Trump creates more trade policy uncertainty hitting BRL

BRL: Trump ramps up tariff pressure on Brazil to address political concerns

The major foreign exchange rates have remained relatively stable overnight with President Trump’s latest tariff announcements having only a muted impact on performance. In contrast, the Brazil real has been hit much harder falling by over 2% against the US dollar. It follows President Trump’s threat to impose a 50% tariff on goods imported from Brazil from 1st August. The size of the tariff was much larger than expected given President Trump had previously planned to implement only a 10% universal tariff rate when the Liberation Day tariff announcement was made back in early April. In a post on Truth Social President Trump stated that “due in part to Brazil’s insidious attacks on Free Elections, and the fundamental Free Speech rights of Americans…we will charge Brazil a 50% tariff” and described the trial of former President Jair Bolsonaro “a Witch Hunt that should end IMMEDIATELY”. He also accused Brazil’s Supreme Court of issuing “hundreds of SECRET and UNLAWFUL Censorship Orders”. It represents a shift in approach from President Trump wo had previously justified tariffs as a tool to address trade imbalances representing a threat to national security concern but now appears to be trying to interfere in domestic politics and legal matters. The development will further heighten US policy uncertainty which was already unusually elevated and has been weighing on the US dollar during the 1H of this year. Brazil has previously got off relatively lightly when President Trump outlined plans for only a 10% tariffs on imported goods from Brazil on Liberation Day reflecting the fact that the US runs a small trade surplus with Brazil which totalled USD6.8 billion in 2024. The US imported USD42.4 billion of goods form Brazil.

While the threat of a 50% tariff on Brazil was a surprise, there have been indications of President’s Trump growing frustration over political developments in Brazil. On 7th July he posted on Truth Social “I’ll be watching the WITCH HUNT of Jair Bolsonaro, his family, and thousands of his supporters, very closely. The only trial that should be happening is a Trial by the Voters of Brazil – It’s called an Election. LEAVE BOLSONARO ALONE!”. The tariff threat puts Brazil into a difficult position as it is not obvious what they can do to appease Trump and avoid the 50% tariff without going as far as cancelling the trial of Jair Bolsonaro. It has been reported that shortly after the announcement was made by President Trump, President Lula called top cabinet members into a meeting at the presidential palace. It was later followed by a post by President Lula on social media in which he stated that Brazil would not be “tutored” by anyone while adding that the case against those who planned a coup is a matter solely for the country’s justice system and “not subject to interference or threat”.

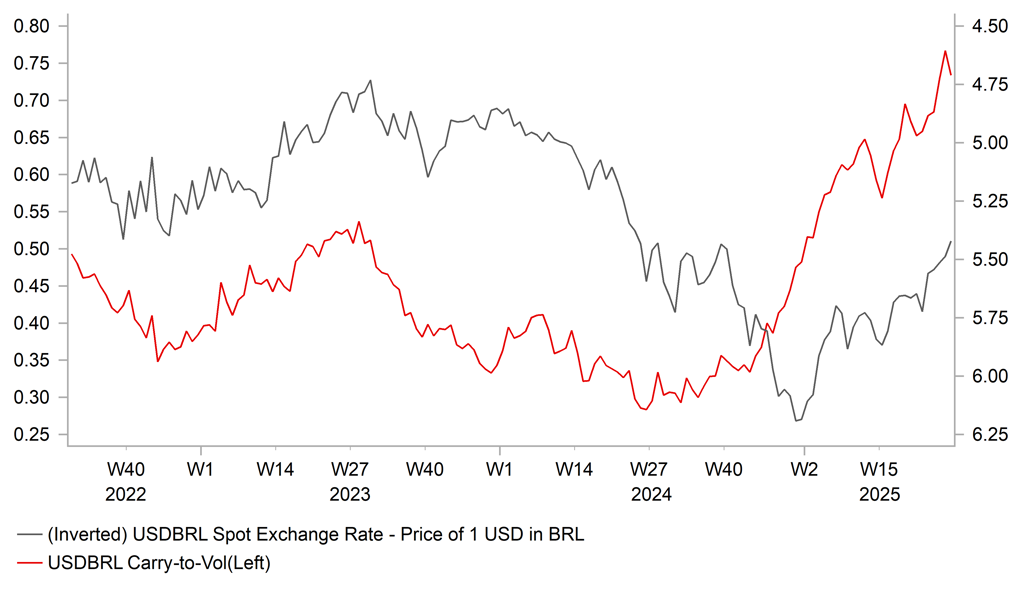

Without a clear path yet to de-escalation, the real is likely to continue to trade on a softer footing in the near-term. The initial real sell-off was exacerbated by the unwind of popular carry trades. The real has strengthened sharply this year boosted by the high yields on offer in Brazil where the BCB have raised the policy rate up to 15.00% helping to lower USD/BRL from a high of 6.3156 at the end of last year to a recent low of 5.3721. The risk is that carry trades continue to be unwound on the back of heightened trade risks and higher financial market volatility triggering a further reversal of real gains. However, there are question marks over whether President Trump has the power to justify imposing tariffs for political reasons.

TRUMP’S TARIFF THREAT TO BRL CARRY TRADES

Source: Bloomberg, Macrobond & MUFG GMR

USD: Additional US trade policy uncertainty justifies Fed caution

The recent tariff announcements from President Trump threatening to impose the higher reciprocal tariffs from 1st August alongside the 50% tariff threats for imports from Brazil and of copper have added to US trade policy uncertainty in the near-term, and provides justification for the Fed’s cautious approach to resuming rate cuts. The Fed still wants to see how inflation responds to tariff hikes over the summer before deciding whether to resume rate cuts as early as in September. The prospect of an even earlier rate cut later this month appears to be off the table now after the stronger than expected nonfarm payroll report for June.

The release overnight of the minutes from the last FOMC meeting in June revealed that policymakers agreed then that uncertainty had “diminished” though it remined “elevated”. They acknowledged that expectations for tariff rates and their effects had declined compared to in April just after Liberation Day. Participants still expect tariffs to “put upward pressure on prices” but there is “considerable uncertainty” over the “timing, size and duration of these effects”. “Many” participants were of the view that it might take time for tariffs to show up in the inflation data. “Many” were also of the view that the effect on inflation could be more “limited” if trade deals are reached quickly or companies prove able to quickly adjust supply chains. Overall, the minutes continued to signal that “most” participants expected it likely would be appropriate to cut rates this year but they are waiting for more data to provide clarity over the impact of tariffs.

The Fed’s reluctance to cut rates continues to draw criticism from President Trump who wants lower rates to support growth and reduce debt costs although the last one is not guaranteed. The WSJ reported yesterday that Kevin Hassett is emerging as a serious contender for President Trump’s pick to be the next Fed Chair. He is currently serving as the White House economic adviser to President Trump. Recently he has stated that there is “no reason for the Fed to not cut rates now”, and would be viewed as more of a “yes” man for President Trump who would be willing to implement lower rates. A development that could increase downside risks for the US dollar in the year ahead.

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

IT |

09:00 |

Italian Industrial Production (MoM) |

May |

-0.2% |

1.0% |

! |

|

US |

13:30 |

Continuing Jobless Claims |

-- |

1,960K |

1,964K |

!! |

|

US |

13:30 |

Initial Jobless Claims |

-- |

236K |

233K |

!!! |

|

US |

18:15 |

Fed Waller Speaks |

-- |

-- |

-- |

!! |

|

UK |

18:30 |

BoE Breeden Speaks |

-- |

-- |

-- |

! |

|

US |

19:30 |

FOMC Member Daly Speaks |

-- |

-- |

-- |

!! |

|

US |

21:30 |

Fed's Balance Sheet |

-- |

-- |

6,660B |

!! |

|

NZ |

23:30 |

Business NZ PMI |

Jun |

-- |

47.5 |

!! |

Source: Bloomberg & Investing.com