USD continues to trade at weaker levels after risk of blowout NFP report is avoided

USD: Focus shifts to US CPI report after risk of blowout NFP report avoided

The US dollar has staged a modest rebound during the Asian trading session following the sell-off at the end of last week that has brought the dollar index back into the middle of the 100.00 to 105.00 trading range that has been in place for most of this year. The release of the non-farm payrolls report on Friday brought some initial relief for market participants that were braced for the risk of another blow out employment report after the ADP survey estimated that private employment likely increased by around 500k in June. However, the non-farm payrolls provided more reassurance that the employment growth is slowing although it remains relatively strong from a historical perspective. The establishment survey revealed that employment increased by 209k in June. In addition, there were downward revisions to employment growth in previous months totalling -110k. After incorporating the downward revisions as well, there is clearer evidence that employment growth is slowing. In the first half of this year employment growth has averaged 278k/month compared to 354k in the second half of last year. The monthly increase in employment of 209k in June was also the lowest since December 2020. The slowdown in employment growth will provide some reassurance to the Fed that the impact of monetary tightening is helping to dampen upside risks from the labour market although it is still too strong for comfort. Furthermore, it was partially offset by stronger average hourly earnings growth in recent months. Average hourly earnings growth has picked up back in Q2 following a slowdown in Q1 when it averaged 0.4%M/M in Q2 compared to 0.3%M/M in Q1.

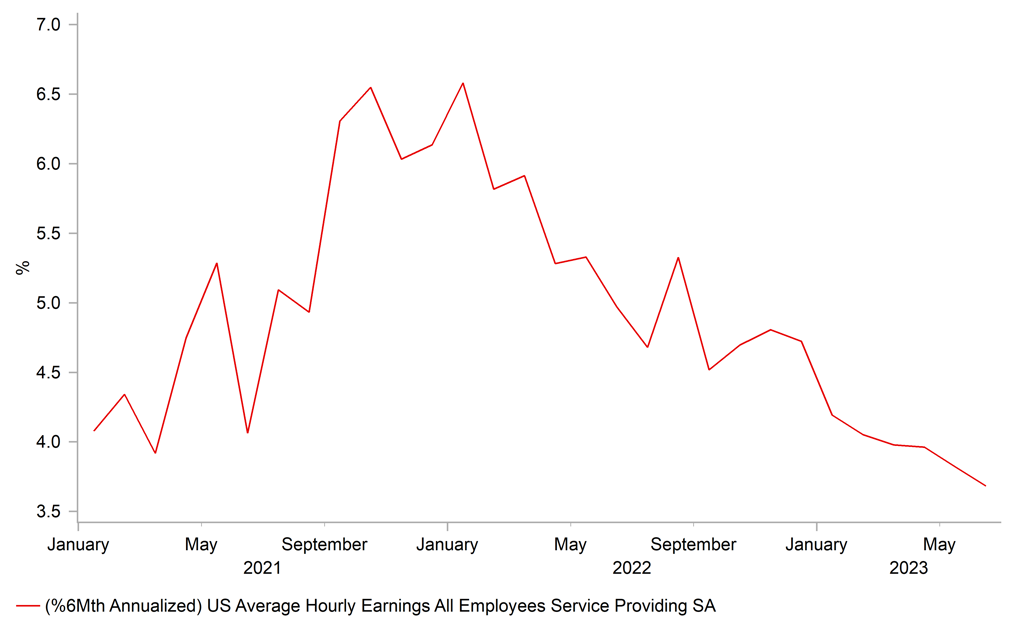

Overall, the developments are unlikely to alter the Fed’s plans to hike rates further. We agree with market pricing that there is still a high probability of the Fed hiking rates by 0.25 point later this month (there is currently 22bps priced in). It does though provide some encourage that the Fed may not need to follow through on plans to deliver a second hike later this year if the labour market continues to weaken and upside inflation risks ease further in the coming months/quarters. In recent months, the Fed has been focusing more on upside inflation risks stemming from the service sector which is more tightly linked to wage growth and could result in a period of more persistently high inflation. Yet the non-farm payrolls should help to dampen those concerns. Employment growth slowed in the service sector to 180k in June and average hourly earnings growth slowed to 0.3%M/M. The slowdown in average hourly earnings growth in the service sector has been more clear as the annualized rate of growth has fallen to 3.7% in 1H of this year down from 4.7% in the 2H of last year. Market participants’ focus will now shift to the release on Wednesday of the latest US CPI report for June. A softer super core inflation reading would open the door for the correction lower for the US dollar to extend further in the week ahead.

SLOWING AVERAGE HOURLY EARNINGS GROWTH IN SERVICE SECTOR

Source: Bloomberg & Macrobond

NOK: Another upside CPI surprise increases pressure on the Norges Bank

The Norwegian krone has strengthened early this morning following the release of the stronger than expected CPI report from Norway. EUR/NOK trading towards the bottom of the 11.500 to 12.000 range it has been in for the last three months after weakening sharply in the first four to five months of this year. The krone is the second weakest G10 currency so far this year just after the yen. It has weakened by -7.6% YTD against the US dollar and -9.6% YTD against the euro.

The Norges Bank has been signalling more concern over krone weakness in recent months. The weaker krone will make it more difficult for the Norges Bank to bring inflation down back towards their target. Unlike in other major economies, core inflation in Norway is continuing to head higher hitting a fresh cyclical high of 7.0% in June even after headline inflation peaked at 7.5% in October of last year. The unfavourable trend for core inflation and weak krone will keep pressure on the Norges Bank to deliver another larger 50bps hike at their next policy meeting on 17th August. Last month’s 50bps hike was the first since September of last year. More decisive action from the Norges Bank will offer more support for the krone but we are not yet convinced that conditions are in place for a sustainable rebound from deeply undervalued levels. Please see our latest FX Weekly report for more details (click here)

KEY RELEASES AND EVENTS

|

Country |

BST |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

SW |

08:30 |

Riksbank Minutes |

!! |

|||

|

SZ |

09:00 |

Total Sight Deposits CHF |

Jul-07 |

-- |

491.9b |

! |

|

EC |

09:30 |

Sentix Investor Confidence |

Jul |

- 17.9 |

- 17.0 |

!! |

Source: Bloomberg