USD firmer in low volatility FX conditions

USD: Subdued trading with a USD stronger skew

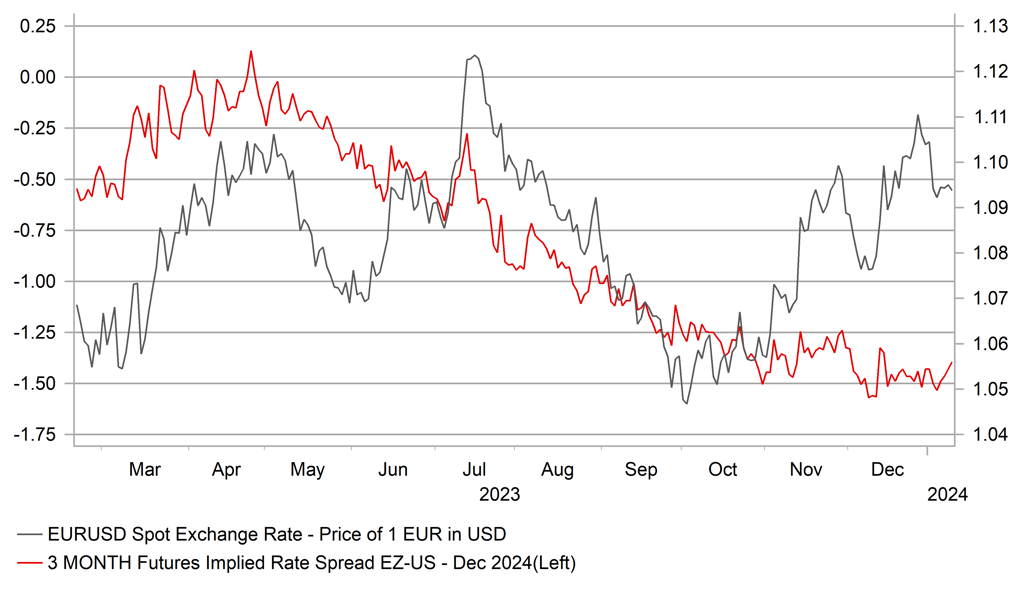

Yesterday was a pretty eventless trading day with most market participants looking to the key inflation data from the US, released tomorrow, as the key event of the week which perhaps is discouraging risk appetite, in particular in the early stages of the calendar year when market participants are keen to get their P&L books off to a good start. The markets in general remained skewed more toward risk-off which is helping lift the US dollar even though UST bond yields have drifted a little lower relative to yields in the euro-zone with core yields there higher on the day. As stated here prior, the EUR/USD rate does look to have over-extended to the upside during the end-2023 US dollar sell-off and if we are to see a realignment of spot to relative short-term rate levels, then there is scope for EUR/USD to continue drifting lower toward the 1.0700-level. Declining equity markets globally, even only modestly, will help reinforce gradual US dollar recovery. The S&P 500 surged over 24% last year with a stellar run that saw two-thirds of the calendar gain unfold in just over the last two months of the year and that makes for the potential for a challenging start to 2024. The gains leave valuation metrics underlining the potential challenges of further gains going forward. In three of the last four years, the forward P/E for the S&P 500 has been above the 5-year average (18.8), and points to hurdles ahead.

The gloomy global growth backdrop that we believe will help limit US dollar selling for now was reinforced yesterday by the latest World Bank ‘Global Economic Prospects’ report that highlighted, given their 2024 forecast, a 5-year growth run that would be the worst since the early 1990’s. The World Bank Chief Economist, Indermit Gill stated that a “major course correction” was required in order to avoid a decade of wasted opportunity in the 2020’s. Global GDP is forecast to slow from 2.6% in 2023 to 2.4% this year. The 2020-24 average growth rate would fall to 2.2%, the weakest since 1990-94, a period that incorporated a US recession, the Gulf War, currency crises and recessions in Europe, and the Mexican peso crisis.

Of course the current subdued trading that is resulting in this gradual reversion of US dollar selling last year could all change tomorrow when we get the latest CPI data from the US. Any shock divergence stronger or weaker from consensus will certainly spark some volatility and with the pricing for a March rate cut at about 60% there is scope for a rates move either way. However, given our analysis shows an overshoot of EUR/USD spot relative to rates spread, we see greater scope of US dollar strength on stronger data than weakness on weak data.

END-2024 EZ-US RATE EXPECTATIONS HAVEN’T BUDGED MUCH AS EUR/USD HAS RALLIED SHARPLY

Source: Macrobond

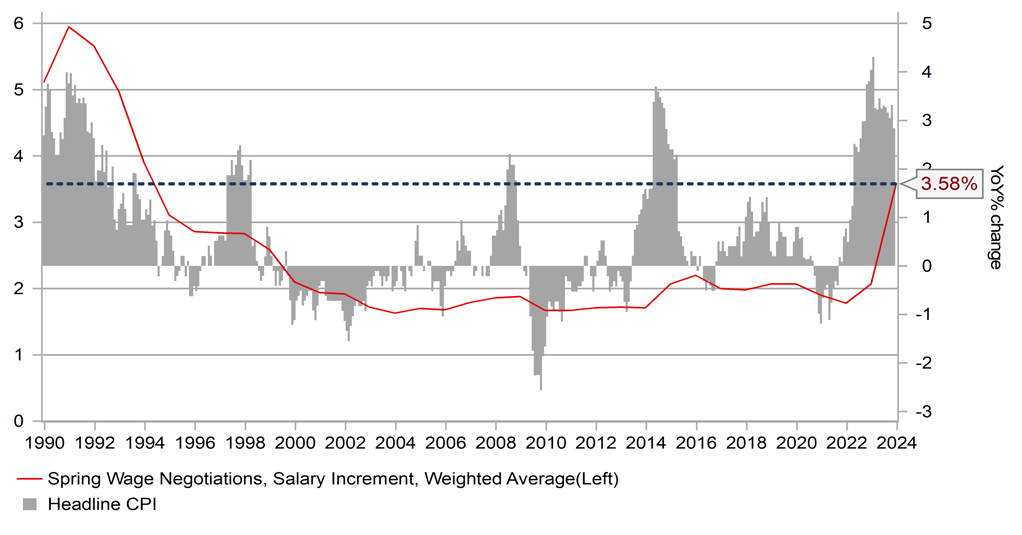

JPY: Wage data disappoints adding to yen weakness

Given the communications from the BoJ on the need to see stronger wage growth in order to become confident on sustained higher inflation at around the 2.0% target level, the monthly cash earnings release is now probably the most important data release of the month in Japan. The yen is underperforming today and is worst performing G10 currency after the release of the cash earnings data for November that came in a lot weaker than expected. Nominal cash earnings grew by just 0.2% on an annual basis in November, down sharply from 1.5% in October. The 0.2% was also well off the consensus of 1.5% as well. There is an element of uncertainty with this data series given the recent changes to the samples used in the data and when the sample changes are excluded the annual gain came in at a healthy 2.0%.

Given the pre-sample change data set continues to show wage growth at around the levels required for a change in monetary policy, the prospect of a monetary policy change later this year remains plausible. We already pushed back the timing of our call from January to April and hence today’s data while weaker on the first look doesn’t change the potential for a rate hike by April.

The other news from Japan today that helps strengthen the prospect of a rate hike is the continued strength of the equity markets. The Nikkei yesterday hit highs not seen since 1990 and today the Topix Index did the same, advancing by 1.3%. While a rate hike by the BoJ could be argued undermines the prospect of equity markets in Japan, the broader easing of financial conditions globally and the prospects of rate cuts and a softer than previously expected soft landing for the US economy all add to the positive backdrop for Japan equities. But the delay in monetary tightening in Japan continues to encourage renewed yen selling. Those drawn to carry see the attractiveness of long USD/JPY given the rates pricing in the US offers a degree of comfort over a reduced risk of further sharp declines in US yields over the short-term.

UPCOMING WAGE NEGOTIATIONS REMAIN KEY & ARE EXPECTED TO BE ROBUST ONCE AGAIN

Source: Macrobond & Bloomberg

KEY RELEASES AND EVENTS

|

Country |

GMT |

Indicator/Event |

Period |

Consensus |

Previous |

Mkt Moving |

|

CH |

08:00 |

M2 Money Stock (YoY) |

-- |

10.1% |

10.0% |

! |

|

CH |

08:00 |

New Loans |

-- |

1,400.0B |

1,090.0B |

!! |

|

CH |

08:00 |

Outstanding Loan Growth (YoY) |

-- |

10.8% |

10.8% |

! |

|

CH |

08:00 |

Chinese Total Social Financing |

-- |

2,200.0B |

2,450.0B |

!! |

|

EC |

08:20 |

ECB's De Guindos Speaks |

-- |

-- |

-- |

!! |

|

IT |

09:00 |

Italian Retail Sales (YoY) |

Nov |

-- |

0.3% |

! |

|

IT |

09:00 |

Italian Retail Sales (MoM) |

Nov |

0.2% |

0.4% |

! |

|

UK |

10:00 |

3-Year Treasury Gilt Auction |

-- |

-- |

4.151% |

! |

|

GE |

10:30 |

German 10-Year Bund Auction |

-- |

-- |

2.450% |

!! |

|

US |

12:00 |

MBA Mortgage Applications (WoW) |

-- |

-- |

-10.7% |

! |

|

EC |

14:00 |

ECB's Schnabel Speaks |

-- |

-- |

-- |

!!! |

|

UK |

14:15 |

BoE Gov Bailey Speaks |

-- |

-- |

-- |

!!!! |

|

US |

15:00 |

Thomson Reuters IPSOS PCSI |

Jan |

-- |

51.08 |

! |

|

US |

15:00 |

Wholesale Inventories (MoM) |

Nov |

-0.2% |

-0.4% |

! |

|

US |

15:00 |

Wholesale Trade Sales (MoM) |

Nov |

-- |

-1.3% |

! |

|

US |

18:00 |

10-Year Note Auction |

-- |

-- |

4.296% |

!! |

|

US |

18:00 |

Atlanta Fed GDPNow |

Q4 |

-- |

-- |

!! |

|

US |

20:15 |

Fed Member Williams Speaks |

-- |

-- |

-- |

!! |

Source: Bloomberg