UK labour market report delivers setback for pound

USD/JPY: Comments from BoJ Governor Ueda briefly trigger sell-off

The yen has been one of the more volatile currencies overnight. USD/JPY briefly rose to an intra-day high of 145.29 before dropping back towards 144.50. The yen initially weakened on the back of comments from BoJ Governor Ueda who was speaking before parliament. The yen weakened after Governor Ueda stated that there was still some distance for the price trend to rise to their target of 2.0% which initially dampened expectations for further BoJ rate hikes. However, he went on to reiterate that if the price trend becomes more certain then the BoJ will raise rates further. The comments indicate that the BoJ remains cautious over raising rates further amidst the “extremely” high uncertainties surrounding the outlook for the economy. We are not expecting the BoJ to provide a stronger signal over rate hikes at next week’s policy meeting even though recent inflation data has been stronger. The BoJ is in no rush to hike rates further and can wait to see how trade talks play out between the US and Japan ahead of the 9th July deadline for higher “reciprocal” tariffs. Japan’s Economic Revitalization Minister Akazawa stated overnight that the trade negotiations with the US are still in a fog. The comment supports our expectations that the main policy change at next week’s BoJ policy meeting will be updated plans for tapering. It has been reported that the BoJ is considering slowing the pace of tapering for the next fiscal year. The BoJ is currently slowing monthly JGB purchases by JPY400 billion every quarter. The pace of tapering could slow to between JPY200-400 billion from April next year. Market expectations for slower tapering could already be encouraging yen selling and helping to dampen upward pressure on long-term JGB yields.

At the same time, market attention is also focused on trade talks between the US and China taking place in London at the start of this week. The trade talks will continue into a second day according to a US official. President Trump told reporters at the White House yesterday that “we are doing well with China. China’s not easy and that “I’m only getting good reports”. The comments have encouraged building investor optimism that a trade deal/agreement can be reached in the coming months to avoid the higher “reciprocal” tariffs being re-imposed on trade between the US and China. According to a Bloomberg report, the US has signalled a willingness to remove restrictions on some tech exports in exchange for assurances that China is easing limits on rare earth shipments. Head of the White House’s National Economic Council Kevin Hassett did add though that they would stop short of removing restrictions on the most sophisticated H20 chips made by Nvidia. The talks are taking place amidst growing evidence of the economic disruption from the tariff war. The latest trade report from China released yesterday revealed that exports to the US declined by almost -20% in May which was the largest monthly drop since the start of COVID. The developments have had limited impact on the renminbi. USD/CNY continues to trade just below the 7.2000-level and is trading close to year to date lows.

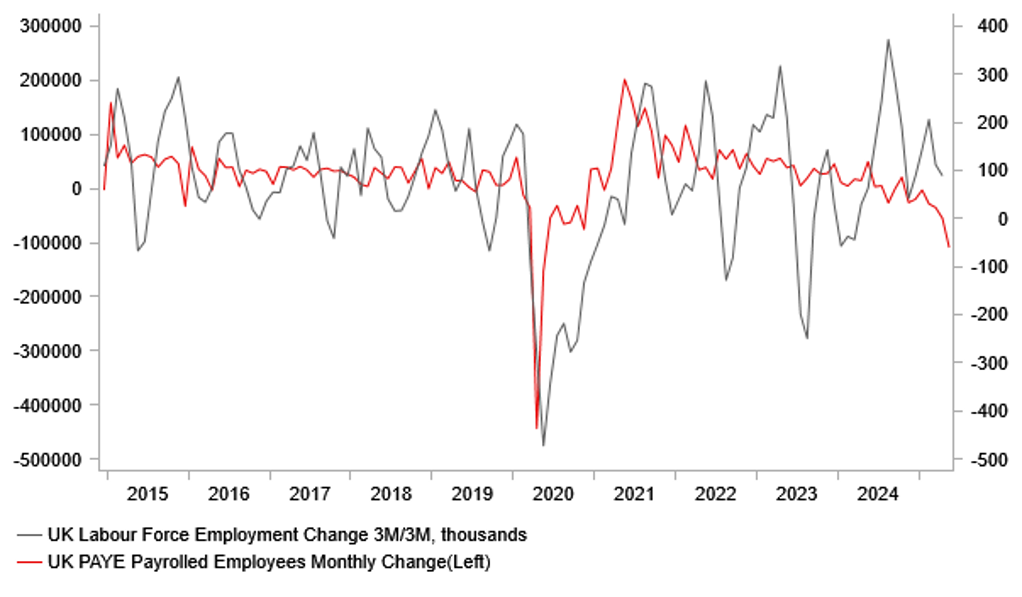

WEAKNESS IN UK PAYROLLS TRIGGERS GBP SELL-OFF

Source: Bloomberg, Macrobond & MUFG GMR

GBP: UK labour market continues to cool weighing on the pound

The main economic data release at the start of the European trading session has been the latest labour market report from the UK. The report has encouraged some pound selling at the start of the day helping to lift EUR/GBP from a low overnight of 0.8418 up to a high of 0.8450. The pair is currently testing the top of this month’s narrow range between 0.8400 and 0.8450. The pound has weakened after the latest labour market provided further evidence that it continues to cool encouraging expectations for the BoE to continue gradually lowering rates. Private sector wage growth excluding the more volatile bonus component slowed to an annual rate of 5.1% in the three months through to April down from 5.5% in the previous report. At the same time, tax data showed that the number of employees on payroll dropped by 109k in May. It was the biggest decline since May 2020. Bloomberg noted that payrolls have shrunk by 276k now since the Government’s Budget was announced in October of last year. The labour market report makes us more confident that the BoE will stick to their current quarter pace of easing and deliver the next rate cut at the August MPC meeting. The UK rate market has moved to more fully price in another 25bps cut by August. It follows the recent announcement as well that the ONS overstated the rate of inflation in the April CPI report.

The dovish repricing of BoE rate cut expectations takes some of the shine of the pound but is unlikely on its own to reverse the recent upward trend unless the BoE signals it is more willing to speed up rate cuts. The pound has been one of the best performing G10 currencies alongside the commodity currencies of the Aussie, Kiwi and Norwegian krone since global equities bottomed on 8th April. The pound has been benefitting from the strong rebound in global investor risk sentiment and drop in financial market volatility which is making carry trades more attractive again. The pound still retains its position as one of the highest yielders within G10 FX and has been supported by the pick-up in demand for carry trades in the near-term.

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

EC |

08:10 |

ECB's Villeroy Speaks |

!! |

|||

|

SZ |

09:00 |

Total Sight Deposits CHF |

-- |

444.9b |

! |

|

|

IT |

09:00 |

Industrial Production MoM |

Apr |

-0.1% |

0.1% |

!! |

|

FI |

09:00 |

ECB's Rehn Speaks |

!! |

|||

|

EC |

09:30 |

Sentix Investor Confidence |

Jun |

- 5.5 |

- 8.1 |

!! |

|

US |

11:00 |

NFIB Small Business Optimism |

May |

96.0 |

95.8 |

!! |

Source: Bloomberg & Investing.com