought forward the expected timing of the next Fed rate cut to June and a cumulative total of 75bps cuts by the end of this year. Developments that have added to downward pressure on the US dollar in the near-term.

USD & US EQUITIES GIVE BACK INITIAL US ELECTION GAINS

Source: Bloomberg, Macrobond & MUFG GMR

EUR/JPY: Higher yields outside of the US continue weigh down on US dollar

The sharp move higher in yields outside of US has been an important driver of US dollar weakness at the start of this year. The 10-year JGB yield hit a fresh year to date high overnight of 1.58% and has now risen by around 40 basis points year to date. The ongoing adjustment higher in Japanese yields was encouraged further overnight by the release of the latest labour cash earnings report for January. The report revealed that base salaries for full-time workers, the pay gauge that smooths out distortions from survey sample changes and is the BoJ’s preferred measure, rose by 3.0% in January up from 2.8% in December. Governor Ueda has previously stated that a rise of around 3% would be consistent with meeting their 2.0% inflation target. The report adds to building speculation amongst Japanese rate market participants that the BoJ will hike rates again by June (14bps) or July (20bps) policy meetings. There are even 7bps of hikes priced in for the May policy meeting. An earlier rate hike from the BoJ would encourage market expectations that the BoJ could lift the policy rate up to 1.00% by the end of this year.

The move higher in German government bond yields last week was even bigger rising by around 40bps to 2.84% and moving closer to the high from October 2023 at 3.03%. Chancellor-in-waiting Friedrich Merz’s plans for a significant loosening of fiscal policy including increased spending on defence and infrastructure have lifted government borrowing costs in Europe and economic growth expectations proving a tailwind in the near-term for the euro and European equities. Bloomberg have reported over the weekend that Friedrich Merz is open to making concessions to the Greens to secure support for constitutional changes required to modify the debt brake. The report stated that military support for Ukraine could be incorporated into the defence package and climate change initiative would “naturally” be included in the list of infrastructure projects to be financed by a planned EUR500 special fund. To secure the two-thirds majority needed overcome institutional barriers, Friedrich Merz needs the support of his CDU/CSU parties, the SPD and the Greens. Last week’s outsized market reaction highlights that investors are very confident that plans for increased defence and infrastructure investment will be passed in parliament. Please see our latest FX Weekly for more details on our updated outlook for the US dollar (click here).

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

09:30 |

Sentix Investor Confidence |

Mar |

-9.1 |

-12.7 |

! |

|

EC |

10:00 |

Eurogroup Meetings |

-- |

-- |

-- |

!! |

|

GE |

13:00 |

German Buba President Nagel Speaks |

-- |

-- |

-- |

!! |

|

US |

15:00 |

Consumer Inflation Expectations |

-- |

-- |

3.0% |

! |

|

JP |

23:30 |

Household Spending (MoM) |

Jan |

-1.9% |

2.3% |

!! |

|

JP |

23:50 |

GDP (QoQ) |

Q4 |

0.7% |

0.3% |

!!! |

Source: Bloomberg